2 companies.

That's all it took this morning to blast the Dow 130 points higher pre-market. Caterpillar (CAT) was up $10 (7%) and that added 85 Dow points and 3M (MMM) jumped $8 (3.5%) and added 64 points so that's 149 of 130 points added by just 2 of the Dow's 30 components – the rest are net negative. What a silly index! The combined market cap of CAT and MMM is $200Bn, only as much as GE but if GE dropped 10%, that would only subtract about 20 Dow points, because GE is a $22.50 stock.

So a $22.50 stock worth $200Bn dropping 10% on the Dow has 1/7th the impact of 2 other stocks with the same TOTAL market cap rising an average of 5.75% between them. That doesn't just not make sense – it's stupid! Think how easy it is to manipulate an index that has those kind of price distortions.

Fortunately, we love these easily manipulated distortions. Yesterday morning, in our Live Member Chat Room, we shorted the Dow (/YM) Futures as they tested 23,300 and we got a great drop to 23,225 which was good for gains of $375 per contract.

Fortunately, we love these easily manipulated distortions. Yesterday morning, in our Live Member Chat Room, we shorted the Dow (/YM) Futures as they tested 23,300 and we got a great drop to 23,225 which was good for gains of $375 per contract.

Even if you don't have access to the Member Chat Room, in our morning's PSW Report, we gave you the long trade idea for /KC at $1.28 and that was good for $375 per contract by 10 am (and today it's back and we can play it again).

Our other Trade Idea from the Monday Morning Report was:

Silver (/SI) is back to $16.90 and that's down 0.40 from Thursday's close but back to where we went long on Wednesday so why wouldn't we play it again (with tight stops below) as it was a $1,500/contract winner last time? $16.75 should be the low-low, so that's where I'd look to try again if $16.90 fails and we'll follow up on this one into Wednesday's Live Trading Webinar.

As you can see, a single contract there picked up gains of $875 by the end of the day and, this morning, we're back to $17 and looking for another nice entry on the long side. So we're shorting the Dow (/YM) at 23,390 – as we don't even think it will make 23,400 but tight stops over if it does – and we're long on Coffee (/KCH8) again at $1.28 and long on Silver (/SI) again at $17 but tight stops there and try again at $16.90 and $16. 75. The stops are VERY important – try to lose less than you win and then you only have to be right half the time!

We already shorting Gasoline (/RB) at $1.69 in Member Chat this morning and we'll take the Oil (/CL) short at $52.25 because it looks like it won't make it to $52.50 as we'd hoped. Futures are a really fun way to day trade as they are very clean to pop in and out of and most Futures traders are technical traders which means, these days, people who read the papers have a huge advantage.

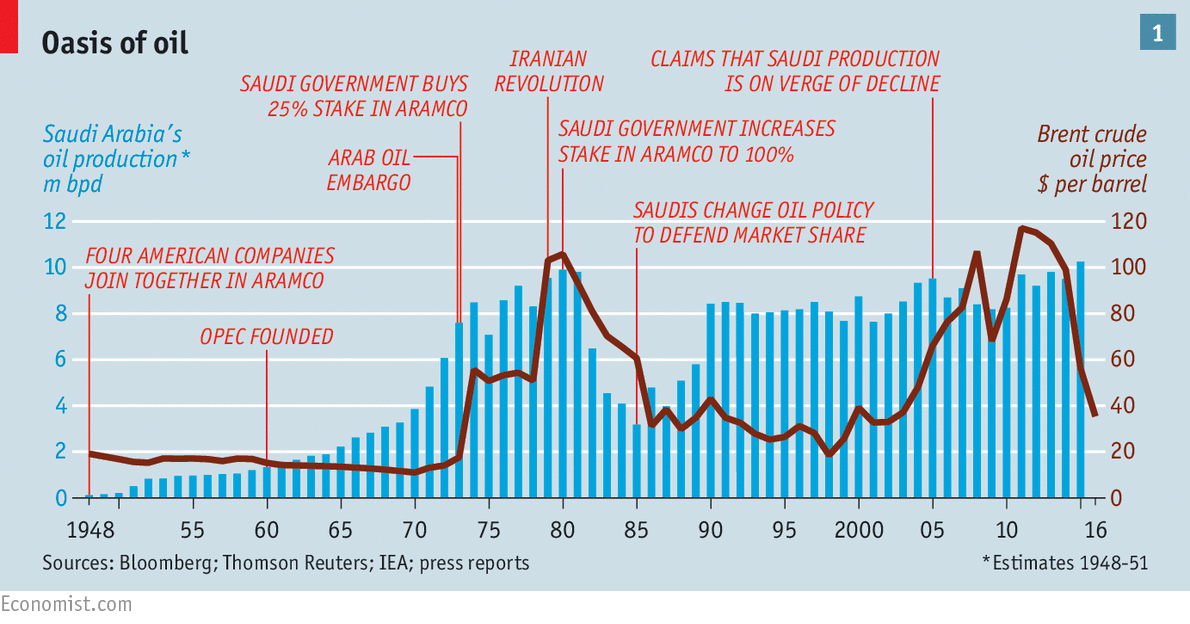

Oil was up this morning on more jawboning from the Saudis, whose desperation to get prices up to justify their Aramco deal is like a palbable stench that permeates all their actions. Just check out the headlines coming out of their investing conference:

- The "sweet spots" that American frackers are focusing on will eventually deplete, forcing them to tap less lucrative acreage, Amin Nasser (Aramco's CEO) says.

- A lack of recent investments in the oil sector could lead to a shortage of supplies.

