Another great day in the markets!

In yesterday morning's PSW Report (just $3 a day and look at all our great days!) I said:

Today is the last day of the month so we're looking for bounces off of all those bottoms and you can play for the bounces (with very tight stops below), which are 20% of the drop as a weak bounce and 40% of the drop as a strong bounce where failing the weak bounce is bearish and the strong bounce has to be taken back in less than 48 hours, or that's bearish too.

That means, for example, the 250-point drop on the Dow (/YM) should get a 50-point bounce, back to 25,350 just to be considered a weak recovery and 25,400 is the strong bounce line. Anything less than a weak bounce today is a strong indication that we're not done selling off – especially on a window-dressing day like today. On the volatile Russell (/RTY), we fell 45 points so we'll round up to look for 10-point bounces to 1,665 (weak) and 1,675 (strong) but we need a stronger Dollar for the Russell to get it in gear.

At the time, the chart on the Russell looked like this. I know it's confusing because we only TELL you what is going to happen and how to make money on it but, when you look back at the trade ideas, you can't believe we didn't have today's chart yesterday, since the market does EXACTLY what we tell you it's going to do. Pretty cool, right?

At the time, the chart on the Russell looked like this. I know it's confusing because we only TELL you what is going to happen and how to make money on it but, when you look back at the trade ideas, you can't believe we didn't have today's chart yesterday, since the market does EXACTLY what we tell you it's going to do. Pretty cool, right?

Likewise the Dow spiked up to 25,475 (up $875 per contract) but then failed it's strong bounce line at 25,400 and finished the day right between our predicted weak and strong bounce lines at 25,374. Remember, we are not using TA – we are Fundamental investors who think TA is complete nonsense – this is just math. It just so happens that our math (the faboulous 5% Rule™) tends to perfectly align with what actually happens on the charts because, whether TA is total and absolute BS or just regular BS (the jury is still out), since 95% of the traders believe in it and follow it, that in itself becomes a fundamental factor we take into account.

Why did the Russell outperform the other indexes yesterday? For exactly the reason we told you it could outperform – the Dollar got stronger! This is not complicated, the Russell 2000 companies get over 75% of their revenues from the US – IN DOLLARS – so a strong Dollar is GOOD for Russell companies but not so good for S&P 500 companies, who get 60% of their revenues in other currencies. Those are FUNDAMENTAL factors we use in order to determine where the market will go.

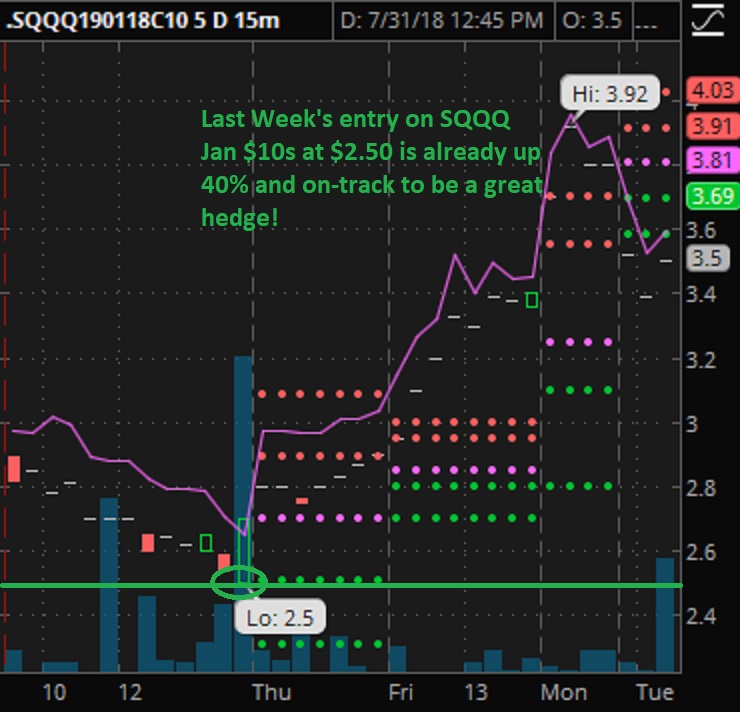

We also expected Apple (AAPL) to beat in their earings report and they did with yet another record quarter but, also as we predicted, it was not enough to push them over $200/share and it's not, by itself, enough to save the Nasdaq from completing our expected 10% correction (to 6,900) over earnings season so we're still short the broad index as our primary hedge, using the Ultra-Short ETF (SQQQ) as noted in last Tuesday's morning report.

Those Jan $10 calls are already $3.50 per contract, up 40% in 7 days. See, you don't have to play the Futures to make fast money in the markets – options work well too. Just check out the spike of buyers as SQQQ hit our $2.50 target. Did we call the floor perfectly or did we set the floor with our call? It's very chicken and egg sometimes but, as long as we get to eat – who cares?

Those Jan $10 calls are already $3.50 per contract, up 40% in 7 days. See, you don't have to play the Futures to make fast money in the markets – options work well too. Just check out the spike of buyers as SQQQ hit our $2.50 target. Did we call the floor perfectly or did we set the floor with our call? It's very chicken and egg sometimes but, as long as we get to eat – who cares?

