Another month another 200,000 jobs?

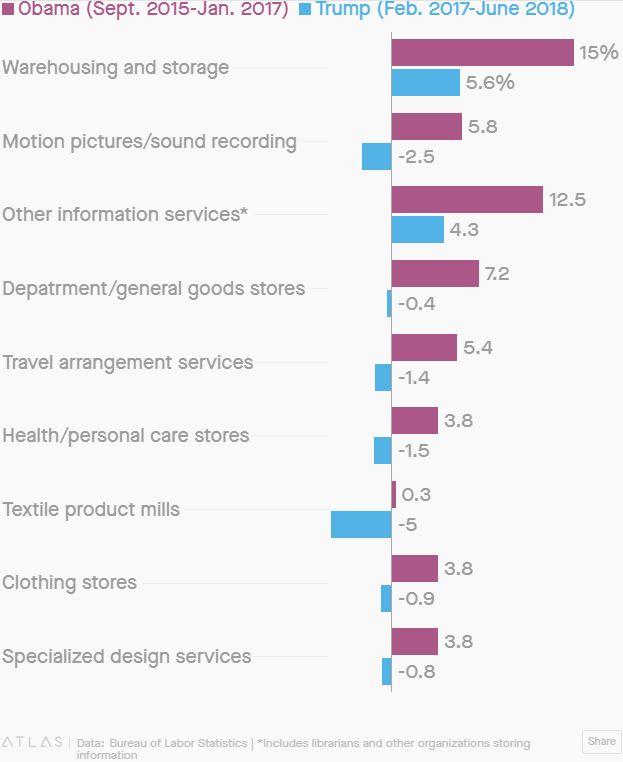

As we discussed last month, 200,000 jobs is not growth, that's just our population growth. Job growth, in fact, has slowed markedly over the past 18 months and this chart shows you how far behind Obama's Trump's are falling – especially in the struggling Retail Sector, where jobs are trending negative over the previous period.

Obama is credited with a net gain of 11.6M jobs during his tenure but that includes 2009's 3.5M lost jobs detracting from the 15.1M jobs that were gained under 7 years of Obama budgets and also not counting the 8th Obama budget – the one Trump takes credit for in his first year for another 2.4M jobs gained.

Of course, so far, Trump's method for creating jobs has been very expensive as the deficit in 2017 was $666Bn (Obama's last budget) but this year we're already over $1Tn (up 50%) and, according to Trump's own budget, there's no end in site to Trillion-Dollar deficts through 2024, so another $8Tn will be added to the $20Tn we already owe – if all goes well. When you consider the average wages paid for a job is $38,000, $1Tn SHOULD buy you 26,315,789 more jobs – each year!

Obviously, that's not happening but let's say that $666Bn of deficit was unavoidable and Trump spent just $333Bn extra Dollars to create jobs (wasn't that the point?). Well, at $333Bn/2.4M it turns out Trump is spending $138,750 per job created and, as noted above, they are not really being created – we're just keeping pace with the population growth of 0.8%.

Obviously, that's not happening but let's say that $666Bn of deficit was unavoidable and Trump spent just $333Bn extra Dollars to create jobs (wasn't that the point?). Well, at $333Bn/2.4M it turns out Trump is spending $138,750 per job created and, as noted above, they are not really being created – we're just keeping pace with the population growth of 0.8%.

The rest of that $333Bn National Debt that Donald Trump is forcing your family to take on is going to pay for Tax cuts for Billionaires – like Donald Trump – sucker! Notice even the GOP, who don't shy away from bullshitting when it suits their purposes, have even stopped saying the words "job creators" as it has, at this point, been exposed as the total farce that phrase always was. I wonder what the BS will be for the next election?

8:30 Update: 201,000 jobs were added so I was off by 1,000 but, more importantly, June and July were revised down by 50,000 jobs – with July now down to just 147,000 jobs and June's "big beat" of 268,000 jobs now 228,000 jobs but it's too late, we already had a huge rally off that number and no backsies!

