The five alternatives to EU single market and customs union would all make UK poorer

Courtesy of Karen Jackson, University of Westminster and Oleksandr Shepotylo, University of Bradford

Concerns are intensifying over the UK’s economic future, thanks to the lack of clarity over what kind of relationship it will have with the EU after Brexit. If the UK were to leave the single market and customs union, there are five obvious alternatives.

We looked at each of these in a recent study and found the UK’s real GDP will drop by 2.63% if there is a shallow free trade agreement in place with the EU (akin to Canada’s). If the UK manages to also conclude a free trade agreement with the US, the effect of leaving the EU will be -2%. And an agreement with the largest Commonwealth countries will make it -1.93% worse off than staying in the EU.

In the case of a hard Brexit, reverting to World Trade Organisation (WTO) free trade rules, the predicted losses will grow to -4.78%. A free trade agreement with the US will reduce predicted losses to -4.13% and, alternatively, a deal with the Commonwealth countries would lessen the blow to -3.96%.

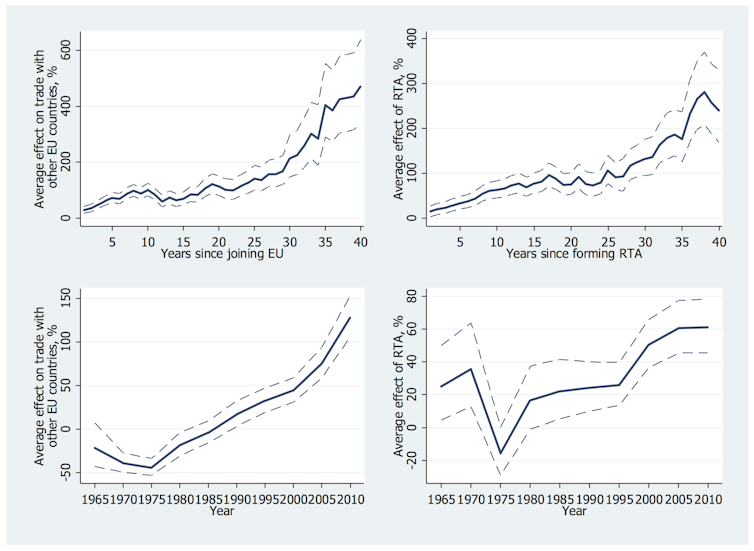

This will not take place abruptly. The losses will occur over a long period, but it’s clear that signing new trade agreements with other countries cannot entirely compensate for leaving the EU. We also found that the trade creation effect of the EU (where trade deals spur more trade between countries after they sign a trade agreement) gets stronger over time and has currently reached its peak. This suggests that our estimates of Brexit are quite optimistic.

Global shifts in world trade

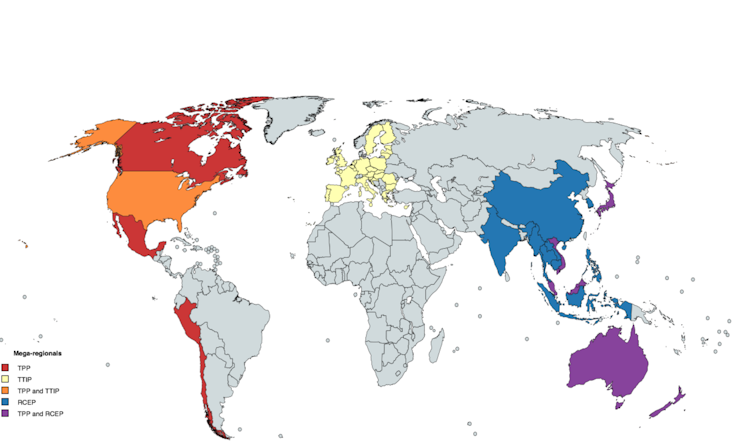

Over the last century, the UK has gone from being a global trade power to an “awkward partner” in the EU, before rejecting its EU membership outright. This nationalist tendency is in contrast to the moves of many countries towards forming mega-regional trade blocs like the the Trans-Pacific Partnership (TPP) between the US and 11 countries around the Pacific, and the 16-nation Regional Comprehensive Economic Partnership (RCEP) – and, of course, the EU.

