Problems, we've got problems…

Problems, we've got problems…

They're not new problems and trade issues and bond issues are self-inflicted problems but, as was made obvious by the Kavanaugh confirmation this weekend – these self-inflicted problems aren't going to go away soon. If America is indeed on the wrong path – the wheels are being locked in with lifetime appointments that insure these policies will last long after Trump has gone to pasture.

As you can see from the chart on the right, other than Israel, Kenya and, of course, Mother Russia, other contries' view of America has been deteriorating rapidly since Trump took office – worse even than Trump's poll numbers at home. People in other countries consider the United States, not Russia or China or Iran – to be the single biggest threat to World Peace.

Meanwhile, Trump's rollback of Obama's Climate Policies and withdrawal from the Paris Climate Accords has, according to the new report from the United Nations, set us on a path for Global Catastrophe as soon as 2040 which, in case you are not good at math, is only 21.5 years away.

The report, issued on Monday by the Intergovernmental Panel on Climate Change, a group of scientists convened by the United Nations to guide world leaders, describes a world of worsening food shortages and wildfires, and a mass die-off of coral reefs as soon as 2040 — a period well within the lifetime of much of the global population.

The report “is quite a shock, and quite concerning,” said Bill Hare, an author of previous I.P.C.C. reports and a physicist with Climate Analytics, a nonprofit organization. “We were not aware of this just a few years ago.” The report was the first to be commissioned by World leaders under the Paris agreement, the 2015 pact by nations to fight global warming.

Look, I know you don't want to hear this stuff on a Monday morning but we are talking about a major global crisis and WE ARE MAKING IT WORSE, not better, not even the same, because we have "leaders" who are not only ignoring the problem but ACTIVELY working to make things worse – working AGAINST the efforts of the rest of the World. Do you know what that makes us? A rogue nation.

Look, I know you don't want to hear this stuff on a Monday morning but we are talking about a major global crisis and WE ARE MAKING IT WORSE, not better, not even the same, because we have "leaders" who are not only ignoring the problem but ACTIVELY working to make things worse – working AGAINST the efforts of the rest of the World. Do you know what that makes us? A rogue nation.

If you don't do something about it, no one will. This is the fate of our planet we're talking about and we're not taking it seriously. The UN report estimates the cost of doing nothing will be $54Tn in damages over the next 40 years but the solution is just as expensive and will require heavy taxes on carbon dioxide emissions, perhaps as high at $27,000 per ton by 2100. To keep that in perspective, the average gas-powered car expells 4.6 tons of CO2 per year!

To prevent 2.7 degrees of warming, the report said, greenhouse pollution must be reduced by 45 percent from 2010 levels by 2030, and 100 percent by 2050. It also found that, by 2050, use of coal as an electricity source would have to drop from nearly 40 percent today to between 1 and 7 percent. Renewable energy such as wind and solar, which make up about 20 percent of the electricity mix today, would have to increase to as much as 67 percent.

“This report makes it clear: There is no way to mitigate climate change without getting rid of coal,” said Drew Shindell, a climate scientist at Duke University and an author of the report.

Clearly by 2100 we should be able to stop using gas-powered cars and even trucks and buses but we need to start NOW or there won't be a 2100. Seriously folks, these are real numbers compiled by 91 of the World's top scientists who reviewed over 6,000 studies from around the World – these are FACTS, not fake news!

Meawhile, the spread of radical conservatisim is giving Trump allies in his quest to destroy the planet. This Sunday, Brazil moved towards electing Jair Bolsonaro, the far-right candidate who is also planning to pull out of the Paris climate accords. The former army captain has made provocative statements on a huge range of issues. He has pledged tough punishments for offenders and the relaxing of gun ownership. He has also spoken of torture as a legitimate practice and wants to restore the death penalty. Bolsonaro's misogynistic and homophobic rhetoric has prompted outrage and protests, and he has taken a strong anti-abortion stance. Sound familiar? You may as well make him Pence's VP now…