8:30 Update: 201,000 jobs were added so I was off by 1,000 but, more importantly, June and July were revised down by 50,000 jobs – with July now down to just 147,000 jobs and June's "big beat" of 268,000 jobs now 228,000 jobs but it's too late, we already had a huge rally off that number and no backsies!

Well, maybe some backsies as August's 201,000 isn't weak enough to take the Fed off the table while losing 50,000 jobs to revisions does take away a lot of the positive momentum the bulls thought they had. Between that and looming tariffs – who is going to be brave enough to go into the weekend with all bullish positions?

Meanwhile, despite lower job gains, wages keep rising and that's not good for Corporate Profit Margins and again, this is the sort of thing that keeps the Fed on track to tighten their policy. Trump has already gone after the Fed for raising rates but this morning, Boston Fed's Eric Rosengren says the Fed is unwilling to pay the cost of artificially low rates and gradual increases are needed to move rates to a "neutral" range of 3.5%.

The wage growth for August was the largest one-month growth since August of 2009 – something very alarming to the Fed.

Speaking of very alarming – Tesla (TSLA) is being sued by short sellers for manipulating their stock and now the Chief Accounting Officer, Dave Morton, has resigned (effective "IMMEDIATELY") just a month after taking the job. That's sending the stock plunging back below $265 this morning as usually accountants resign immediately to avoid being complicit in frauds they uncover. We are, of course, short TSLA and we even had a discussion of whether or not to get back in at $100 but I'm leaning towards no. As I noted in last month's: "Wednesday’s Whopper – Musk Claims Some Idiot Offered Him $420/share for Tesla!":

We took the opportunity, while TSLA was shooting for the moon yesterday afternoon, to set up a short position (we already had both longs and shorts in our Hedge Fund) as I said to our Members:

Let's take Elon at his word and sell 2 TSLA Jan $420 calls for $23 ($4,600) in the STP and buy 3 Jan $450 ($100)/420 ($79) bear put spreads for $21 ($6,300). That's net $1,700 on the $9,000 spread.

The way this spread works is that we bought the $450 puts and offset the cost of them by selling the $420 puts so anything below $420 net's us $30 per contract ($3,000) and we also sold the $420 calls, so anything under $420 casuses them to expire worthless. If Elon is committing FRAUD and TSLA gets bougth for $420, the short calls are still worthless (as it's not over $420) and we win. If Elon is committing FRAUD and TSLA drops lower – we win. The stock has to go up over 20% by January expirations for us to lose and, even then, we can roll the short calls to a higher strike in a longer month. So – many ways to win, not too many ways to lose, 417% upside potential return on cash.

There's a nice, quick way to make $7,300 (429%) in just a few months. How do we do it? FUNDAMENTALS! We discussed the boring old fundamentals in the linked post and we had been patiently waiting and waiting and waiting for TSLA to climb back to our shorting zone before making that play (we had a successful short play in June as well) but now I'm not so sure they're coming back – where is that $420 buyer when you need him?

There's a nice, quick way to make $7,300 (429%) in just a few months. How do we do it? FUNDAMENTALS! We discussed the boring old fundamentals in the linked post and we had been patiently waiting and waiting and waiting for TSLA to climb back to our shorting zone before making that play (we had a successful short play in June as well) but now I'm not so sure they're coming back – where is that $420 buyer when you need him?

Not that Musk seems to care, he was actually smoking a joint on TV yesterday during a live interview.

They even discussed whether or not that was going to be good for the stock before he did it. Frankly, I think Musk wants to be fired so he can later claim that the demise of Tesal wasn't his fault and was caused by the idiots that tried to replace him because he knows he's running out of plates to spin and the whole house of cards is about to come crashing down all around him if he can't get out in time – something I've been predicting all year.

Ufortunately, I also predicted that TSLA's collapse may cause people to rethink all these sky-high valuations on stocks that are many years away from proving their actual worth – we'll have to wait and see how that drama plays out over the next couple of months.

Have a great weekend,

– Phil