What’s Wrong With Value?

Courtesy of Michael Batnick

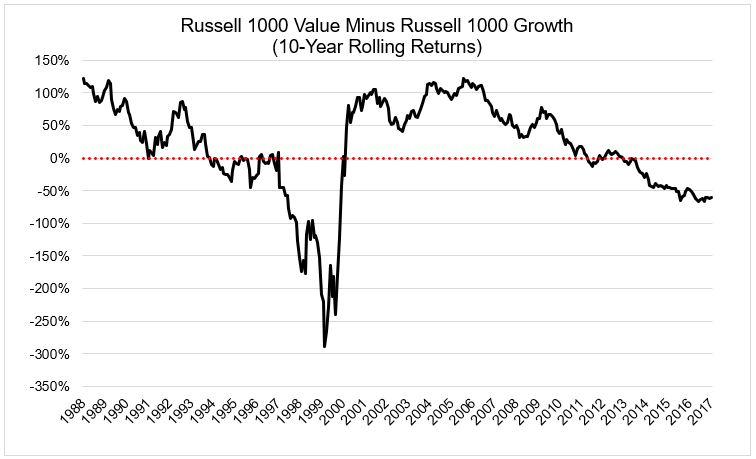

It has been a tough decade for value investors. Over the last ten years, it’s trailed growth to the largest extent since the inflating of the dot-com bubble.

The chart below shows that the Value stocks, as represented by the Russell 1000 Value Index, have underperformed growth stocks over the last ten years by 61%.

I understand there is a world of difference between value investing that the Dodd and Graham disciples practice and what is represented by a value index. I also understand that Russell indices are not the purest representation of growth and value, but I’m going to use them for the sake of making the a few points. By the way, the Fama French indices tell the same exact story, only to a greater degree. Here, growth has outperformed value by 118% over the last decade. Ouch.

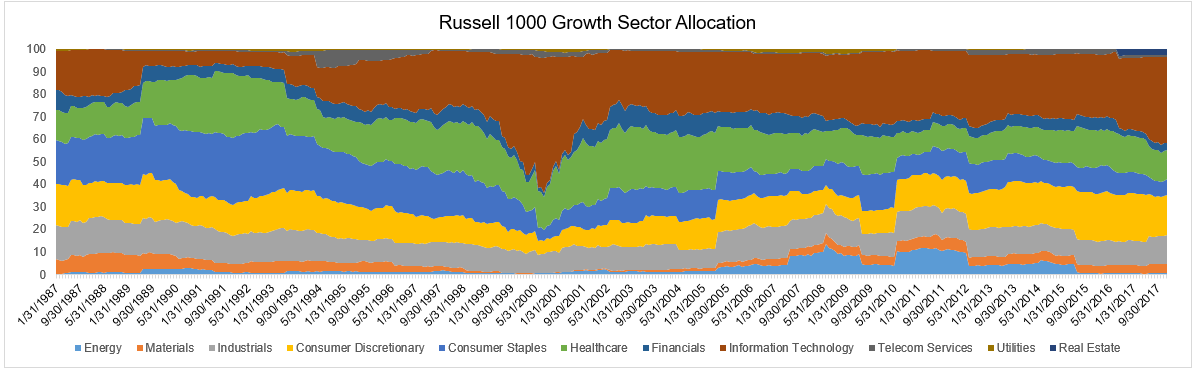

I think there is a very simple explanation to what’s going on, and it begins and ends at the sector level. Below are the sectors that comprise the Russell 1000 Growth Index. This is dominated by tech (38%) and consumer discretionary (18%) stocks, which make up 56% of the portfolio.

*Sector data provided by iShares

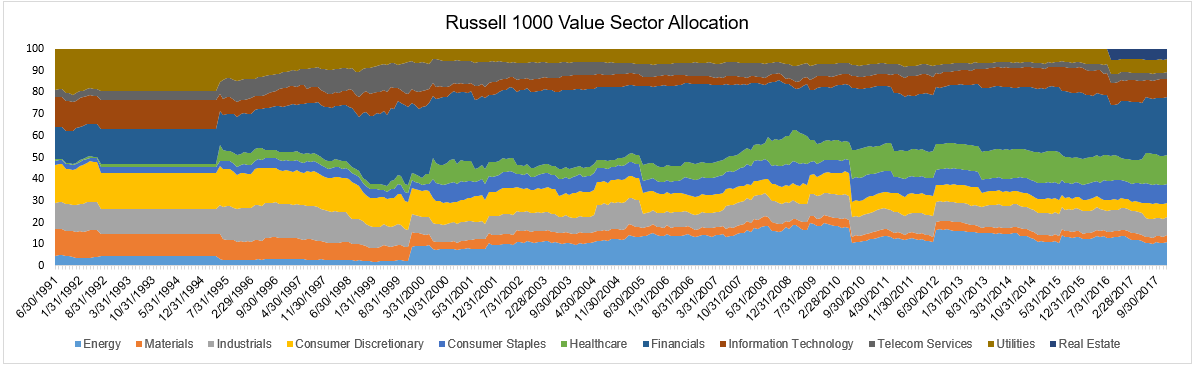

Tech and consumer discretionary make up just 15% of the value index. This index is dominated by financials (27%) and healthcare (14%).

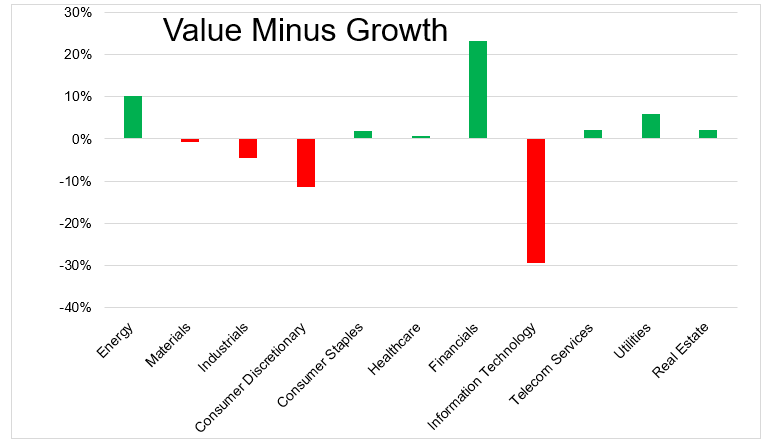

Below shows the difference in sector composition. The green bars means there is more in value, and the red bar shows where there is more in growth. Value has 23% more exposure to financials and 29% less exposure to tech. This is the primary driver of the gap in performance over the last ten years.

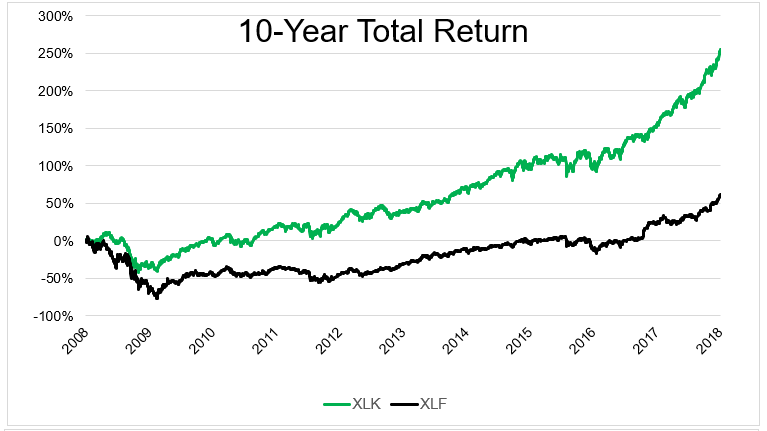

Over this time, tech stocks have gained 255% while financials have gained just 61%!

The value premium exists because investors extrapolate too far. It works the same way that momentum does, only in the opposite direction. In my opinion, the excess returns that investors have earned over the looooong run are driven by human behavior, which cannot be arbed away. But this is a risk premium, and sometimes investors eat the risk for longer than they thought possible. So to answer the question, other than the returns relatively sucking, nothing is wrong with value.