The G7 starts today.

The G7 starts today.

The market indexes are at record highs as Americans have total confidence in our President's ability to win the trade war as he sits down for a 3-day meeting with other World Leaders. Trump has signaled his intention to continue pursuing an aggressive trade agenda even if it comes at the expense of America’s standing in the world. The “World trade system is a mess,” Mr. Trump’s top economic adviser, Lawrence Kudlow, told reporters on Wednesday. “Trump is trying to fix this broken system.”

Of course, the "broken system" is the sole opinion of Team Trump while the rest of the World thinks it's America that is "broken" and that difference of opinion could turn very ugly if our leaders can't come to some agreements over the weekend.

“Tariffs imposed last week by President Trump on the EU and Canada have increased significantly tensions before the meeting,” a senior EU official said, adding that a breakthrough to ease trade tensions was unlikely. “We have extremely low expectations.”

The consequences of the U.S. driving away allies, even if it wins short-term trade concessions, could do lasting damage to the strength of America’s coalition (see "4 charts showing why putting tariffs on your friends is a bad idea"). “If the U.S. loses their support, then it’s a different ball game at the global leadership level,” said Fred Bergsten, the founding director of the Peterson Institute for International Economics. At last week's meeting of Global Finance Ministers, all 6 other G7 Nations put out a joint statement rebuking Trump's tariffs on steel and aluminum.

The consequences of the U.S. driving away allies, even if it wins short-term trade concessions, could do lasting damage to the strength of America’s coalition (see "4 charts showing why putting tariffs on your friends is a bad idea"). “If the U.S. loses their support, then it’s a different ball game at the global leadership level,” said Fred Bergsten, the founding director of the Peterson Institute for International Economics. At last week's meeting of Global Finance Ministers, all 6 other G7 Nations put out a joint statement rebuking Trump's tariffs on steel and aluminum.

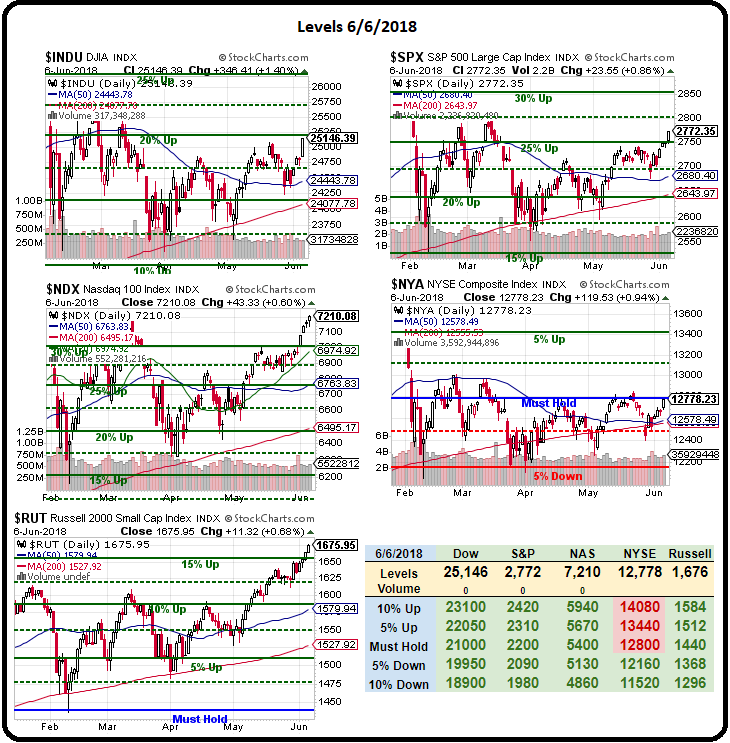

US companies are also almost unanimously opposed to the tariffs but, so far, Trump has turned a deaf ear to all of them. The markets have also turned a deaf ear to the Trade Wars – as well as every other thing that's going on in the World. Bad news is good news, no news is good news and good news is good news as the Dow, the Russell and the Nasdaq are each up about 10% in Q2 while the S&P has moved a more modest 178 points up from 2,600, so that's "just" 6.8% in just over two months.

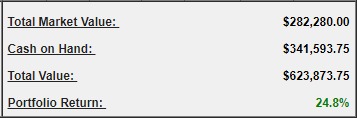

We keep taking short pokes and keep getting shot down but you have to have SOME shorts to protect your ill-gotten gains in your long positions. With yesterday's surge, our $500,000 Long-Term Portfolio came in just under 25% up for the year at $623,873 (24.8%) and that's up $25,364 since our 5/17 Review while our $100,000 Short-Term Portfolio, which keeps our hedges has dropped to $171,650 – still up 71.6% for the year but down about $4,000 since the same day's reviews.

We keep taking short pokes and keep getting shot down but you have to have SOME shorts to protect your ill-gotten gains in your long positions. With yesterday's surge, our $500,000 Long-Term Portfolio came in just under 25% up for the year at $623,873 (24.8%) and that's up $25,364 since our 5/17 Review while our $100,000 Short-Term Portfolio, which keeps our hedges has dropped to $171,650 – still up 71.6% for the year but down about $4,000 since the same day's reviews.

That's how hedges are supposed to work – they are insurance policies and keeping our portfolios well-hedged is the only way we can sensibly keep long positions after they've already gained 20% for the year.

Maybe this is a full-blown 1998/1999 rally but we've got PLENTY of longs so all we're worried about now is whether or not we have enough shorts. We still like the 7,200 line to short the Nasdaq Futures (/NQ) and 2,780 is a great shorting line on the S&P (/ES) as is 1,680 on the Russell (/ES). The Dow is simply too silly to short at 25,250 but I wouldn't mind taking another Dow Ultra-Short (DXD) spread like this:

- Buy 100 DXD July $31 calls for $1.55 ($15,500)

- Sell 100 DXD July $32 calls for $1 ($10,000)

- Sell 5 DIS 2020 $90 puts for $5 ($5,000)

That's net $500 cash and $3,112 in ordinary margin on the $10,000 spread that's currently 100% in the money. Your worst case is you lose $500 and have to buy 500 shares of DIS for $90 ($45,000), which is something we'd love to do (you can subsitute any stock you'd love to own like LBrands (LB) 2020 $30 puts ar $4.20 or IBM 2020 $115 puts at $5). Essentially, if the Dow is below 25,200 on July 20th (expiration day) – you can cash out the spread for $10,000 with a $9,500 cash profit and, if you want, you can then spend half of your profit to release your obligation on the puts.

DXD dis bottom out at $30 (split-adjusted) in late Jan, when the Dow ran up to 26,800 so it's by no means a "safe" bet – but it is a nice hedge and, certainly, if the Dow is busting up to 26,800 – it's not likely DIS is going to tank, so the net of the trade won't be so terrible. Also, if the Dow does break up hard from here, we simply need to roll the 100 July $31 calls while they still have more than 0.55 in value to salvage that cash and build another spread.

We'll keep track of this hedge and adjust as necessary.