Courtesy of Declan.

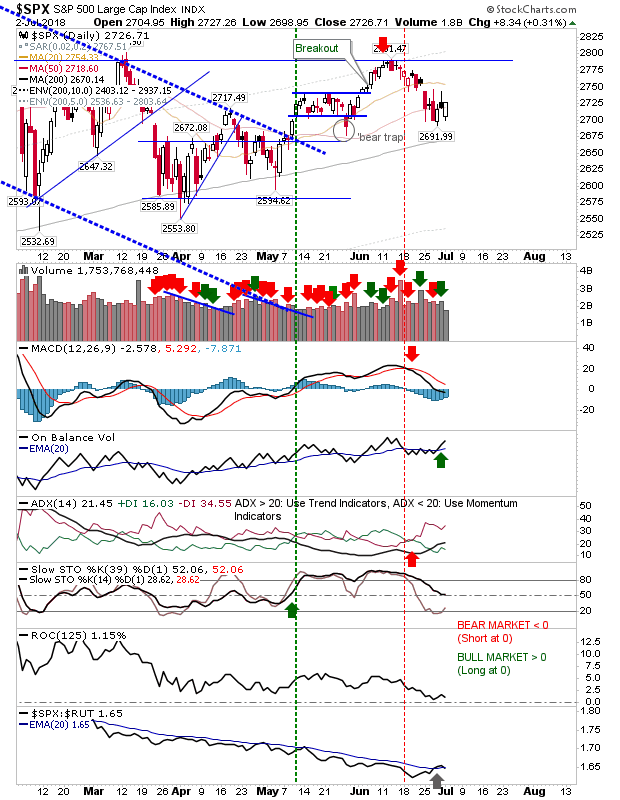

In yet another turnaround for markets, today started with a large gap down which had the makings of a sizable bearish sell-off – only for bulls to start buying from the open and to continue to do so throughout the day. Better still, today’s surge undid much of the damage done Friday.

For the S&P, the action over the last six days has much in common with the scrappy action around the 200-day MA in March/April. The only thing I don’t like about this action is the frequency of the tests of the 200-day MA; the more frequent the tests the greater the chance for a break. A move above the 20-day MA should be enough to confirm a new swing low and deliver a challenge on resistance of the June swing high; riskreward measured on a loss of 2,690. There was even an uptick in relative strength against the Russell 2000.

The Nasdaq had a more natural defense level of the 50-day MA and a horizontal support level. Support at 7,420 is stronger than the corresponding support in the S&P. There was also a relative performance uptick against the S&P; again – further confirmation of its net strength against its peers.

The Russell 2000 also posted a good day with buyers confirming 1,630 as a swing low. Relative performance has struggled against the Nasdaq and now looks to be struggling against the S&P. While the index has the most attractive – current – swing-low ‘buy’ play, it may be entering a phase when this advantage starts to unwind.

As for other indices, the Dow Jones Index is at channel support but relative performance remains weak. Buyers can use the swing low at 24,000 for risk:reward with a target of channel resistance.

The Semiconductor Index has the riskiest swing low ‘buy’ play with it trading at its last point of defense, the 200-day MA. Technicals are all net bearish and relative performance is very weak. Not for the faint of heart.

Today’s watch was for bearish follow through, which never materialized. Tomorrow will be looking for bullish follow through – something to which the swing low can be confirmed.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.