They’re All Going to Leave

Courtesy of Michael Batnick

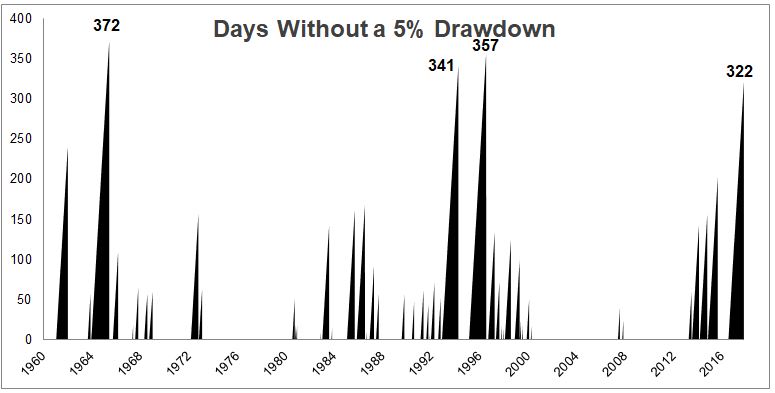

Stocks have been near all-time highs for a while now. The S&P 500 has gone 322 days without experiencing a 5% drawdown, colloquially known as a “pullback.”

Stocks haven’t just been hanging out near all-time highs, they’ve been printing new ones daily. In 2017, 47 out of 201 sessions have closed at an all-time high. It’s been a remarkably smooth ride. Not day-to-day, of course it never is, but in reality the S&P 500 has gained 19% since last July without giving anything back. This is a rare moment in stock market history. Be thankful.

One more chart and I’ll arrive at the point. The average daily drawdown over the last three years is just -2.27%. Meaning, over the last three years on average, the S&P 500 has been within 2.27% of its all-time high. It’s remarkable to think back on all the top calls and angst that we’ve all experienced over the last 756 trading days. And look at that flat red line not worrying about a damn thing.

Okay, here’s the point. A lot of people have this idea that when this ends, badly or otherwise, and one day it will, that all the money that’s gone from active to passive will exit just as fast as it entered. I don’t necessarily buy this, but for arguments sake let’s just say that money flees at the first sign of trouble. Is the counter that they would behave better during a bear market if there money was in an actively managed fund?

Consider a piece of data from Jack Bogle’s Common Sense on Mutual Funds:

Following the -48 percent market decline in 1973-1974, investors made withdrawals from their holdings of equity mutual funds during 24 consecutive quarters, from the second quarter of 1975 through the first quarter in 1981.

If stocks fall 48% again, investors are exiting. They’re exiting because stocks are falling and stocks are falling because they’re exiting. But in a garden variety bear market, say 25% or something thereabouts, I think people with balanced portfolios, generally speaking, will do okay. But anything deeper than that and we’ll do what we do when we feel threatened, we’ll run.

Money that only recently came around to the idea that plain market beta is a better way to invest than expensive closet beta will flee, but that money always has one foot out the door and the wrapper doesn’t matter.