David Brin is an astrophysicist, technology consultant, and best-selling author who speaks, writes, and advises on many topics including national defense, creativity, and space exploration. He’s also one of the “World’s Best Futurists.” Find David’s books and latest thoughts on various matters at his website and blog. If you missed my interview with David, read it here. ~ Ilene

The Velocity of Money… and Revolution

.jpg) Courtesy of David Brin, Contrary Brin Blog

Courtesy of David Brin, Contrary Brin Blog

If you’re perfectly comfy with the economy’s gyrations, then pay no attention as I explain what’s actually going on. Economists have been recognizing signs of serious dislocation for some time. Even right-of-center fellows like newsletter mavens John Mauldin and Lacy Hunt have finally recognized the core indications. I wish I could share their excellent newsletters with you. But – at some risk of misinterpreting or even treating them unfairly – I intend to paraphrase. And criticize.

A recent Mauldin missive correctly cites the most disturbing symptom of trouble in the U.S. economy: a plummet in Money Velocity (MV).

To quote John: “You may be asking, what exactly is the velocity of money? Essentially, it’s the frequency with which the same dollar changes hands because the holders of the dollar use it to buy something. Higher velocity means more economic activity, which usually means higher growth. So it is somewhat disturbing to see velocity now at its lowest point since 1949, and at levels associated with the Great Depression.”

To quote John: “You may be asking, what exactly is the velocity of money? Essentially, it’s the frequency with which the same dollar changes hands because the holders of the dollar use it to buy something. Higher velocity means more economic activity, which usually means higher growth. So it is somewhat disturbing to see velocity now at its lowest point since 1949, and at levels associated with the Great Depression.”

Somewhat… disturbing? That’s at-best an understatement, since no other economic indicator is as telling. MV is about a bridge repair worker buying furniture, that lets a furniture maker get dentures, so a dentist can pay her cleaning lady, who buys groceries….

There are rare occasions when MV can be too high, as during the 1970s hyper-inflation, when Jimmy Carter told Paul Volcker “Cure this, and to hell with my re-election.” But those times are rare. Generally, for all our lives, Money Velocity has been declining into dangerous sluggishness, falling hard since the 80s, rising a little in the 90s, then plummeting.

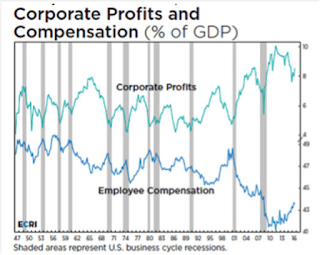

Alas, while fellows like Hunt and Mauldin are at last pointing at this worrisome symptom, they remain in frantic denial over the cause. Absolutely, it is wealth disparity that destroys money velocity. Bridge repair workers and dentists would spend money – if they had any.

We have known – ever since Adam Smith gazed across the last 4000 years – that a feudal oligarchy does not invest in productive capacity. Nor does it spend much on goods or services that have large multiplier effects (that give middle class wage earners a chance to keep money moving). Instead, aristocrats have always tended to put their extra wealth into rentier (or passive rent-seeking) property, or else parasitic-crony-vampiric cheating through abuse of state power.

See my earlier posting: Must the Rich be Lured into Investing?

Situation Normal: Cheating Flows Up

Do not let so-called “tea party” confederate lackeys divert you. The U.S. Revolution was against a King and Parliament and royal cronies who commanded all American commerce to pass through their ports and docks and stores, who demanded that consumer goods like tea be sold through monopolies and even paper be stamped to ensure it came from a royal pal. Try actually reading the Declaration of Independence. “Taxation without representation” was about how an oligarchy controlled Parliament through jiggered districts and cheating, and used that power to funnel wealth upward.

Do not let so-called “tea party” confederate lackeys divert you. The U.S. Revolution was against a King and Parliament and royal cronies who commanded all American commerce to pass through their ports and docks and stores, who demanded that consumer goods like tea be sold through monopolies and even paper be stamped to ensure it came from a royal pal. Try actually reading the Declaration of Independence. “Taxation without representation” was about how an oligarchy controlled Parliament through jiggered districts and cheating, and used that power to funnel wealth upward.

Here’s a fact that shows where we came from… and might be going: over a third of the land in the thirteen colonies was owned – tax-free – by aristocratic families.

