Not just a weak week but a weak 45 days since February.

Not just a weak week but a weak 45 days since February.

After testing our 30% line on the S&P 500 at 2,860 at the end of January, we plunged down to our 20% line at 2,640 in early Feb and now, 5 weeks later, we have struggled to hold the 25% line, which has now become the 50-day moving average as well at 2,750.

The annotation on the chart is not our 5% Rule™ but a simply Fibonacci retracement and it shows you what a cleanly technical move the market is making. That, in turn, indicates that the majority of this trading is being done by robots and those robots are not trading with emotion or enthusiasm – they are just trading their pre-programmed ranges and it won't take much of a change of human hearts to send the whole thing crashing back down another 10% from here.

I told CNBC in Japan earlier this week that my number one Global concern was a Trade War and now, in addition to steel and washing machine tariffs, we (and NATO) are sanctioning Russia and Russia is retaliating against us and now Trump is readying "sweeping tariffs and investment restrictions on China" – this is what a trade war is folks – no one declares it, it just happens step by diplomatic step. Suddenly, among Conservatives, "Globalism" and "Globalists" have become bad words, words used to describe their enemies the way they used to say "Communist" and "Socialist". These are very dangerous times, folks.

This myopic, anti-Progressive, anti-progress, protectionist view of the World comes right out of the early 1900s and in fact, the first "America First" Committe was formed as an attempt to keep the US from "meddling" in World War II and was "characterized by anti-semitic and pro-fascist rhetoric." Trump's form of Fascism isn't anti-semetic yet, just anti-Muslim and anti-Mexican and anti-African and anti-Poor so, as long as you aren't one of THOSE – you're good – for now.

Hoover's America First protectionism and tariffs landed us in the Great Depression and Hoover, like Trump, literally promised his base "A Chicken for Every Pot" saying, right there in the history that we tend to forget and repeat: "Under higher tariff and lower taxation, America has stabilized output, employment and dividend rates." "Republican prosperity is written in factory chimney smoke, written in the peak value of stocks and bonds… silenced discontent…"

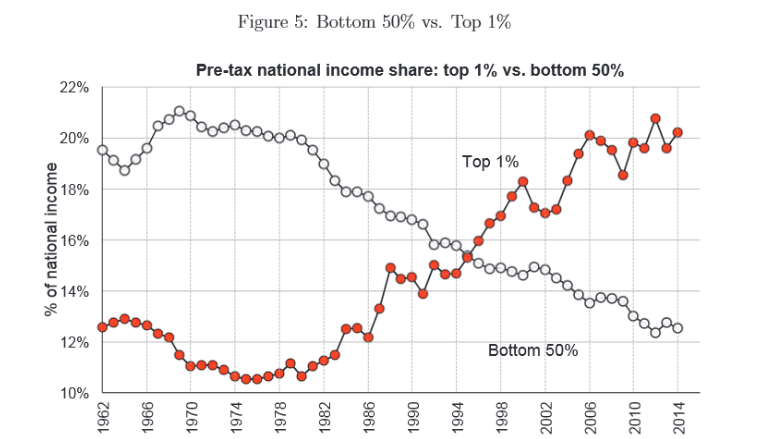

It would be funny if that wasn't the GOP platform of October 30th, 1928 – one year before the economy collapsed and it would be ironic if it wasn't the GOP of March 16th, 2018 – indicating we have learned NOTHING in the past 80 years. Well, I take that back, we have learned something, the Rich became much, much richer in the economic upheavals of the early 1900s, reaching peak income inequality in 1929 – a record that has only just been surpassed this year.

As a country, the US fares pretty poorly when it comes to income inequality: according to the CIA Factbook, the US has the 40th highest level of inequality out of 150 countries — around the same level as Jamaica, Peru, and Cameroon. Analysis from political geographer Richard Morrill showed that areas like the South, where income inequality was more pronounced, also have high minority populations.

The US has gone from being the World Leader in income equality in the 60s and 70s to 40th place in 40 years. Trump's tax plan is setting us up for another parabolic move in Top 10% wealth compared to the bottom 90% – like the one we had after Reagan got that ball rolling in the 80s. We're in the Top 10% so YAY!!!, I guess.

The US has gone from being the World Leader in income equality in the 60s and 70s to 40th place in 40 years. Trump's tax plan is setting us up for another parabolic move in Top 10% wealth compared to the bottom 90% – like the one we had after Reagan got that ball rolling in the 80s. We're in the Top 10% so YAY!!!, I guess.

The big question is, how poor can the poor get before the system falls apart?

And let's not delude ourselves, every single Dollar gained by the Top 1% (people earnings over $615,800 per year) comes right out of the pockets of the Bottom 50% to the point where the Bottom 50% now earn less than 12% of the National Income while the Top 1% earn 20% and the rest of the Top 10% earn another 10% so that's 30% for 10% of the people (3 shares each) and 12% for 50% of the people (1/4 share each).

And let's not delude ourselves, every single Dollar gained by the Top 1% (people earnings over $615,800 per year) comes right out of the pockets of the Bottom 50% to the point where the Bottom 50% now earn less than 12% of the National Income while the Top 1% earn 20% and the rest of the Top 10% earn another 10% so that's 30% for 10% of the people (3 shares each) and 12% for 50% of the people (1/4 share each).

And the funny thing is that, even in this example, I end up talking about the Top 10% but the Top 10-2% are splitting 10% – that's about 1 share each while it's The Top 1%, with their 20 shares EACH, that are completely out of control and causing ALL of the inequality. But when you hear them talking about unfair taxation and estate taxes that only affect people with more than $10M, they point their finger at YOU and tell you that YOU are going to be taxed if we try to make the system fair when YOU are only in the Top 2-10% and making 1/20th as much as the people who want you to vote for them so they can reduce the tax burden.

