Usually, we don't care so much about Europe.

However, Germany's DAX index is critically testing the 11,800 line, which would be it's lowest point since early 2017 and, in 2015, DAX had a 20% correction after failing at this mark – all the way to 9,000 so failing here would be extremely significant and the Euro Stoxx Index faces a similar test at 3,200 – but it's still 100 points above that line – a larger percentage (3%) than the DAX (1%) has to fall.

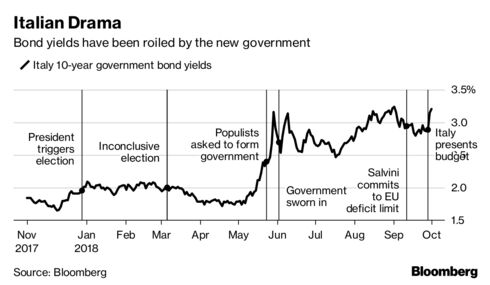

Brexit, of course, remains the big story over in Europe but Italy is also falling apart and, just this morning, the Parlimentary Budget Office said the Government's forecast of 1.5% growth next year was exaggerated, indicating deficits will be larger than projected and far afoul of EU regulations. Italy's debt is already 130% of GDP and that's considered a crisis – said the writer in a country who's debt is 110% of their GDP and also has BS inflated Government projections for economic growth.

EU authorities are expected to declare Italy in violation of the bloc’s rules on fiscal discipline unless Rome changes course. Leaders of the League and 5 Star have defiantly denounced EU officials, raising the specter of a monthslong confrontation. Last Friday, the EU’s executive arm criticized Italy’s budget plans, saying they represent a “significant deviation” from recommended fiscal policies. Skeptical investors have dumped Italian bonds and stocks, especially banking-sector shares. The yield on Italy’s benchmark 10-year bonds touched a four-year high of 3.7% on Tuesday.

EU authorities are expected to declare Italy in violation of the bloc’s rules on fiscal discipline unless Rome changes course. Leaders of the League and 5 Star have defiantly denounced EU officials, raising the specter of a monthslong confrontation. Last Friday, the EU’s executive arm criticized Italy’s budget plans, saying they represent a “significant deviation” from recommended fiscal policies. Skeptical investors have dumped Italian bonds and stocks, especially banking-sector shares. The yield on Italy’s benchmark 10-year bonds touched a four-year high of 3.7% on Tuesday.

3.7% is off the chart and that chart is up over 100% since May! By comparison, Germany is still borrowing money at 0.55%. Italian Finance Minister Giovanni Tria said the government is worried by the “unacceptable” bond yield spread, which on Tuesday was near the widest in more than five years. "If the spread reaches 500?” Tria said in response to a hypothetical question. “The government will do what it does in an unexpected crisis, because we aren’t expecting that.” That's not actually reassuring since Italy in the 70s and 80s massively devalued their currency and engaged in hyperinflation to pay off debts (ie. pay debts with worthless currency to pretend they aren't defaulting). Italy, unlike Greece, is a $2Tn economy and a crisis there would spread rapidly.

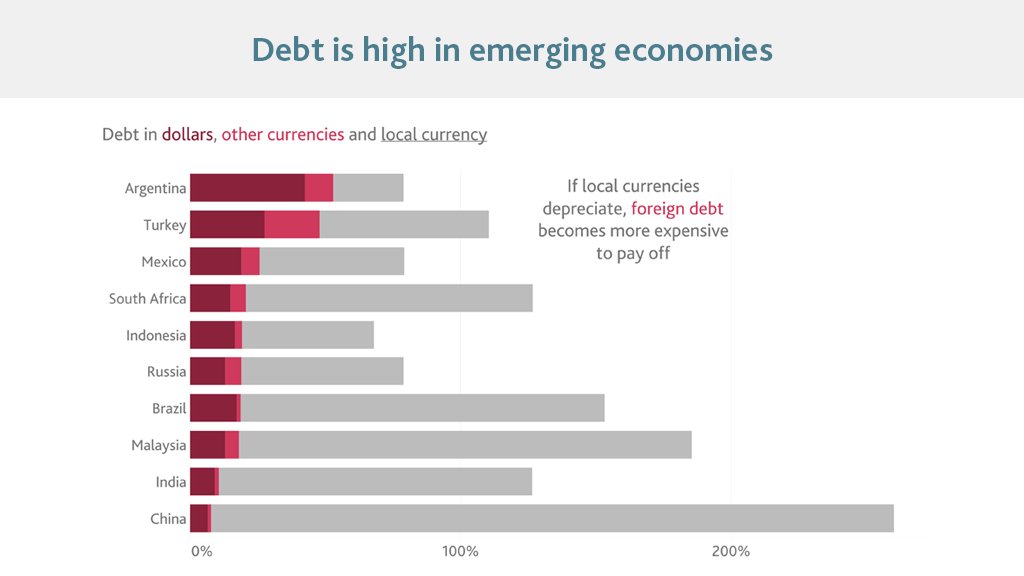

Speaking of spreading rapidly, Fed Chair Powell is in Bali this week at a Global Policy Summit and Inonesia's Finance Minister kicked things off by stating that the Fed's rate hikes are triggering capital outflows that are damaging Emerging Market Economies. The U.S. “needs to be very mindful that spillover from the effect of their policies is very real for many countries,” said the minister to open the conference.

