The Break

Courtesy of Michael Batnick

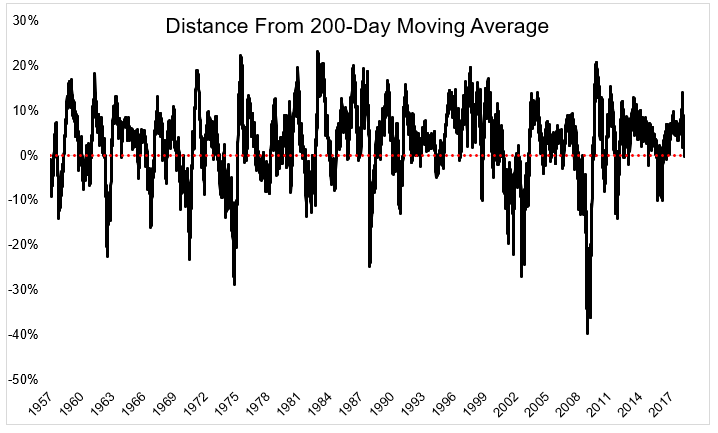

If you’re reading this, you’ve probably already heard. The S&P 500 closed below its 200-day moving average for the first time 443 days, ending the third longest streak of all-time.

Were we “due” for a pullback? Well, at their peak in January, stocks were trading as far above their 200-day moving average as they had since 2011. But historically, returns have actually been better when stocks were in “due for a pullback territory.” When the S&P 500 was one standard deviation above its 200-day, returns 60 days later were 2.35% on average, compared to just 1.68% for all other times.

It’s never fun when stocks fall, but they’ve treated investors very kindly over the last few years. The S&P 500 has been positive 91% of the time year-over-year going back to 2013.

For me, the 200-day moving average is not a line in the sand, but rather an indicator of what type of market we’re in. I’m more concerned with the direction of the line as opposed to whether stocks are above it or below it. For example, I’d be more confident if stocks were below the 200-day when the line is rising (today) than if stocks were above a declining 200-day. But that’s just an opinion, here is some data. Historically, the S&P 500 has traded below its 200-day moving average 31% of the time, and unfortunately, stocks tend to be way more volatile below the 200-day than above it.

In 2015 I wrote, “The average 30-day return going back to 1960 is 0.88%. The average 30-day return when stocks are below the 200-day is -2.60%.” Declining prices attract sellers and bad things tend to happen when sellers are in control. “Of the 100 worst single days over the last 55 years, 83 of them happened while stocks were below the 200-day.” (As of 2015)

There are no iron laws when it comes to the 200-day moving average or with any other stock market indicator. All you have are probabilities and possibilities.

For the investor who would rather ride through a lousy market instead of trying to avoid it, well, here we are. It’s been a while, but surely you didn’t think stocks only go one direction. I wish I could tell you it’s going to get better from here, but if I knew that to be the case, I’d be levered 100:1. Sadly, I am not.