Should I Time the Market?

Courtesy of Michael Batnick

Ben and I spoke about a listener question on this week’s Animal Spirits podcast.

The question came from a young person in their 30s, and he was asking about timing the market. Given where valuations are, and that he has many decades ahead of him, would it make sense to wait for a better pitch over the next five years?

We could have had the exact same conversation in 2013 as the market was approaching new all-time highs. It was reasonable to be a bit weary, after all the last two times stocks hit those levels they crashed by more than 50%. And stocks weren’t exactly a bargain. In March 2013, at a CAPE of 22.5, it was 87% higher than all readings.

Waiting for a better pitch seemed sensible at the time, but bull markets aren’t kind to risk management. In the five years since the time the S&P 500 made a new all-time high in March 2013, it’s gained 90%. Stocks would need to decline 42% just to get back to those levels.

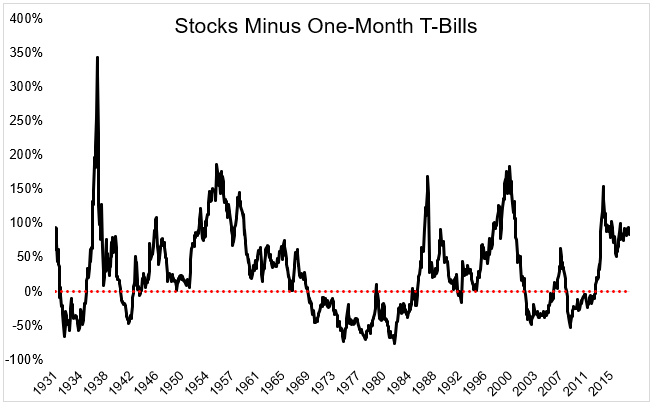

But 2013-today is just one moment in time, so let’s look at how often cash has outperformed stocks over rolling 5 year periods (after inflation). I was surprised to find that cash outperformed stocks 36% of the time. So maybe you should time the market, just make sure you’re right.

Waiting for a better pitch is always tempting, but timing the market is notoriously difficult, even for the shrewdest investors.

If you have multiple decades ahead of you, there will be plenty of inflection points. Are you going to nail every one of them? And if you’re asking Ben and I whether you should time the market, you probably shouldn’t time the market.