- Saudi Aramco IPO never been linked to oil market – CEO on TV

- Saudi Aramco CEO Affirms IPO On Track For H2 2018

- Saudi Aramco's IPO is a mess

For a conference that's supposed to be about the "new" Saudi Arabia (where women can now drive… starting in June… maybe) and how they are getting away from oil dependence, this conference has been all about oil and all about Aramco's $2Tn pending offering (soon to be $1Tn). The "on track" date for the IPO has already been bumped back twice, from now to Q1 and now "2nd half" of 2018, this is not really what you expect from an IPO so "hot" that they will intially offer at 3 times the size of the World's 2nd largest companies (AAPL, XOM).

Obviously, if oil isn't over $55 pretty much all of next year, this thing flops and the new Saudi Prince may find his head in a basket, so saying there's a lot of pressure on Prince Alwaleed bin Talal is a bit of an understatement. Though he already has over $20Bn it's just a small part of the family's $1.4Tn fortune, most of which is locked up in Aramco, which contols 261Bn barrels of proven reserves. At $50/barrel, that would be about $13Tn worth!

But Aramco doesn't get $50, they get about $45 on average and it costs them $10-15 to get the oil out of the ground so call it net $30 and that's "only" $7.8Tn worth of oil BUT they "only" sell 11Mb/d so 4Bn barrels a year is $120Bn a year in theoretical profit, which is why they think they can get $2Tn (16.66 x earnings). The problem is the Saudi Royal family needs most of that money to run the country that controls that oil and the rise of electric cars and the crackdown on greenhouse gasses means they may not have enough time (65 years at this rate) to get all that oil out of the ground before it's essentially worthless – so it's kind of a "wind-down" asset.

But Aramco doesn't get $50, they get about $45 on average and it costs them $10-15 to get the oil out of the ground so call it net $30 and that's "only" $7.8Tn worth of oil BUT they "only" sell 11Mb/d so 4Bn barrels a year is $120Bn a year in theoretical profit, which is why they think they can get $2Tn (16.66 x earnings). The problem is the Saudi Royal family needs most of that money to run the country that controls that oil and the rise of electric cars and the crackdown on greenhouse gasses means they may not have enough time (65 years at this rate) to get all that oil out of the ground before it's essentially worthless – so it's kind of a "wind-down" asset.

That is what the Saudis need to fight against. They need to convince potential Aramco investors of two things: That oil will stay over $50 a barrel for the long-term and that oil will continue to be consumed at the current pace long into the future. What if, in reality, consumption drops just 2% a year for the next 20 years? That would mean that, by 2038, only 5.5Mb would be needed from Aramco as 2% compounded 20x is 48.5% off the current rate. So their average output over 20 years would be more like 8.5Mb/d and assuming prices hold $50 in that scenario is a pipe dream (or hookah dream, in this case).

8.5Mb/d at $50 is just $93Bn and the Saudis are already running a 10% defict at $120Bn, which is why they are desperate to fill the gap with a $200Bn IPO but even that won't last them and the Royal family may be looking to take the money and run – rather than put it into the sinking ship that is the Saudi economy. What happens to your Aramco investment then? We'll talk more about this mess as the IPO moves along.

8.5Mb/d at $50 is just $93Bn and the Saudis are already running a 10% defict at $120Bn, which is why they are desperate to fill the gap with a $200Bn IPO but even that won't last them and the Royal family may be looking to take the money and run – rather than put it into the sinking ship that is the Saudi economy. What happens to your Aramco investment then? We'll talk more about this mess as the IPO moves along.

Meanwhile, the Saudis are spreading their cash around to pay off anyone and everyone to talk up their country, their company and the price of oil. CNBC is a non-stop commercial for the Saudis this week and the US is doing it's part to support our "friends" with Climate Denier Scott Pruitt of the EPA now so hated that he's had to double his security at a cost of $2M taxpayer Dollars but he's the most effective ally the Saudis have in rolling back the Global march towards clean energy.

Now that Nicaragua has signed the Paris Climate Agreement, the only two rogue nations on the Planet Earth that have not signed the accord are Syria and, of course, the United States – two regimes dominated by dictatorial strongmen who insist they are only doing the will of the people. To the other 195 countries on the planet, we are officially outsiders, intent on destroying the world they are trying to save.

According to the Government Accountability Office (GAO) the Federal Government has spent $350Bn over the past 10 years on Disaster Relief NOT including the damage from this year's wildfires and hurricanes, which will likely double that total. Climate change is also expected to double those costs and the GAO considers the situation "dire".

The report says the fiscal impacts of climate change are likely to vary widely by region. The Southeast is at increased risk because of coastal property that could be swamped by storm surge and sea level rise. The Northeast is also under threat from storm surge and sea level rise, though not as much as the Southeast. The Midwest and Great Plains are susceptible to decreased crop yields, the report said. The West is expected to see increased drought, wildfires and deadly heatwaves. Speaking of which, it's 100 degrees in California this morning – on October 24th!

The report says the fiscal impacts of climate change are likely to vary widely by region. The Southeast is at increased risk because of coastal property that could be swamped by storm surge and sea level rise. The Northeast is also under threat from storm surge and sea level rise, though not as much as the Southeast. The Midwest and Great Plains are susceptible to decreased crop yields, the report said. The West is expected to see increased drought, wildfires and deadly heatwaves. Speaking of which, it's 100 degrees in California this morning – on October 24th!

Earlier this month Trump nominated Kathleen Hartnett White of Texas to serve as his top environmental adviser at the White House. She has credited the fossil fuel industry with "vastly improved living conditions across the world" and likened the work of mainstream climate scientists to "the dogmatic claims of ideologues and clerics." White, who works at the Armstrong Center, a conservative think tank that receives funding from fossil-fuel companies, holds academic degrees in East Asian studies and comparative literature.

Just the kind of background needed to weigh in on our children's future…