Negotiating these blocks requires large-scale trade diplomacy and prolonged discussions. They take years to negotiate.

Global trade deal groups. Oleksandr Shepotylo and Karen Jackson

While UK policy makers have been keen to highlight the opportunities of signing new trade deals, it is becoming increasing apparent that negotiating an implementation period to do so is an important next step. Hence, the UK Brexit secretary, David Davis, has called for a time limited period after Brexit where the EU’s trade agreements with third countries continue to apply to the UK.

In other words, it is starting to become clear that grandfathering agreements, where agreements that apply to the EU would be rolled over and apply to the UK, is not quite as simple as it may have first appeared.

In the face of such difficulties it is somewhat predictable that the US and Commonwealth get mentioned as the light at the end of the tunnel. Certainly the Commonwealth remains as a group of member states. But re-establishing it as a trading club headed by the UK, or the UK signing a collection of bilateral trade agreements through it, may prove difficult.

After World War I, the UK defence of imperial preferences was seen by some as a desperate attempt to maintain a powerful position in the world-trading environment. More recently, African countries have been reticent to sign up to EU trade deals amid accusations that they are a type of colonialism. Meanwhile, India is backing their “Buy in India” programme rather than looking to trade with the UK.

Five alternatives

Our research highlights the losses stemming from the lower bargaining power of the UK as a standalone country, rather than as a member of a powerful trading bloc like the EU.

Signing free trade agreements with countries that are farther away, such as the US or Commonwealth countries (Australia, Canada, New Zealand, India, Pakistan, South Africa) cannot compensate for these losses, as some commentators suggest. But it reduces the blow by about 0.65 to 1.1%, depending on the scenario. A hard Brexit would generate losses from 4.1% to 5.3% of real GDP – that’s roughly £77 billion to £99 billion.

Again, it’s important to recognise that these losses will not be immediate, nor will a hard Brexit cause a catastrophic decline in trade flows between the EU and UK. These are long-run forecasts and these changes would occur gradually after Brexit has taken place.

The multiplier effect

To understand how the effect of trade deals influence trade creation over time, we studied all free trade agreements around the world over the period 1960-2014. Several important trends emerge. First, the positive effect of a free trade agreement (or negative effect of exiting it) accumulates over several decades. Second, preferential trade agreements, in particular, the EU common market are currently having the strongest impact on trade in the European region.

Dynamics of regional trade agreements (RTA) and the EU, 1960-2014. Karen Jackson and Oleksandr Shepotylo, CC BY-ND

Countries benefit from integrating into large regional trade and economic blocs. Those that do not, experience significant economic losses. Even if a country outside the bloc is a more efficient exporter, they lose out to less efficient exporters that are in the trade group. Similarly, countries in trade blocs give each other preferential treatment, causing those outside the group to decline in importance.

So a resurgence of the Commonwealth group as a mega-regional would be beneficial, but not to the extent that it would compensate for the losses associated with Brexit. That’s assuming it would be possible to sign a free trade agreement with the largest Commonwealth countries. A US-UK free trade agreement would also face significant political difficulties and, if realised, the benefits would not outweigh the negative effect of Brexit.

![]() The UK decision to step outside the EU framework and embark on independently negotiating trade deals is a risky endeavour and likely to bring significant losses. Signing TTIP would further weaken the UK’s position. Instead, the UK would be wise to negotiate a way it can play the new mega-regional game as part of the EU bloc.

The UK decision to step outside the EU framework and embark on independently negotiating trade deals is a risky endeavour and likely to bring significant losses. Signing TTIP would further weaken the UK’s position. Instead, the UK would be wise to negotiate a way it can play the new mega-regional game as part of the EU bloc.

Karen Jackson, Senior Lecturer in Economics, University of Westminster and Oleksandr Shepotylo, Lecturer in Econoimcs, University of Bradford

This article was originally published on The Conversation. Read the original article.