This is not pretty:

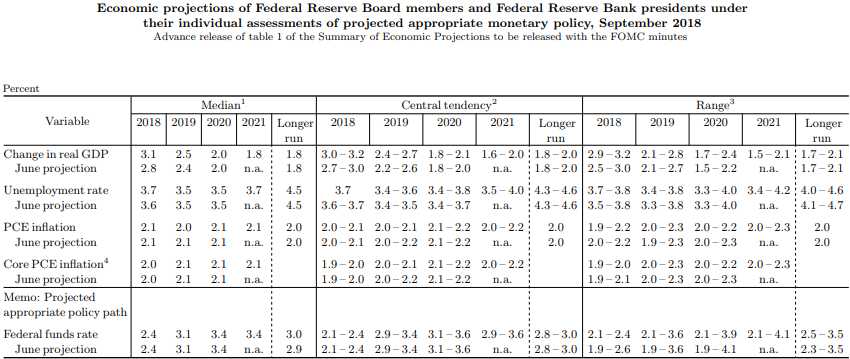

While this morning's GDP Report may show that we grew at a 4.2% pace in Q2, the Federal Reserve thinks that's so unusual that our annual GDP gain will still only be 3.1% for 2018 and then they see that DROPPING to 2.5% in 2019, 2% in 2020 and 1.8% in 2021, giving Trump and his policies the worst 4 years of GDP growth since Bush's 2nd term or Hoover's only term.

What's even worse is that Trump's budget projections expect 4% GDP Growth and if we fall 2% shy that's $400Bn less growth than anticipated and Trillions of additional Dollars will compile into our debt if the Government fails to hit their collection targets – which we all knew was based on a ridiculous trickle-down fantasy in the first place – we just didn't expect it to all fall apart so soon.

What's even worse is that Trump's budget projections expect 4% GDP Growth and if we fall 2% shy that's $400Bn less growth than anticipated and Trillions of additional Dollars will compile into our debt if the Government fails to hit their collection targets – which we all knew was based on a ridiculous trickle-down fantasy in the first place – we just didn't expect it to all fall apart so soon.

The Fed is calling this the bottom in Unemployment as well and does not project more than the usual amount of jobs to be created, despite the massive stimulus that's been given to the Top 1% and their Corporations. Again, any idiot could have predicted that but 63M people believed the BS enough to vote for Donald Trump or, more accurately, 62,400,000 believed the BS and the other 600,000 were happly to screw them over in order to get their tax cuts.

The Fed, for its part, still sees the need to "normalize" interest rates and project a 3.25% rate by the end of next year, which would be 4 more 0.25% hikes over the next 8 meetings but that's going to be miles behind the bond market, which is already hitting 3.05% on the 10-year notes. Even more alarming, the 10-year note began this month at 2.85% so up 0.2% in a month is a 7% increase in less than 30 days. While the Fed may be content to keep lending at unrealistically low rates, real-world lenders are not and borrowing costs are increasing – no matter where the Fed sets their "benchmark."

Rising interest rates traditionally have a negative impact on Business Profits, Home Sales and Consumer Spending so, as long as the stocks you are holding don't have anything to do with those things – you should have nothing to worry about!

As I noted on Tuesday, we are already getting swamped by companies who are issuing negative guidance for Q3 and the good news is that's going to lower the expecations bar considerably, so it won't be as easy to disappoint but Bed Bath and Beyond just reported a rough quarter and that stock tumbled 15% after hours. The Retail ETF (XRT) is trading at record highs – it was only at $22 before collapsing to $8 in 2008 and now it's at $52, so it makes a fun short if you are worried about Retail Stocks (and we are). For our Short-Term Portfolio (STP) we can add the following hedge:

- Sell 10 XRT Jan $52 calls for $1.85 ($1,850)

- Buy 20 XRT Jan $55 puts for $4.15 ($8,300)

- Sell 20 XRT Jan $50s for $1.45 ($2,900)

That's net $3,550 on the $10,000 spread that's more than 1/2 in the money to start so the upside potential below $50 is $6,450 (181%), not bad for 3 months and a great way to hedge potential losses on retail stocks.

I'm also liking AMZN on the short side again but they are super-scary to short so I think we'll patiently wait to see if they can get back to $2,050 before putting our foot down. What's enticing about AMZN is you can sell the Jan $2,400 calls for $21 and probably better than $22 this morning as they test $2,000 and, while AMZN has moved 20% in a quarter many times before – they haven't done so when 20% was $200Bn. Not only that but the Jan $2,400 calls can be rolled to half as many of the 2020 $3,000 calls, which are currently $57 so, if you have the money for it, it's a fun short.

Selling 10 of the Jan $2,400 calls for $21 nets you $21,000 but requires $80,000 in ordinary margin. Nonetheless, making $21,000 on $80,000 in 3 months is a pretty good use of sideline cash and it's very hard to imagine AMZN gaining 20 times Macy's (M) entire $10Bn valuation in that period of time – their earnings would have to be truly astonishing! Still, too risky for our Member Portfolios, though we may consider the short position if we can find a good way to hedge it.

There are lots of ways to make money in a down market. In fact, we sold $3,000 worth of short Jan $20 calls on BBBY just yesterday in our Live Member Chat Room as well as 8 other plays where we're betting on a flat to down market into the end of the year from here. I know I've been bearish most of the year but that hasn't stopped us from making long-term long plays because expecting a correction is not the same as expecting a crash – though the correction has, so far, remained elusive.

That's why even the positions we're adding have long-term bullish components. That way, even if we're wrong and the bubble keeps expanding for 3 more months, we have gains on the long side to offset any short-term losses we may incur. The headline on Durable Goods was encouraging this morning – up 4.5% but, at the core (ex-aircraft), we're only up 0.1% so good for Boeing (BA), bad for everyone else.

We're expecting the markets to be held up for the next couple of days to make the end of Q3 look pretty but, after that – it's going to be a wild-card.