No news is good news.

No news is good news.

That's true for the markets as the lack of negatives puts us back into default mode (up), despite there being any real positives to point to either. We're well over our bearish levels now and in full-on recovery mode and, usually, I would make a comment about yesterday's comically low volume but that never seems to matter either – so we're just going to go with the flow and enjoy the ride until it stops.

This morning we had a calmer CPI number at 0.2% as energy prices came down and the Core CPI (ex food and energy) remains at 1.8%, which briefly blasted the markets higher but then Trump fired Rex Tillerson and we gave back half the gains but now Trump appointed the CIA Director (Pompeo) to be Secretary of State because, I guess, Director of the CIA isn't an important enough job. Of course, Pompeo is a very loyal Tea Party Republican, appointed by Trump last year (he had previously been a Congressman).

The good news is Pompeo is being replaced by Deputy Director Gina Haspel, who is an actual CIA lifer and was, in fact, Obama's Director of National Clandestine Services and I don't know exactly what it is but it sounds cool! Essentially she's the female Jack Bauer, who's been on the ground all over the World fighting terrorism and she even ran a black site prison in Thailand – so she probably knows how to get people to talk!

The good news is Pompeo is being replaced by Deputy Director Gina Haspel, who is an actual CIA lifer and was, in fact, Obama's Director of National Clandestine Services and I don't know exactly what it is but it sounds cool! Essentially she's the female Jack Bauer, who's been on the ground all over the World fighting terrorism and she even ran a black site prison in Thailand – so she probably knows how to get people to talk!

Now, you would think, being a liberal, that I have a problem with this but I don't. Terrorists don't play by the rules and you have to fight fire with fire – not that Haspel has been accused of anything very bad (other than, perhaps, "accidentally" deleting a few "interview" tapes). What will be interesting now is how vigorously she will pursue Russian Election Hacking – something Pompeo hasn't touched during his year in office (though he did say the CIA concluded it definitely happened).

Meanwhile, the Saudis have lost control of the price of oil (/CL) and we shorted it this morning at $61.50 in our Live Member Chat Room. As I noted to our Members:

I think the Saudis have, at great expense, been sustaining Brent above $65 and they are having trouble keeping a lid on production (for other OPEC members) and the US is killing them with their production increase and they can't sustain it long enough to make the IPO, so they are delaying the IPO. If it weren't almost May, I'd bet oil would crash hard but, as it is, I just like the bet from $61.50 to $60 for now and then we'll see if that holds.

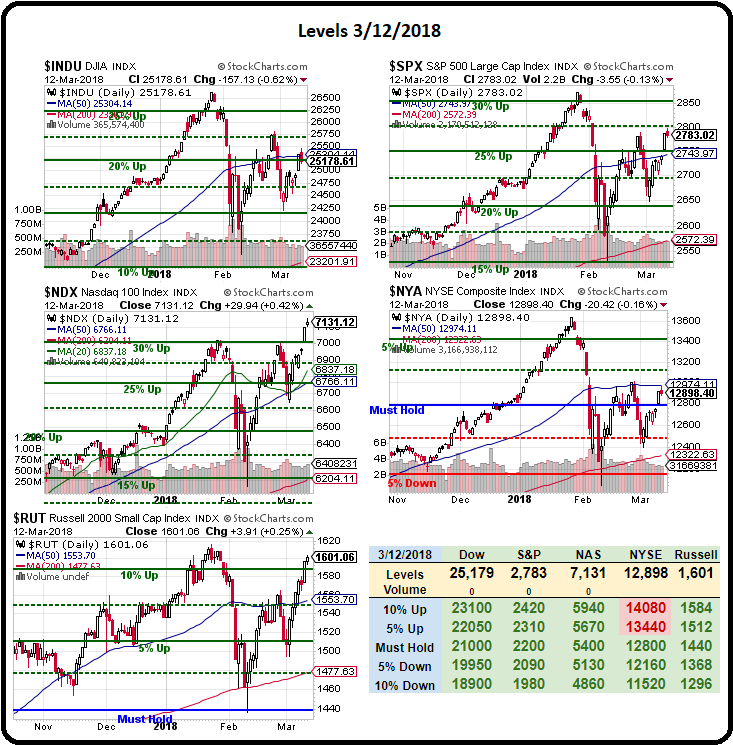

As to the indexes – I would have said watch the 50 dma on the Dow at 25,304 but we blasted over that this morning so now just make sure it doesn't break down but the Nasdaq is 7.5% over it's 50 dma at 6,766 and the Russell is 3% over 1,554 with the S&P up 2.5% from 2,572. Only the NYSE hasn't crossed back over their 50 dma at 12,974 and that's the last line we need to confirm the rally is back in full swing.

Nonethelss, I was on CNBC Japan last night and they asked me what my top concern was and I said it was Trade Wars but only because Central Bank tightening wasn't a "concern" – as it's already a fact in progress. Given the current environment of monetary policy tightening and rising rates coupled with the possiblity of a Global Trade War – I told the interviewer we were still playing things cautious with our Long-Term Portfolio over 80% in CASH!!!.

I said we plan on deploying more cash when the S&P drops to 2,400, which is 15% down from the current 2,800 but that includes people paying $1,600 for a share of Amazon (AMZN) that generated $4.56 in profit last year for a return of 0.285% – Japanese bond investors laugh at Amazon shareholders!

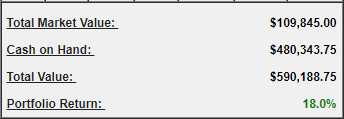

Not that we don't enjoy the rally. Our Long-Term Portfolio (LTP) has jumped to $590,188, which is up 18% for the year (we started fresh with $500K on Jan 2nd) and that's up $32,000 since FRIDAY morning's Report – without touching a single position. Come on folks, this is ridiculous – markets can't sustain these kinds of gains. Even worse, it's all just the net $77,702.50 in positions we had on Friday (see the Report), the cash is the same $480,343.75 but now the positions are worth $109,845.

Not that we don't enjoy the rally. Our Long-Term Portfolio (LTP) has jumped to $590,188, which is up 18% for the year (we started fresh with $500K on Jan 2nd) and that's up $32,000 since FRIDAY morning's Report – without touching a single position. Come on folks, this is ridiculous – markets can't sustain these kinds of gains. Even worse, it's all just the net $77,702.50 in positions we had on Friday (see the Report), the cash is the same $480,343.75 but now the positions are worth $109,845.

Well, I shouldn't say "worth" but it's what they priced at at yesterday's close. So the positions themselves popped $32,142.50 (41.3%) in two sessions. Of course we are using margin and options for leverage but, NONETHELESS, this is a ridiculous amount of money to make in two days and it simply indicates that we have a completely broken system that will, one day – come off the rails in a spectacular fashion.

We'll be reviewing all five of our Member Portfolios over the next few days and, of course, we'll be adding more hedges to lock in our ill-gotten gains!