The Nasdaq is only down 250 points (3.33%) from the high and that's what a good hedge does, gives you a 40% gain on a 3% drop so 5% of your money put aside on hedges can mitigate 2/3 of the damage on the way down. A good hedge doesn't prevent you from losing ANY money – when you do that you are over-hedged and over-hedging is more likely to prevent you from MAKING money!

As noted in our recent Money Talk Portfolio Review (7/17), which we adjusted live on the show that night, you have to have a trading plan for each of your positions and you have to KNOW how much money you expect them to make and you have to KNOW whether they are on track or off track at any given time and you have to be ready, willing AND able to make the necessary adjustments to keep them on track (or cut them loose) as necessary. If you KNOW exactly how much money your positions will make in a good market and how much they will lose in a bad market – your hedging decisions become obvious.

In that review, after cashing out $54,650 worth of winners in a portfolio that started with $50,000 last September, we had a new trade idea for General Mills (GIS) as follows:

As a new entry, I like a nice, boring play on General Mills (GIS), makers of Bisquick and Cheerios, Cocoa Puffs, Fruit Roll-Ups, Go-Gurt, Haagen-Dazs, Lucky Charms, Old El Paso, Pilsbury, Progresso and dozens of other things you have in your cabinets. Last year, GIS made $2.1Bn on $15.7Bn in sales yet you can buy the whole company for $26.25Bn at $44.25 – that's just silly!

There's no "story" to this, it's a blue-chip stock that's been in business 100 years and will likely be in business 100 more and Amazon doesn't hurt them because they are not a retail store – they just supply stuff that retail stores sell – including Amazon. The drop from $60 was caused by a combination of higher transportation costs and fears of rising labor cost and raw goods costs that, so far, have not materialized.

Also, the company stretched out, buying Blue Buffalo pet food for $8Bn, which was 25x their $329M earnings so WAY higher then GIS's valuation but GIS sells $16Bn worth of stuff and has fantastic distribution so I think they will quickly squeeze another $200M out of Blue Buffalo, which would grow their earnings 25% to perhaps $2.65Bn and even applying a 12x multiple to that gets us to $31.8Bn, 20% higher than the stock is now.

We don't have to shoot for the moon here – or even $60. Let's go for $47.50 (10% higher) with the following spread:

- Sell 10 GIS 2020 $42.50 puts for $3.90 ($3,900)

- Buy 15 GIS 2020 $40 calls for $6.50 ($9,750)

- Sell 15 GIS 2020 $47.50 calls for $2.85 ($4,275)

The net cost of the spread is $1,575 and, if all goes well, at $47.50 or higher in Jan 2020, the spread will pay $11,250 for a gain of $9,675 (614%). If GIS is below $42.50 you do have an obligation to buy 1,000 shares of the stock for $42.50 but the margin requirement should be only about $2,000 and you would take the loss and sell – not buy all that stock (even though it would be great to own, long-term).

As noted above, it would be great if GIS goes up and up and we make 614% in 18 months in our sleep but you can't expect that. The idea is just to have a diversified group of good, conservatively-targeted trades in solid companies that COULD make ridiculous amounts of money and, usually, some of them will and a 614% winner can pay for a lot of losers along the way so, in the end, you are very likely to come out consistently ahead!

Once again, the chart makes it look like we had the results before we made the trade but, at the time, GIS was heading lower and we simply made a value call at what we thought was the bottom of a silly sell-off. While it's up less than 10% since our call, the options give us huge leverage (yet still a very manageable downside) and already the short puts are down to $3.15 ($3,150) as the panic subsides and the bullish $40/47.50 spread is now ($7.85-$3.65) = $4.20 ($6,300) for net $3,150 which is already up $1,575 – exactly 100% in 2 weeks.

That is just our FREE sample portfolio that we only adjust once a quarter, live on TV. How do we do it? FUNDAMENTALS!!!

Another winning trading strategy we teach our Members is NOT to trade when you don't know what's going to happen because, even when you think you know, you're still going to be wrong about 40% of the time. Of course, combining being right 60% of the time with good cash-management techniques we also teach our Members is a fantastic winning formula.

Another winning trading strategy we teach our Members is NOT to trade when you don't know what's going to happen because, even when you think you know, you're still going to be wrong about 40% of the time. Of course, combining being right 60% of the time with good cash-management techniques we also teach our Members is a fantastic winning formula.

Today then, is a "no trade" day as Apple just had earnings and it's going to be up at the 5% rule ($199.50) and that will add 75 points to the Dow by itself and mask a lot of selling. It's also Fed day and we'll be doing our Live Trading Webinar at 1pm, EST, which will be very exciting at 2pm. AAPL is also the largest component on the S&P and it's 15% of the Nasdaq – so all 3 major indexes will be pushed up by AAPL but THEN, if they fail their strong bounce lines, we will get right back to shorting the indexs as there are not any Apples left to report and, we think, it's more likely to be downhill from here in August – especially with Tariff Talks ratcheting up again.

Be careful out there.