Schrodinger's Market.

Schrodinger's Market.

The bouncing cat is either dead or alive at S&P 2,800 and we won't really know which is which until the weekend as the S&P failed to hold it yesterday and our 5% Rule™ demands 2 full days over the strong bounce line (2,800) before we can put our rally caps back on. Strong bounces are NORMAL – it's what we expect on the way down as each 5% move lower is followed by a 1% (weak) or 2% (strong) bounce in a healthy correction. The downtrend isn't broken until the strong bounce line is held – a very simple way to tell whether or not it's a good time to jump back in.

Of course, Schrodinger contended that the market was neither dead nor alive until you observed it but the act of observing it causes the outcome to change – that's very true in a bot-traded market where an act of programming made 6-18 months ago determines the movement of the market today as thresholds are crossed on various trading programs which, upon observation of the action, then cause the market to be more alive or more dead as they too kick in and start trading.

That's why we have the 2-day rule, you have to let the various cross-currents play out before you can say you are really recovering. Take the Shanghai Composite, for example. China's market looked like it was bouncing in 2015 but went lower and then made another protracted bounce that collapsed early this year and now it turns out we've been consolidating for a move lower for 3 years.

That's why we have the 2-day rule, you have to let the various cross-currents play out before you can say you are really recovering. Take the Shanghai Composite, for example. China's market looked like it was bouncing in 2015 but went lower and then made another protracted bounce that collapsed early this year and now it turns out we've been consolidating for a move lower for 3 years.

I know – who cares about China? What happens there doesn't affect us, right? That's the same thing I heard back in 2006 when I told people that we should be very concerned about a slowdown in China. It took a while, but it did matter in the end…

Does Europe matter? Last Wednesday, we were right on top of shorting the market BECAUSE Germany's DAX Index was going to fail the 11,800 line and I pointed out that, in 2015, the DAX had a 20% correction after failing that mark. Traders may not remember these things but TradeBots never forget! Well, the DAX failed to get back over the 11,800 mark this week and it turning down again and so are the EuroStoxx – Europe's 50 biggest companies. Still want to ignore it?

As Banksy would say, "the writing is on the wall" and we are NOT really recovering so this may be a good time to press your hedges if you feel inadequately prepared for a deeper sell-off. China slowing down is bad for metals, bad for oil, bad for materials, bad for shipping…. To some extent, it's a self-inflicted wound caused by Trump's idiotic trade policies but, as evidenced by last week's Supreme Court fiasco – that's not going to change.

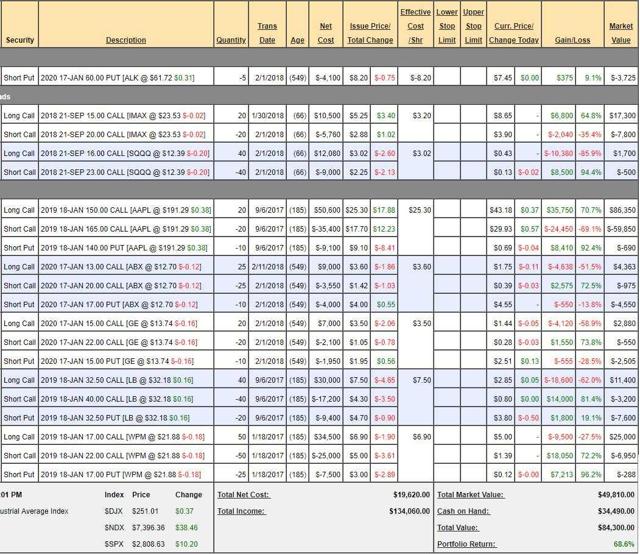

Change is what we'll be concernd with today as we review our 5 Member Portfolio which have, so far, held up pretty well during the carnage. One of those portfolios we share with the public and that's our Money Talk Portfolio, which has the odd restriction that we only trade it once a quarter, when I am a guest on BNN's (Bloomberg Canada) Money Talk Show. The last time we made adjustments was July 19th, when I shared the changes with Seeking Alpha Readers. At the time, we had these positions:

On the show, we cashed out IMAX (IMAX), sold our Nasdaq Ultra-Short (SQQQ) Sept calls (replaced them with a June 2019 spread), cashed out Apple (AAPL), got more aggressive with Barrick Gold (ABX) and GE (GE), Limited Brands (LB) and Wheaton Precious Metals (WPM) and added General Mills (GIS) to get us through the summer.

