Courtesy of Declan.

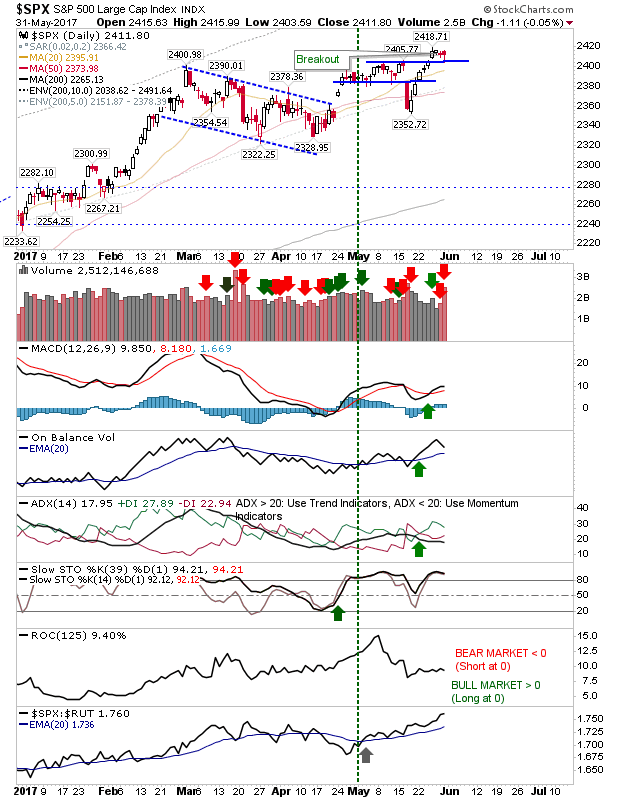

After a couple of weeks of light trading volume picked up as seller returned to markets. However, sellers were unable to reverse market breakouts.

The S&P tagged 2,403 at the low of today, but recovered to leave it halfway between recent highs and 2,400. Technicals are net bullish with the MACD slowly building on its recent ‘buy’ trigger.

It was a similar story for the Nasdaq as it too retained its breakout on solid technical strength.

It was looking like it was going to be another tough day for the Russell 2000. However, buyers came in late in the day to bid this back up to near today’s highs. Not sure there is enough for a swing low as the broader trading range is the dominant action here. Aggressive players may look too long positions with a stop on a loss of today’s low.

The Dow Jones was not so dramatic, but it too looks well placed for a breakout. Technicals are wavering a little with On-Balance-Volume on the verge of a ‘sell’ trigger, but others remain strong.

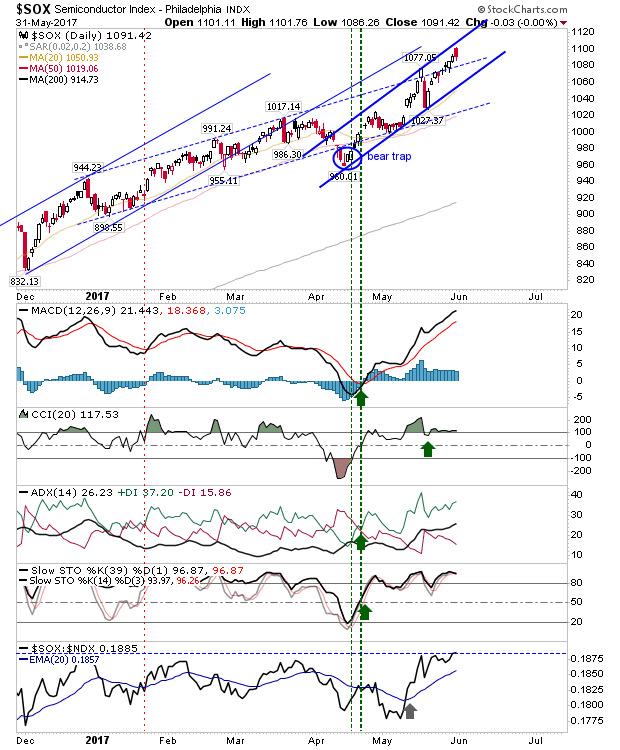

Shorts may want to take a look at the Semiconductor Index. Today’s action ranks as ‘bearish cloud cover’, but given the proximity to channel resistance it may be in a position to fall back some more. Supporting technicals are good, although I’m surprised relative performance to the Nasdaq 100 has remained pinned by marked horizontal resistance.

For Thursday, bulls may be the ones to gain most satisfaction as breakouts in the S&P and Nasdaq evolve. The Dow Jones may represent the value play while day traders could look to benefit from morning upside in the Russell 2000. Shorts should watch the Semiconductor Index for leads; stops on a break above today’s high.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.