The Dow is up 116 points as of 8am.

The Dow is up 116 points as of 8am.

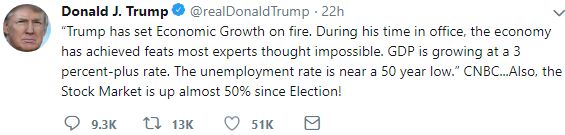

Why? Just because, it seems. Asia closed down on Trade War fears but Europe is up slightly and US Futures are tracking higher on very thin trading (it's Jewish new year, people have off in NY) as Trump tweets about how GREAT things are, even though he's clearly lying as the S&P 500 was at 2,200 when he was elected and 2,300 when he took office but, even since the election, 2,850 – 2,200 is 650 and 650/2,200 is 29.5%, not "almost 50%" but, amazingly, no one bats an eye because, for Trump, that's a lot closer to the truth than most of the things he says…

We're just going with the flow for the moment. We did add a bearish Top Trade on the S&P (SDS) last week but we also put out bullish Top Trade Alerts on DLTR, OIH, HBI, LB, WPM, AAPL, MU and PZZA since Aug 15th, so still finding plenty of bargains – even in what we consider to be a very toppy market. As I've said a lot recently – it's a lot like 1999 but the market doubled in 1999 before actually failing in 2000 so, if we are in a bubble – we can play it bullish while it lasts – as long as we are well-hedged and ready to act if things do begin to fall apart.

When a market is hot, we look for OPPORTUNITIES to pick up stocks that get sold off for bad reasons. Back on Aug 3rd, China Mobile (CHL) got hit on news that two of their rivals were merging but CHL is so big, they are the reason their rivals have to merge to compete so I said to our Members:

CHL – Another one we just added to the hedge fund (also uncovered). My notes to Doug were: They may get less per subscriber but China is smaller than the US so they are covering less area but they have 887M subscribers. They have rich people who are as rich as our rich people and those people are willing to pay whatever for high-speed services. China's Top 10% is 140M people – that's pretty much our top 40% so all as much as the US Middle Class and higher so why does CHL get "just" a $182Bn valuation with $16.5Bn in profits (p/e 11) while T is at $233Bn with $13Bn in profits (p/e 18)?

In the LTP, we sold 10 Sept $47.50 puts for $3.80 so we'll be rolling them and we have we own 20 Sept $40/47.50 bull call spreads at net $5,700 and $45 would pay back $10,000 – so all good there. As a new trade on CHL (which is essentially what we'll be moving to this month), I like:

Sell 10 March $45 puts for $2.70 ($2,700)

Buy 15 March $40 calls for $5 ($7,500)

Sell 15 March $45 calls for $1.80 ($2,700)

That's net $2,100 on a $7,500 spread that's practically all in the money to start so return over $45 would be $5,400 (257%) in just 6 months. Wow, that one has to be a Top Trade Alert, right? Let's officially add that to the OOP and the LTP but we can do 20 short puts and 30 spreads in the LTP. We will adjust the old spread (basically close it out) later in the month.

We didn't KNOW it was going to turn around that fast – we only KNEW it was undervalued at $44 but we're already over goal and the short March $45 puts are down to $1 ($1,000) while the $40/45 spreads are already net $4 (of $5) so $6,000 for those less the $1,000 owed on the short puts is already net $4,000 on the spread which is up $1,900 (90%) for the month and still $3,500 more to make by March.

The S&P is up 50 points (1.7%) for the same month so, when we can outperform the market by 50x on our spreads, it means we can risk 1/50th of our CASH!!! and still keep up with the market – there's no need to tie up a lot of money chasing a bubble – so why risk it?

The S&P is up 50 points (1.7%) for the same month so, when we can outperform the market by 50x on our spreads, it means we can risk 1/50th of our CASH!!! and still keep up with the market – there's no need to tie up a lot of money chasing a bubble – so why risk it?

That Top Trade was from Aug 3rd and we also had a long-term play on MO in that alert, which is also taking off, though not as dramatically as CHL. As noted above, on 8/16 we sent out a Top Trade Alert for Poppa John's (PZZA) and that company is still in turmoil but that net $6,150 spread is already net $8,250, which is up $2,100 (34%), which is better than ALL of the gains Trump is bragging about for 18 months in a single month!

Seriously though, it's out of a potential $30,000 so still good for a new trade with $21,750 left to gain. When your trade goal is to make $23,850 (387%) then making $2,100 (34%) in a month is simply what we call "on track" at PSW!

So, when I am "negative" on the momentum stocks – keep in mind it's because I think there are far more productive AND less-risky things to do with your money than buying Amazon (we're short) at $1Tn ($1,950) and needing it to get to $1.2Tn to make 20% while I can buy PZZA or CHL at multi-year lows and make 20% in a month. China Mobile's ENTIRE market cap is $200Bn and they MAKE $16Bn a year on $100Bn in sales while Amazon has $177Bn in sales and makes $3Bn.

Yet Amazon will have to gain an ENTIRE China Mobile in value just to make 20% from here while CHL only has to increase profits 20% to add an entire AMZN's worth of profits.

THAT is how you know market valuations have gotten ridiculous and I'll stick to investing on the under-valued ones rather than the over-valued ones!

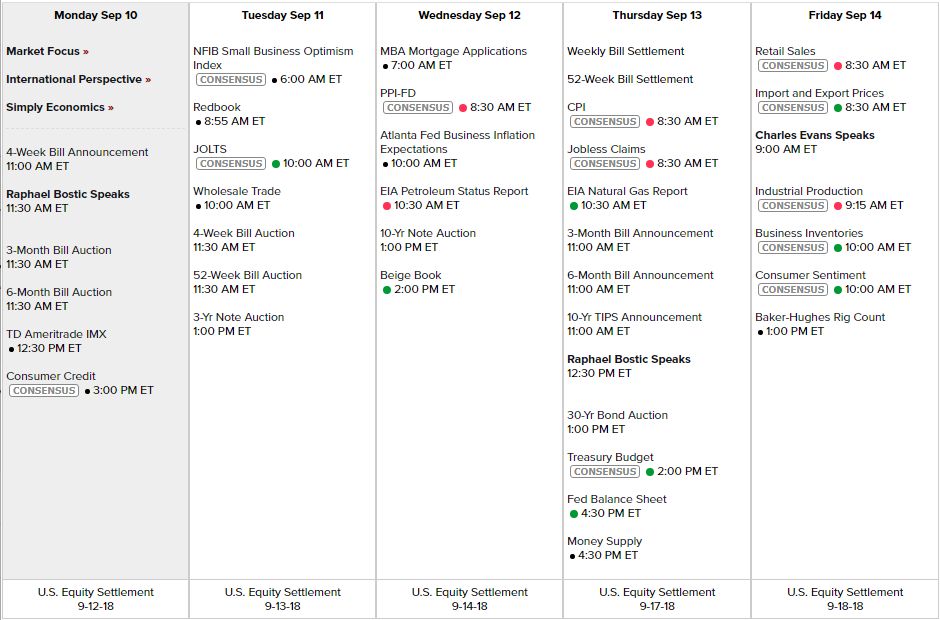

It's a very boring data week with not much Fed speak and almost no earnings so the market will be very focused on trade. We'll see if this pre-market rally will last but, on the whole, it's just a 9-point (20%, weak) bounce off the 45-point drop on the S&P since 8/29 – wake us up when we're over the strong bounce at 2,888, where we should be rejected in this morning's no-volume rally: