When Stocks and Bonds Fall

Courtesy of Michael Batnick

“The economy has changed and investors can no longer rely on a diversified stock-bond portfolio to provide protection in times of market volatility, according to JP Morgan Asset Management.” This comes from a recent Bloomberg article, A Diversified Portfolio May Not Help Investors Much This Year. We’re just two months into the year, but this observation is spot on.

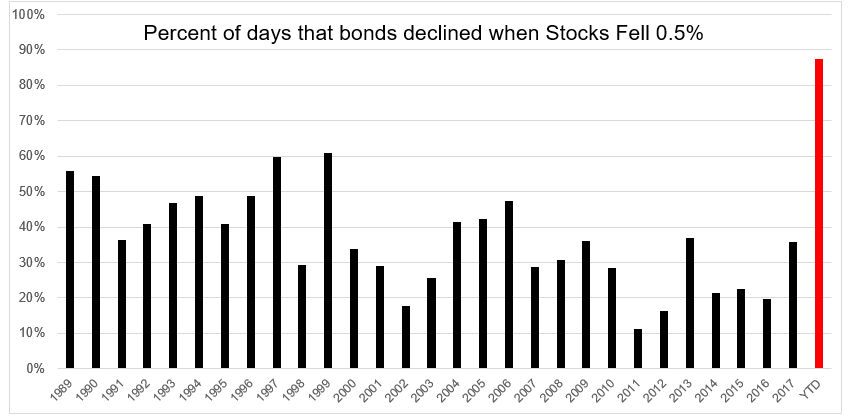

Twenty percent of all days in 2018 have seen stocks (S&P 500) fall at least 0.5% with bonds (U.S. Barclays Agg) closing negative on the same day. This is quite a change from what investors have experienced over the last few years.

One would expect high quality bonds to provide some stability when stocks come under pressure, but what one expects and what actually happens doesn’t always line up. Granted we’re only 16% through the year, but as the chart below shows, in the 8 days that the S&P 500 fell at least 0.5%, bonds declined in all but 1 of those days. I would expect this number to come down as the year goes on, but finishing above 50% would not be unprecedented. In 1999, stocks fell at least 0.5% 79 times, and bonds fell 48 of those 79 days. (Stocks gained 19% on the year, bonds lost 0.82%)

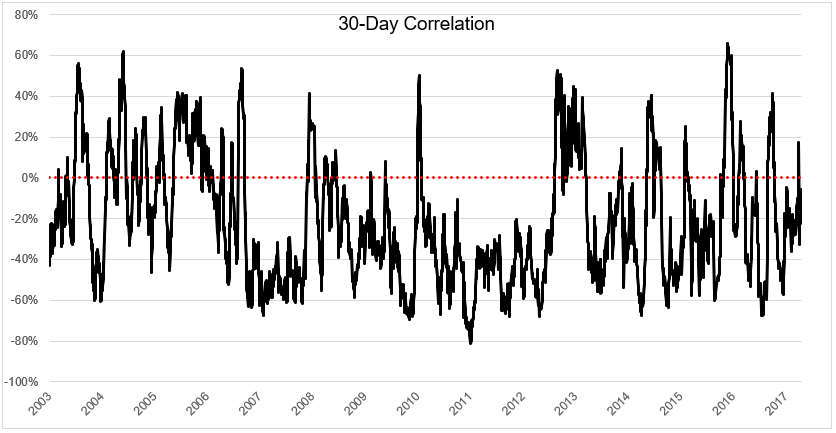

Below is the 30-day correlation between stocks and bonds (SPY, AGG). On average it’s negative (-0.21), but I’d be careful saying stocks and bonds are negatively correlated. This implies that when stocks go down, bonds go up, which isn’t always the case. They have had a positive correlation in 25% of all periods, so I think it’s more reasonable to say that stocks and bonds are not correlated, rather than stocks and bonds are negatively correlated. This is a subtle but critically important distinction.

It’s true, bonds might not help you in the short run when stocks fall. Now what do we do with this information? Investors have a few options.

- First and foremost, you can add assets outside the United States to your portfolio. You can also include things that are neither stocks nor bonds.

- If you want to include something in your portfolio that is not only not correlated to stocks, but negatively correlated, then you’re probably going to have to add something that has negative expected long-term returns, like a put option for example. These will expire worthless most of the time and will be a drag on your long-term returns, but they would rise when stocks fell.

- Hold more cash. Cash is a drag on long-term returns, but if you’re incapable of being fully invested in a balanced portfolio, then the drag from cash is nothing compared to the drag on selling into a decline.

- If you’re constantly worried, it’s probably a good idea to own less stocks and more bonds. But what about if stocks and bonds fall? Well, what do you want me to tell you? Investing comes with few guarantees.

Stocks and bonds haven’t declined in the same calendar year since 1969 (the S&P 500 fell 8.5%, 10-year treasury bonds fell 5%), so even though bonds have not cushioned the blows thus far in 2018, you’ll probably be better off if you can look past the day-to-day. But even then, all bets are off. Would anybody be surprised if rising rates cause stocks to have a negative year? And would that really be the end of the world? If you can’t handle twelve months worth of negative returns, you’re in for a rude awakening at some point in time.

Stocks and bonds are both risk assets with positive expected returns. But these returns are not promised, and the benefits of owning non-correlated assets aren’t always felt over the short-term.