Speaking of spreading rapidly, Fed Chair Powell is in Bali this week at a Global Policy Summit and Inonesia's Finance Minister kicked things off by stating that the Fed's rate hikes are triggering capital outflows that are damaging Emerging Market Economies. The U.S. “needs to be very mindful that spillover from the effect of their policies is very real for many countries,” said the minister to open the conference.

As you can see from the chart, countries with high levels of Dollar-denominated debt are hit very hard when their currency (which they collect in taxes to pay the debts) is devalued against the Dollar, which is a function of the Federal Reserve setting their rates higher. That leaves the emerging market with no choice but to raise their own rates to maintain what strength they can but that then increases all of their borrowing costs. As you can see, Turkey and Argentina are completely F'd – there's no saving them from what's about to happen.

Indonesia has been swept up in the rout that’s hit global emerging markets this year as rising U.S. interest rates, a stronger dollar and a worsening U.S.-China trade conflict prompt investors to dump riskier assets. The rupiah has slumped to its weakest level in two decades, breaking through the 15,000 level to the dollar last week despite strong action by authorities, including interest-rate hikes, import curbs and delays to some project spending.

Indonesia has been swept up in the rout that’s hit global emerging markets this year as rising U.S. interest rates, a stronger dollar and a worsening U.S.-China trade conflict prompt investors to dump riskier assets. The rupiah has slumped to its weakest level in two decades, breaking through the 15,000 level to the dollar last week despite strong action by authorities, including interest-rate hikes, import curbs and delays to some project spending.

The escalating trade war between the U.S. and China as well as the volatility that has engulfed emerging markets are set to be high on the agenda at the Bali gathering after the IMF on Tuesday trimmed its global growth forecast. The fund also warned that risks to the global outlook have risen in the last three months, which would accelerate capital flight from emerging markets.

“I don’t think that the Fed is reckless, I’m sure they take account of these things,” he said in an interview on Bloomberg Television from Bali. “What we didn’t foresee was that this could be taking place at a time when escalating trade tensions would then complicate the whole picture.”

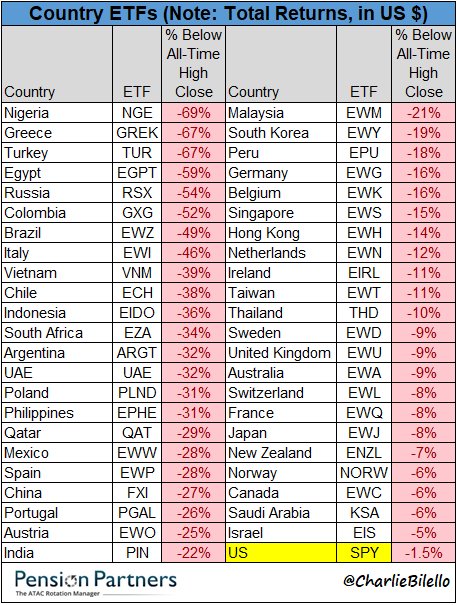

Indonesia is a $1Tn economy that's in BIG trouble and that's what's going on at the moment on the other side of the World while we worry about who Taylor Swift is voting for. Hope springs eternal among the Finance Ministers and, just this morning, there were rumors of sudden progress on US/China Trade Talks but, since there were no significant meetings scheduled – it's doubtful they were true. Indeed, if this week's meetings don't show progress – Emeriging Markets (red line) have a lot further to fall than they already have:

The currencies (blue line) have already massively corrected but well-trained "dip buyers" have been holding up the indexes so far as they think they are getting bargains but those bargains have been a constant burn all year long and failure at this critical support line is likely to spark panic-selling and tax-loss-taking that can send things into a real tailspin – one that can form a vortex that sucks the major global markets down with it. So we have that to look forward to...