The U.S. Founders fought back. After their successful revolt, they redistributed fully a quarter of the wealth and land, and they did it calmly, without the tsunami of blood that soon flowed in France, then Russia, then China. That militantly moderate style of revolution actually worked far better at fostering positive outcomes for all. For the people… and yes, for local aristocratic families, who retained comforts, some advantages. And their heads.

Nor was that the only time Americans had to push back against proto-feudal cheating, which we now know erupts straight out of human nature. The Civil War was certainly a massive ‘wealth redistribution’ by giving millions of people ownership of their own lives and bodies. During the 1890s Gilded Age, we avoided radical revolution in favor of reform – e.g. anti-trust laws.

Our parents in the Greatest Generation – who adored FDR – sought to prevent communism by keeping market enterprise flat, competitive and fair. Far lessradical than the Founders, their reforms created the flattest social structure and the most fantastic burst of economic prosperity, ever.

And dismantling the work of that generation has been the core aim of the confederate aristocracy, since Reagan.

Dire beasties! Debt and the Fed

But let me share with you more of the myopia of decent men. John Mauldin continues: “Debt is another big issue for Lacy Hunt. People compare debt to addictive drugs, and as with some of those drugs, the dose needed to achieve the desired effect tends to rise over time.”

John then shows a chart (he always has the best charts!) revealing the additional economic output (GDP) generated by each additional dollar of business debt in the US. Needless to say, the effectiveness of each dollar of debt, at growing healthy companies, has plummeted.

Um…. Duh? Once upon a time, the purpose of corporate debt was to gather capital to invest in new productive capacity (factories, stores, infrastructure and worker training), with an aim to sell more/better goods and services that would then produce healthy margins that pay off the debt, across a reasonable ROI (Return on Investment) horizon.

This would then actually decrease the net ratio of debt to company value, across a sapient period of a decade or so. This approach still holds, in a few tech industries, but not wherever companies have been taken over by an MBA-CEO caste devoted to Milton Friedman’s devastating cult of the quarterly stock-price statement.

Today, companies borrow in order to finance stock buybacks, market-cornering mergers and other tricks that our ancestors (again, in the Greatest Generation or “GGs”) wisely outlawed. Tricks that GOP deregulatory "reforms" restored to the armory of cheaters. Tricks that enable the CEO caste to inflate stock prices and meet their golden incentive parachutes, with the added plum of pumping rewards for their Wall Street pals who arrange the debt.

Every parasitic act of “arbitrage” is justified with semantically-empty incantations like “correct price determination” – mumbo-jumbo spells that bear absolutely zero correlation with reality.

No wonder each added dose of debt is ineffective at actually growing long-term company value! What’s so hard to understand? Why are Mauldin and Hunt puzzled?

Oh, yeah. They are honest and sincere men, at last able to perceive symptoms. But alas, they are also far too stubborn to acknowledge the root disease — a conspiratorial cabal of would-be feudal lords. Loyal to a fault… (well, these plutocratic connivers are their friends)… John and other residually-sapient conservatives choose denial over admitting that Adam Smith had it right, all along.

Instead, Mauldin focuses again and again on his chosen Bête Noir … theFederal Reserve, even though the Fed has almost insignificant power over any of the things we’ve discussed here. It’s Congress – Republican for all but two of the last 23 years – who sent U.S. fiscal health plummeting, from black ink to red that’s deeper than an M Class dwarf star. Congress did this while devastating every protection against monopoly/duopoly or financial conspiracy.

Misunderstanding your own icons and heroes

Consider that Friedrich Hayek – often touted as the “opposite to Keynes” – actually agreed with John Maynard Keynes about many things, like the need for a very wide distribution of economic decision-makers. In an ideal market, this would be all consumers, empowered with all information. (There goes Brin’s broken record, repeating “transparency!” over and over.) Though yes, a 21stCentury Keynsian will call for a government role in (1) counter-cyclical stimulation and (2) inclusion of externalities, like the health of our children’s children and their planet. (Note the spectacular success of the greatest modern Keynsian politician, California's Jerry Brown.)

Hayek complained that 500,000 dispersed and closely watched civil servants could never substitute for the distributed wisdom of an unleashed marketplace of billions. Hm. Well, that’s arguable. But so?

What does the right offer up, as its alternative? A far, far smaller, incestuous cabal of a few hundred secretly-colluding golf buddies in a circle-jerking CEO caste? That’s gonna allocate according to widely-distributed market wisdom?

Hayek spins in his grave.

This selfsame CEO-caste went on a drunken debt spree that blatantly served the cabal and not their companies, nor the economy or civilization.

