Thank goodness!

Thank goodness!

I thought I was losing my mind as the Futures were up this morning after Trump blew up the G7 meeting and refusted, for the first time ever, to join the rest of the Free World Leaders in signing the joint communique. How can the markets be bullish when we are walking back the steps the nations agreed were necessary after WWII to prevent WWIII? Trump can double down tomorrow if he also blows the negotiations with Kim Jung Un and ticks the Doomsday Clock up to 11:59:30.

German Chancellor Angela Merkel said Sunday that President Trump's refusal to endorse a communique from the Group of Seven (G7) leaders was "sobering and a bit depressing." In the same interview, Merkel said the European Union was preparing to implement counter-measures against U.S. tariffs on imported steel and aluminum. If they retaliate, they're making a mistake," Trump declared before departing the annual Group of Seven summit, which includes Britain, Italy, France, Germany and Japan.

Speaking of Doomsday, the Fed is almost certain to raise rates 0.25% on Wednesday and that should kick the 10-year rates permanently over 3% for the duration. So far, the markets have shrugged off every possible sign of rising rates, rising wages and rising inflation as stock prices have inflated to record levels but, for those of us who believe in Physics, Match, Economics…. Reality – a day of reckoning is coming – we just don't know when.

Crypto currencies are also having a doomsday as BitCoin falls below $7,000 as a South Korean Coin Excahange was hacked over the weekend. See, this is why we have BANKS and Government-backed currencies – there's a massive system in place that insures against loss and theft of your US Dollars. We put that in place after years of the exact kind of random losses, robberies and devaluations associated with old monetary systems. Crypto currencies are sure making things great again – for bank robbers!

Crypto currencies are also having a doomsday as BitCoin falls below $7,000 as a South Korean Coin Excahange was hacked over the weekend. See, this is why we have BANKS and Government-backed currencies – there's a massive system in place that insures against loss and theft of your US Dollars. We put that in place after years of the exact kind of random losses, robberies and devaluations associated with old monetary systems. Crypto currencies are sure making things great again – for bank robbers!

And sure, eventually consumers will wise up and learn to "bank" their crypto-coins in more reputable exchanges with better securtiy and crypto may even develop it's own FDIC to insure deposits but all that stuff is hard to do if you are trying to stay "anonymous" (though it's not really anonymous at all). Meanwhile, unlike Ripple, which has lost 70% of its value this year vs. BitCoin, which still has almost half of its Dec 31st value, my Dollars don't tend to drop 10% overnight so I'll stick to US Dollars when I'm in CASH!!! – thank you….

8:30 Update: I guess I am losing my mind as the Futures are turning positive again. It's Monday though, so we can't take any moves seriously but this stuff is serious folks – it's not going to end well! As Bernanke said on Friday, the US Economy is very much like Wile E Coyote: We've already run over the cliff but we're only going to fall AFTER we realize there's no ground beneath us….

8:30 Update: I guess I am losing my mind as the Futures are turning positive again. It's Monday though, so we can't take any moves seriously but this stuff is serious folks – it's not going to end well! As Bernanke said on Friday, the US Economy is very much like Wile E Coyote: We've already run over the cliff but we're only going to fall AFTER we realize there's no ground beneath us….

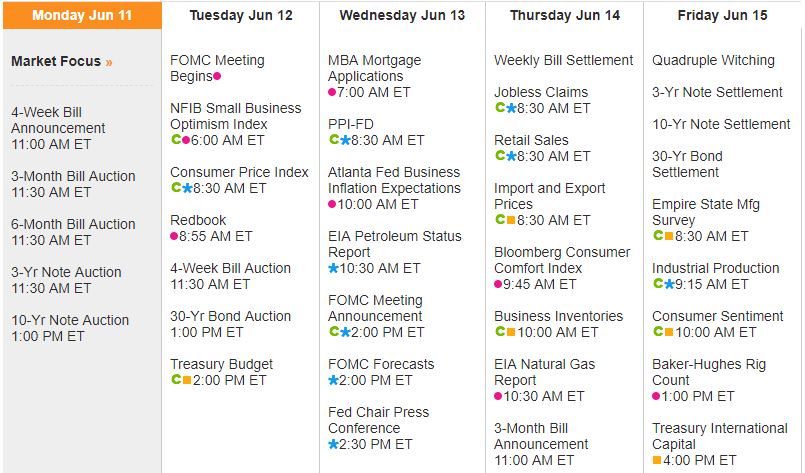

The US will borrow another $54Bn this afternoon in 3-year and 10-year note auctions with a 30-year note auction scheduled for tomorrow – all ahead of Wednesday's FOMC Announcement and their Revised Forecasts. Other than that, it's a fairly light market news week so it's going to be all about Trump and Kim tomorrow as we head into June options expirations (already) on Friday.