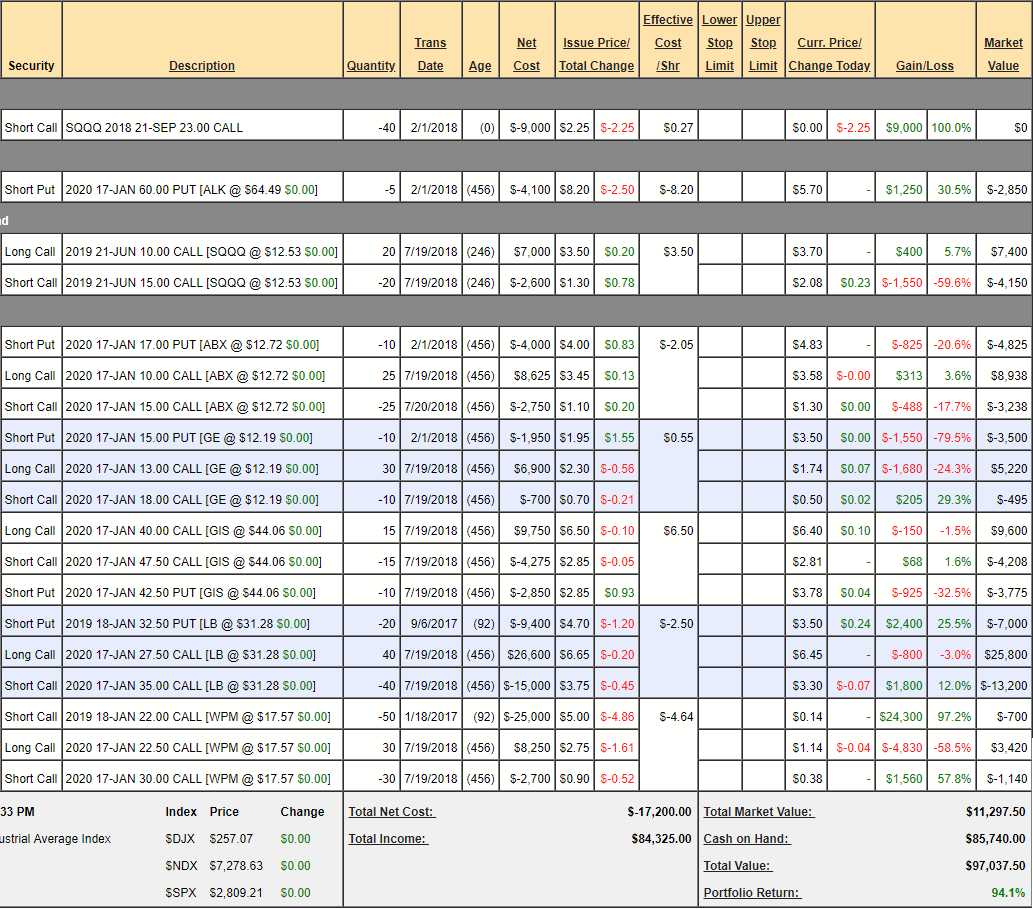

As it turns out, those were generally positive changes because, even despite the recent turmoil, the Money Talk Portfolio is now at $97,037, which is up $12,737 in about 3 month, which is 25% of our originally $50,000 portfolio which is, after one year and one month – very close to doubling up. I will be on the show again next Wednesday (7:30) and we will also put up a printed version of the changes as well. As of today though – no changes since July 19th but here's where we stand:

Notice we're mostly in CASH!!! as I didn't trust the markets over the summer (S&P was 2,800 then too) and we're currently using $30,000 of ordinary margin to maintain these positions (out of $170,000 of buying power), so we're nice and flexible and, hopefully, we can do a bit of bargain shopping next week – so tune in!

Also note that ABX, GE and GIS are all trades that haven't even made money yet – so each are still good as new trade ideas.

My goal is to finish the reviews for our other 4 portfolios today but that may be unrealistic, as we have a lot of positions to go over though, given the indecision in the market – I think our current neutral stance is fine and we're likely to mostly maintain what we have. The Fed Minutes did not give any presents to investors yesterday so the market will have to stand or fall on their own and we'll be watching the same bounce lines I laid out on Monday but, for now, I'd rather error on the side of caution.