Blaming the Federal Reserve for that is like condemning the owners of a liquor store for all the drunk drivers crushing pedestrians. Sure, the low price of booze might have contributed, but it’s not the primal cause. Oh. And yes, it’s been Congress that keeps funneling wealth from the middle class into gaping, oligarchic maws.

Some of these guys almost get it

How I wish I could share John Mauldin’s newsletter with you! It’s smart! I mean it. I always learn a lot, the charts are excellent. Moreover, I get self-pats on my own back, for assiduously reading the smartest commentators that I can find, from every side. Also, John’s a cool dude and way fun. I read every word and its maybe 70% real-smart stuff!

(For contrast, see the super-smart liberal “Evonomics” site; the place where Adam Smith is most-discussed and would be most at-home.)

Moreover, John does honestly acknowledge – forced by the blatantly obvious – that income and wealth disparities are problematic and rising, while money velocity plummets.

Moreover, John does honestly acknowledge – forced by the blatantly obvious – that income and wealth disparities are problematic and rising, while money velocity plummets.

Only then he goes to the newest catechism of the rationalizing right… arm-waving that technology is at fault.

Yes, okay, automation has a depressing effect on middle class wages. So? Then it is time for a conversation about the social contract again. Like how to keep the middle class “bourgeois” – by keeping them vested in shared ownership of the means – as well as output – of production. It’s what the Greatest Generation did, while troglodytes accused them of “communism.” The most-entrepreneurial generation in history, they were far from commies.

Some in-yer-face time

Okay, it’s that time again; so let me talk again directly to the confederate/feudal elites aiming to restore inherited hierarchies of old. This is no longer about Mauldin, but the would-be overlords standing right in front of him, in his blind spot.

Dear oligarch-traitors. Let me avow that human nature and history seem to be on your side. Our experiment in flat-fair-open systems always had the odds stacked against it. Hence, you feudalists will probably get your wish. Briefly. The middle class will very likely fall into proletarian poverty while you rake it all in.

Your evident plan is to leverage new technologies to entrench oligarchic rule, right? I depict something like it in EXISTENCE, though done by far smarter zillionaires than you.

Only – was it really part of the plan to wage open war on every single fact-using profession? Now including not just science and journalism and law, but the FBI, intelligence agencies and the military officer corps? And all the folks who are innovating in genetics and artificial intelligence, too? Really? Are you that confident?

Or else, perhaps you are like so many past lords — so lulled by sycophants that you cannot hear Karl Marx chuckling, as he rises from his mere-nap. (Copies of his works are flying off the shelves, faster than any time since the 1970s.) If so, you may get much more than you bargained for. More revolution than any sane person would want.

Adam Smith wasn’t the only one to seek a way out of this dilemma. Nor were the U.S. Founders. Will Durant – one of the greatest historians – said this, in his book, "The Lessons of History":

“In progressive societies the concentration (of wealth) may reach a point where the strength of number in the many poor rivals the strength of ability in the few rich; then the unstable equilibrium generates a critical situation, which history has diversely met by legislation redistributing wealth or by revolution distributing poverty.”

The recent “great” time for America was built by moderate, if somewhat leveling, legislation. The Greatest Generation chose a Rooseveltean alternative to violent revolution. And it worked — inarguably, spectacularly — till cheating once more gained the upper hand.

Me? I stand with the Founders. With Adam Smith and a flat-fair-open market society filled with opportunity for all and grand, cheat-advantages for none. A relatively-flat society that still has loads of incentives. One wherein true competition among healthy-confident equals can thrive, pouring a positive-sum cornucopia for everyone.

And now, yes, “equals” must include all previously-squelched sources of talent – genders, races and the raised-up/blameless children of the poor.

You confederates, you are the traitors to that flat-fair-open-accountable Better Capitalism. The form that stood up to Marx and quelled him to sleep. The only kind of market system that can withstand the coming wind, when he awakens.

I stand with the Greatest Generation… and greater ones to come.

I stand with the moderate, scientific, flat-fair revolution that accepts facts and complexity and denies simplistic incantations. Moreover, that moderate/calm/eclectic kind of revolutionary numbers in the tens… hundreds of millions. We include nearly all of the most-skilled, and our growing cadre hears the alarum.

We awaken. We rise. And you had better welcome this. Because it will either be our reforms or the tumbrels of Robespierres.

Choose.

[Read also: Must the Rich be Lured into Investing?, "Class War" and the Lessons of History, and our recent interview with David Brin.]