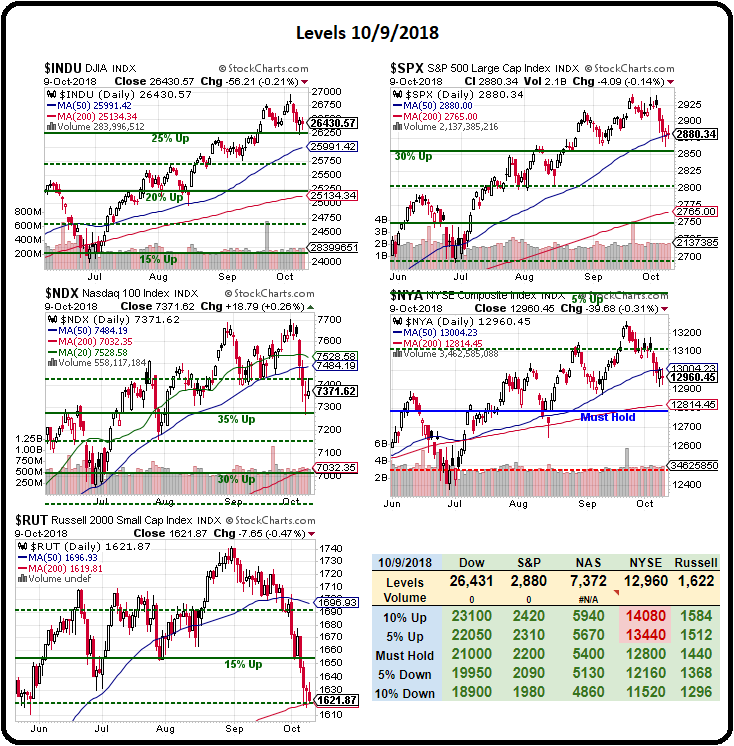

We also have a potential 1,000-point drop in the Dow (/YM) to look forward to if it fails at 26,250 so yes to Futures shorts below that line if it fails, with tight stops above. If the S&P is below 2,860 and the NYSE is still below 13,000 and the Nasdaq fails 7,275 and the Russell is below 1,620 – that's going to confirm a bearish market and we'll get more aggressive on our shorts but, so far, we're pretty well-balanced in our 5 Member Portfolios and we will review them today in our Live Trading Webinar.

As noted by StJeanLuc in this morning's Live Member Chat Room, the rest of the World is correcting and it's the US in general that's lagging. A lot of this is because half our population (and most of the investing population) is brainwashed into believing in "American Exceptionalism", which is the same nonsense they believed in 2008, when the rest of the World was going to Hell and traders here thought we'd be immune.

As noted by StJeanLuc in this morning's Live Member Chat Room, the rest of the World is correcting and it's the US in general that's lagging. A lot of this is because half our population (and most of the investing population) is brainwashed into believing in "American Exceptionalism", which is the same nonsense they believed in 2008, when the rest of the World was going to Hell and traders here thought we'd be immune.

It's a Global Economy and we're part of the globe but, just like with Global Warming and their parents' lack of adequate Retirement Funds, a large percentage of traders believe that, if they just ignore something long enough, it won't bother them anymore.

Meanwhile, another terrible hurricane is barreling through the Gulf of Mexico and looks like it will hit the top of Florida at a category 4 (100+ mph winds), making it the strongest storm to make landfall there in the past 100 years with 6-9 foot storm surges plowing across what is essentially completely flat land so MASSIVE flooding is expected and then, to add insult to injury, the storm is projected to move up to the Carolinas, where it will add to their flooding troubles.

That's a lot of economic destruction to start Q4 off but it should be good for Home Depot (HD), who have pulled back 10% recently from $215 to $195 and should hold up at the 200 dma at $190 – as it has many times before. I don't think HD is particularly cheap at $195 as that's $223Bn and they "only" made $8.6Bn last year so 26x earnings is still up there but Sears (SHLD) will likely be bankrupt soon and all that hardware business will go mostly to HD and LOW, who have similar multiples.

The best way to play a stock we WISH would go lower is to sell puts and, fortunately, HD has some expensive puts to sell so I like selling the 2021 $180 puts for $16 because, even if HD goes lower and it gets assigned – your net entry is just $164, which is another $31 (16%) below the current price so our worst case is owning HD at $164 and our best case is keeping the $16 so let's sell 5 of those in the Long-Term Portflio for $8,000 and see how it works out.

Again, this is how we can make money, even in a choppy market, using the margin from our sidelined cash. The Long-Term Portfolio is at $863,307 (up 73% for the year) so we have $1.5M(ish) in buying power and 5 short HD 2021 $180 puts uses $13,779 in ordinary margin on ThinkOrSwim so it's a margin-efficient trade and $8,000 is 1% of our total – on just that one trade – that's a lot better than putting money in the bank and waiting for your interest payments!

Be careful out there…