So what?

The Dollar plunged from 93.95 to 93.25, which is 0.75% and the S&P 500 went up from 2,713 to 2,733, which is 0.75% – that is not a rally, that is the repricing of mechandise against a falling currency! If you don't keep an eye on the Dollar, you are missing half the story on any market and also missing valuable trading signals that can make you lots of money!

In last Thursday's Report, we noted that the 5% Line™ on the Dollar was at 93.45 and you can see that line acting like a magnet, pulling the index back down for consolidation before going any higher. While day to day news may pop the Dollar up or down, over the longer-term, it pretty reliably reacts to longer-term macros as the Dollar is the blood that flows through the global economy – it generally stays in a temperate and reliable band as the Global Economy breathes in and out over time.

Meanwhile, WTF is with Donald Trump? Oh wait, I guess I should specify – WTF is with Donald Trump and this completely crap deal he made with China? The trade deal he's walking away with is SO TERRIBLE for the US that even the Wall Street Journal has titled their front-page article: "Beijing Outplays the U.S. in Trade War". That's right, we got played as China gets everything they wanted in exchange for…. wait for it… Cutting Import Tariffs on Cars from 25% to 15%. Ta f'ing da!

Aside from the fact that this "negotiating point" is one President Xi already said he was cutting way back in April, when it was noted in the WSJ: "Even so, people in the industry said the reshaping of China’s auto industry wouldn’t necessarily hand an advantage to entrenched foreign players that have come to rely on their Chinese partners, many of which are influential state-owned enterprises. Although overseas car companies entered the joint ventures reluctantly, some say they have come to accept them as a fact of life in a country where foreign businesses can struggle without local allies."

In other words, after a month of tense negotiations by our Business Genius President, we got ZERO additional concessions from China and the one we got is meaningless. Boy did China get their $500M worth on that Trump bribe, right?

Could you imagine what would have happened if Obama had done something like this? Aside from completely acquiescing to China literally the day after they give him $500M in "financing" for his new golf course, Trump also dropped the penalties on ZTE – a company that completely violated our Iran Sanctions AND installed spyware on phones they sold to Americans. ZTE will change their managers and promise not to get caught spying on us again – what a negotiator!

Since the Dollar has been holding things up, today is a good day to short Oil Futures (/CL) at $72.50 for a quick dip but get out before the API report this evening. We're just looking for a quick win with VERY TIGHT STOPS above the $72.50 line. The whole key to trading the Futures is having a good backstop so you can limit your losses. 6,950 on the Nasdaq (/NQ) is also a good line and 2,740 on the S&P (/ES) makes a good stop line with shorting below as we're at 2,738 this morning and it's my contention that 20 points of that is due to the Dollar so we'll look for at least a 10-point drop, to test the strong bounce line at 2,728 again – and that's up $500 per contract against the $100 risk at this level.

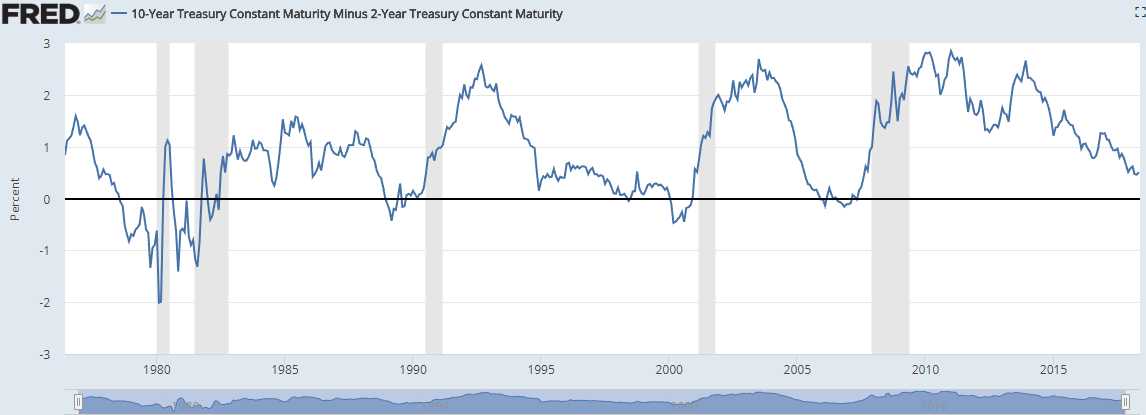

Other than the non-trade war, there's nothing in the news today to justify more market gains and not data (just the Richmond Fed at 10) and no Fed speak but there is a two-year note auction and people are very concerned about the inverting yield curve, so that may spark some selling this afternoon. The yield spread is now 0.5 and notice that the only time we hit the 0 line is before we have a recession (grey bars):

That doesn't mean we can't party like it's 1999 or 2006, because that's about where we are – about a year before things all fall apart for reasons that are always very obvious in hindsight. Are we buying stocks that are drastically overvalued? Check. Are there idiotic investing crazes in paper (or digital) assets that are totally worthless? Check. Are oil prices killing consumers? Check. Do we have moronic Government policies that are sending us on a road to ruin? Check. Well, then it's just a matter of time before one of those things matters and the market collapses, right?

WHEN is always the tricky part but NOT having a trade war that you weren't having in March is no reason for the market to make new highs – we have to do much, MUCH better than that:

That means we're likely to remain range-bound and that means 2,728 remains a TOP, not a bottom and that's why we're shorting /ES this morning and, while I'm writing this and since I posted this half-written article "in progress" as I do for our Members each morning, the oil shorts have already gained over $100 each so a $220 gain on 2 of them in 30 minutes is a good start to our day!

It only costs $3 a day to subscribe to the PSW Report so there's a trade that pays for 2 months (and you can double-dip if we bounce back!) – almost 3 if you do the money-saving annual subscription! Remember, I can only tell you what the markets are likely to do and how to make money trading them – the rest is up to you!