Trump wins!

Trump wins!

North Korea said they are willing to hold talks with the US about giving up nuclear weapons and "normalizing" relations with Washington (whatever normal is these days). The two Koreas also agreed to hold a summit meeting between Mr. Kim and President Moon Jae-in of South Korea on the countries’ border in late April, Mr. Moon’s office said in a statement.

“The North Korean side clearly stated its willingness to denuclearize,” the statement said. “It made it clear that it would have no reason to keep nuclear weapons if the military threat to the North was eliminated and its security guaranteed.”

“The North expressed its willingness to hold a heartfelt dialogue with the United States on the issues of denuclearization and normalizing relations with the United States,” the statement said. “It made it clear that while dialogue is continuing, it will not attempt any strategic provocations, such as nuclear and ballistic missile tests.”

Between that news and the growing consensus that Trump's tariffs won't really affect much of the Global Trade (the EU retailiated with just $3.5Bn in sanctions against US goods) the markets are sharply higher yet again and, once again we'll check in on the S&P's bounce lines to answer the eternal question: "Are we there yet?" Here's the line we were looking for a month ago:

And here's where we are today:

I would be more excited but last Monday we had a fake 80-point gain on low volume and yesterday we had an 80-point move on low volume – so it remains to be seen if it actually holds up for more than a day. Also, last Monday was far more impressive than where we are now and we fell 140 (5%) points by Thursday – so let's not get carried away by getting halfway back to where we were, OK?

There's not too much market-moving news, we had Powell's testimony last week and then the Tariff thing and now we have possible peaceful moves in North Korea but were we really discounting the market over North Korea in the first place? Hard to say something is now a positive when it wasn't really a negative before. We're out of earnings season and data has been mixed so what catalayst do we have to take the market back to it's highs (S&P 2,872 – still 5% higher than we are now)?

Where we are, at the moment, is halfway between where we peaked out and January and where we felll to in February. A bit bullish if we stay above the strong bounce line – but certainly nothing worth throwing a party over.

The key is getting back over the 50 dma at 2,736 – otherwise we're likely consolidating between the 50 and 200 dma and that means this is the top, not the bottom, of the range to come. It's a little scary to short this morning but if the Dow Futures (/YM) dip back below 25,000 – that's a good line to keep a tight stop on with a short below. It should line up with 2,730 on /ES, 6,720 on /NQ and 1,555 on /TF (also fun to play short) so look for 2 to go below and then short the laggard – stopping out if any of them go back over.

Again, nothing has fundamentally changed, this is most likely dip buyers running in again because they believe that 2,872 was the "right" price but that's like thinking 105.9 is the "right" body temperature, just because you spiked that high once. Markets overshoot the mark all the time and then they settle down to a more realistic level – we don't believe 2,872 or even 2,640 is a realistic level – most likely it's the top of a channel that goes 10% lower to 2,420.

We've been saying that for a month and Goldman Sachs disagrees with me, they say 2,449 is the right level for the S&P 500 using this chart and the following voodoo;

The index saw an initial selloff that was impulsive in nature (wave A). This tends to mean that there’s likely going to be another impulsive 5-wave decline to complete an ABC 5-3-5 count. From current levels, an eventual C wave could reach somewhere close to 2,449.

Having said that, it’s not uncommon for wave B to form complex structures (often triangles). Although ultimately bearish, there’s scope for some initial consolidation/ range-bound price action while still in the “body” of the February range.

The next significant retrace level below is 61.8% from Feb. 9th at 2,631. The 200-dma will likely be critical at 2,560. This particular moving average held very well at the prior low. Getting a break below it would therefore help to confirm that this is in fact wave C targeting at least ~2,449.

Reaching this 2,449 level would also mean retracing ~38.2% of the immediate advance from Feb. ‘16 (2,467). This would therefore be an ideal target from a classic wave count perspective; that is, if correcting the rally from Feb. ‘16.

As has been discussed in previous updates, the market could also be starting a much bigger/more structurally corrective process, counter to a V wave sequence from the ‘09 lows. If that’s the case, there should be room to continue a lot further over time. At least 23.6% of the rally since ‘09 which is down at 2,352.

Bottom line, it’s worth considering the possibility of continuing further than 2,467-2,449. Doing so might imply that this is not an ABC but rather a 1-2-3 of 5 waves down, in a larger degree ABC count that could take months to fully manifest. While it is still far too early to make this call, the important thing to note is that the 2,467-2,449 area will likely be trend-defining.

I don't know about all that nonsense but our 5% Rule™ says 2,420 and the 5% Rule™ is not TA, it's just math! On the whole though, it does have many of the same elements as the Fibonacci Retracements Goldman's technical team is hanging their hats on so we'll agree to disagree on the exact target but, if I were you, I'd take the main point seriously and make sure your positions are well-hedged (see last week's PSW Reports for trade ideas to that effect).

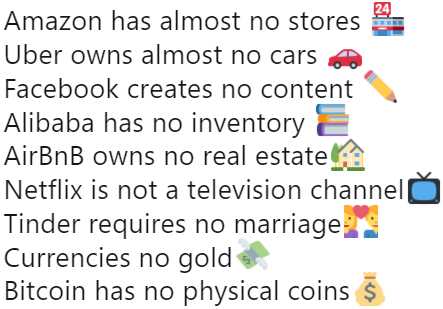

Steve Burns did a good job of summing up what's wrong with the current market valuations – they are based on NOTHING! We are valuing middleman companies like Amazon (AMZN), Uber, Facebook (FB), AirBnB and Netflix (NFLX) at tens of Billions of Dollars – even though they are essentially the same dot-com models that evaporated into dust 20 years ago (next year is the Crashiversary).

Steve Burns did a good job of summing up what's wrong with the current market valuations – they are based on NOTHING! We are valuing middleman companies like Amazon (AMZN), Uber, Facebook (FB), AirBnB and Netflix (NFLX) at tens of Billions of Dollars – even though they are essentially the same dot-com models that evaporated into dust 20 years ago (next year is the Crashiversary).

And why not? As Steve points out, we're buying them with currency that is backed by nothing to the point that we're willing to exchange that for currencies some kid made up in their basement last week (see the Madness of DogeCoin for a great example of that). There are always "experts" willing to explain to you why "this time is different" and we can create wealth out of thin air and everyone will be a Billionaire and there will be no consequences – it all sounds great, until it doesn't.

I don't like to be Cassandra or even Chicken Little but I turn 55 this month and I've seen it all before – several times and we're still 80% in CASH!!! and very well-hedged in our portfolios because we don't think this is the end of the selling – just an intermission.

Be careful out there!