Sadly, it works. The Top 1% candidates tell you Government is evil and wasteful and is sqandering your money helping poor people or whatever and they get you to vote to cut all the social welfare programs the Government needs tax money for – even while drastically increasing military spending. In the end, the poor get poorer and the rich get richer.

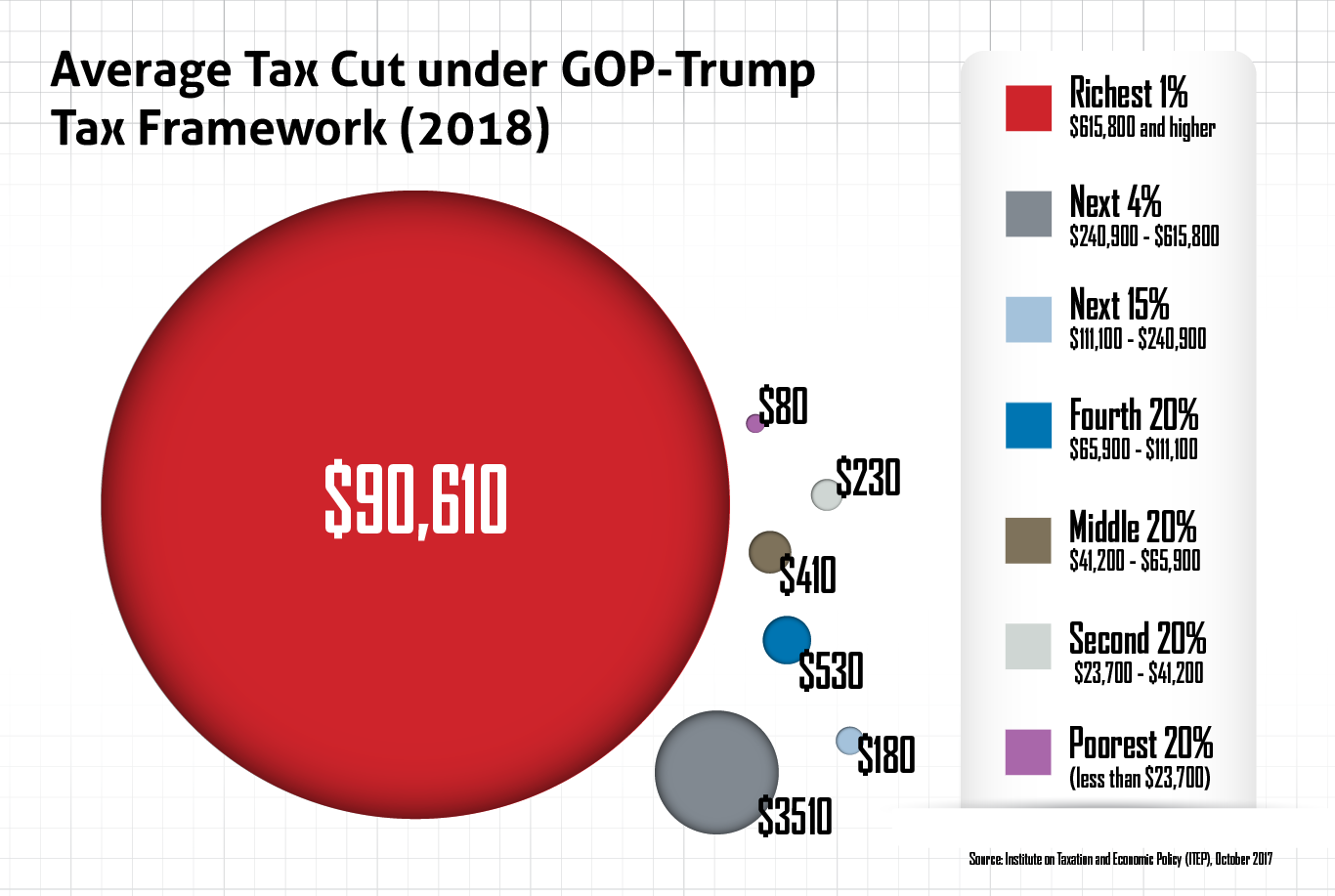

The real problem with giving the richest 3M Americans another $90,000 ($270Bn) per year in tax breaks is that it then increases the deficit 317M of us have to pay back by, you guessed it – $270Bn. Divide $270,000,000,000 by the 317M of us who didn't get $90,000 and that's $3,000 EACH that we have to pay to subsidize the tax breaks for the Top 1%. Well, those of us in the Top 2-10% can certainly afford $3,000 and those of us in the Top 2-4% are even getting a $3,510 tax break of our own so we end up $510 ahead! America is truly great again...

For the rest of the population though, these tax cuts are a net loss and, though it doesn't come directly out of their pockets, the increase in national debt pressures rates to go higher and devalued the Dollars they have and so they find themselves a little bit poorer – despite the extra few hundred dollars they get to keep for the year.

Like China, our US Corporate Masters don't care how much the people of their own country are suffering or how awful their working conditions are, as long as they have access to cheap labor and low taxes. After all, they sell their products to the World, not just US consumers and the Top 10% of the Planet Earth is 800,000,000 consumers with plenty of money to spend.

As to the other 7.2Bn suckers – let's just hope they don't realize how badly we are screwing them over and revolt!