Meawhile, the spread of radical conservatisim is giving Trump allies in his quest to destroy the planet. This Sunday, Brazil moved towards electing Jair Bolsonaro, the far-right candidate who is also planning to pull out of the Paris climate accords. The former army captain has made provocative statements on a huge range of issues. He has pledged tough punishments for offenders and the relaxing of gun ownership. He has also spoken of torture as a legitimate practice and wants to restore the death penalty. Bolsonaro's misogynistic and homophobic rhetoric has prompted outrage and protests, and he has taken a strong anti-abortion stance. Sound familiar? You may as well make him Pence's VP now…

Speaking of ineptitude by the administration, replacement Secretary of State Mike Pompeo blew up the China meeting this weekend on "fundamental disagreements" including what China calls "escalating trade disputes, interfering on Taiwan and meddling in the country’s domestic affairs." “These actions have damaged our mutual trust, cast a shadow over China-U.S. relations, and are completely out of line with the interests of our two peoples,” Foreign Minister Wang told Pompeo.

China’s public show of displeasure also represented one of the strongest signs yet that the widening list of disputes between the U.S. and China could undermine their cooperation on North Korea. Unlike a similar trip in June, Chinese President Xi Jinping granted no audience to the U.S. Secretary of State. In the speech at the Hudson Institute in Washington last week, U.S. Vice President Mike Pence accused China of “a whole-of-government approach” to sway American public opinion, including spies, tariffs, coercive measures and a propaganda campaign.

Needless to say Chinese markets opened sharply lower as they came back from a week-long holiday and, of course, our own futures are continuing last week's downturn on worsening conditions between the World's two largest economies.

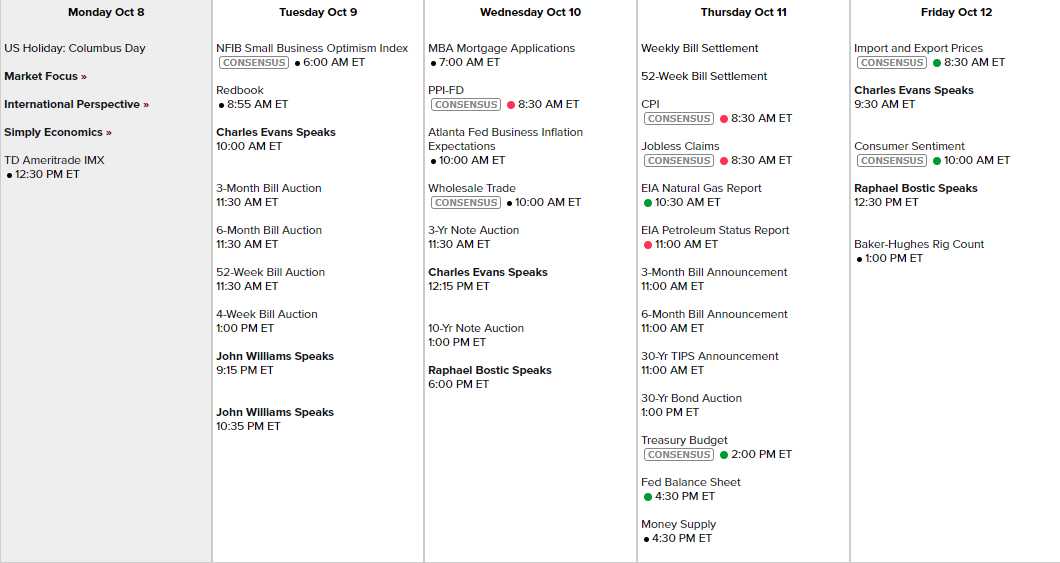

Today is a semi-holiday in the US so we can't take the markets seriously and there's not much data this week but there is a lot of Fed speak with 7 market-moving speeches planned for the week:

We're still watching the same pullback lines we expected last week and, so far, the Short-Term Portfolio (STP), where we have our hedges, is up $25,000 since 9/24 while the Long-Term Portfolio (LTP) is down $43,000 so the STP is doing it's job of mitigating the damage and the LTP should look better once the VIX calms down (since we sell a lot of premium, we get hurt when the VIX rises in the LTP).

On the whole, I'm very pleased with our last round of portfolio balancing – especially the moves we made to make the STP more aggressive!