Oh what a beautiful morning!

Oh what a beautiful morning!

We went long on Gasolione (/RB) into the weekend as we expected OPEC to do SOMETHING to prop up Oil (/CL) at the $60 mark and we thought /RB Futures would make a good play into Thanksgiving regardless. We did, in fact, get noise over the weekend that our freinds the Saudis see the need to cut oil ouput by another 1Mb/d next year to maintain "price stability".

I had predicted we'd get down to $62 when I was interviewed on Nov 1st at Investing.com, but our first attempt to go long on oil and gasoline failed but this time /RB made the big payout with an almost $5,000 gain on 6 long contracts as we stopped out our last contracts at $1.64 – a nice way to start our week…

The next long attempt can be made over $1.65 on /RB or back at the $1.625 line and, of course, we'd love to give $1.60 another try but you have to use tight stops on Gasoline as the contracs pay OR LOSE $420 per penny of movement on each contract.

When you get a strong move based on a quote – even from a very reliable source – you have to look to take quick profits because, as is the case with Gasoline – nothing has Fundamentally changed – just some Saudi Oil minister says (while oil is failing $60 and US inventories alone are climbing by 5Mb/week) that they "might" need to cut Global Production by 7Mb/week – a month from now – if the other OPEC members agree.

So, for future reference (and we've done this before but it's like school, I have to repeat things many times before a light bulb appears above the students' heads): OPEC (now called the new and improved OPEC+ in an effort to rebrand and include Russia, Mexico and Kazakhstan) generally acts to support oil at $60 ($70 for Brent) like it's an emergency so wherever Gasoline is at the time tends to benefit as well and especially when you have a major down move, you can play the 5% Rule™ for a bounce:

We fell from $66 on the 31st, so that was 9 trading days so oil has to be back over $66 a week from Friday (23rd) to get back its bullish mojo. We don't believe it will get over that line though I'm sure OPEC will try very hard to talk it up but the trade lines up perfectly with our expectations for the Thanksgiving holiday and oil contracts pay $1,000 per $1 move higher ($10/penny) and we're below $61 so you can play /CL long at $61 with a stop below $50.90 ($100 loss) and you would be risking $100 against a potential $5,000 gain at $66 though I would certainly be THRILLED to take 1/2 off the table at $62.50 to lock in gains.

See how easy Fundamental trading is? Read the paper, think about how it will affect the market and place a bet. It takes a bit of practice to get used to watching ALL the factors that might affect a trade. In oil's case, the Dollar can affect the price intra-day and another reason we like the bullish trade is that the Dollar is also high in its channel having pushed very close to a 10% move from 89 in Q1 to 97.4 this morning.

89 x 1.1 is 97.90 but call it 98 as our expected top and thats a move of 9 so the retraces are 1.8 and we'll call them 2 (it's not an exact science!) back to 96 (weak retrace) and 94 (strong retrace) and you can see on the chart how both of those lines were significant on the way up – as predicted by the 5% Rule long before the move ever happened. So, if we're expecting the Dollar to pull back, we expect that to provide some lift to all commodities as well as the indexes but the Dollar's effect is short-term and wears off pretty quickly.

That means Silver (/SI) and Gold (/YG) are also getting interesting down here at $14.05 and $1,205 and I would play $14 or $1,200 with some conviction so not much harm in scaling into a position here – as long as you don't mind adding one at $14.025 or $1,202.50 and 2 more at $14 and $1,200 which would put you into 4 /SI at an average of $14.0125 with a $250 loss on 4 Silver ($50 per penny, per contract) or 4 /YG at an average of $1,201.25 with a $161 loss on 4 Gold ($32.20 per Dollar, per contract).

Those losses can double if you set your stops the same distance below our support lines as your cost basis is above them so $13.9875 on /SI and $1,198.75 on /YG. Of course the hope is that we go up and don't have to worry about doubling down but, if you don't have a plan when you start a trade then you must be planning to fail!

If the metals go below that price, we simply take our losses and wait for the next opportunity to catch them crossing over and we jump back in over the line with even tighter stops below (assuming we still like our premise, of course). Don't forget, a large part of the premise is that the Dollar fails the 97 line and heads lower so, if it doesn't – you should be very quick to stop out that trade!

If you are still Futures-challenged, you can still make the long-term play we liked back on October 31st using Wheaton Prescious Metals (WPM) as a proxy for Silver. Earnings are this week so kind of risky but we love this trade and, at the time, I said:

Earnings are on Nov 14th and silver is much lower than it was last November ($17) and last quarter averaged $15.25, falling from Q2's $16.50 so estimates are for WPM to make just 0.10/share vs 0.15 least year and 0.16 last quarter but, for the year, they are still on track to make 0.52/share vs 0.63 last year so -20% and WPM was in the low $20s last year so $16.50 may be a bit oversold – especially considering they are a contract streamer and not a miner so, going forward, they stand to reap a huge benefit from rising silver prices as well as a new production deal on their Stillwater project. As a new trade, I'd go with:

- Sell 10 WPM 2021 $15 puts for $2.10 ($2,100)

- Buy 20 WPM 2021 $15 calls for $3.85 ($7,700)

- Sell 20 WPM 2021 $20 calls for $2.05 (4,100)

The net of that spread is $1,500 and it pays $10,000 if WPM is over $20 in Jan, 2021 and that would be a gain of $8,500 (566%) and the put sale obligates you to buy 1,000 shares if WPM is below $15 for $15 so worst case is owning 1,000 shares for a net of $16.50 ($16,500), which is the current price. I'ts a very margin-efficient trade as only $1,340 of ordinary margin is tied up on the short puts.

As of Friday's close, the 2021 $15 puts were still $2 ($2,000) and the 2021 $15 calls were $3.75 ($7,500) and the short 2021 $20 calls were $1.85 ($3,700) so that's now net $1,800 up only $300 (20%) since we took the trade but that's a drop in the bucket for a trade that is projected to make $8,500 (566%) if WPM is over $20 in January of 2021. Of course now, you would only make $8,200 which would be "just" a 455% gain from $1,800 – sorry if you missed it earlier…

We're still playing the markets very cautiously and very skeptically but we also have PLENTY of (well-hedged) bullish positions and our portfolios seem very well-balanced so we'll just continue to look for great sales on good stocks that have bad earnings for good reasons while keeping our eye on Trump, Mueller, China, Russia, Brexit, Inflation, Fed Hikes, Italy… and a dozen other macro concerns that keep us VERY CAUTIOUS as we STILL haven't had a proper correction.

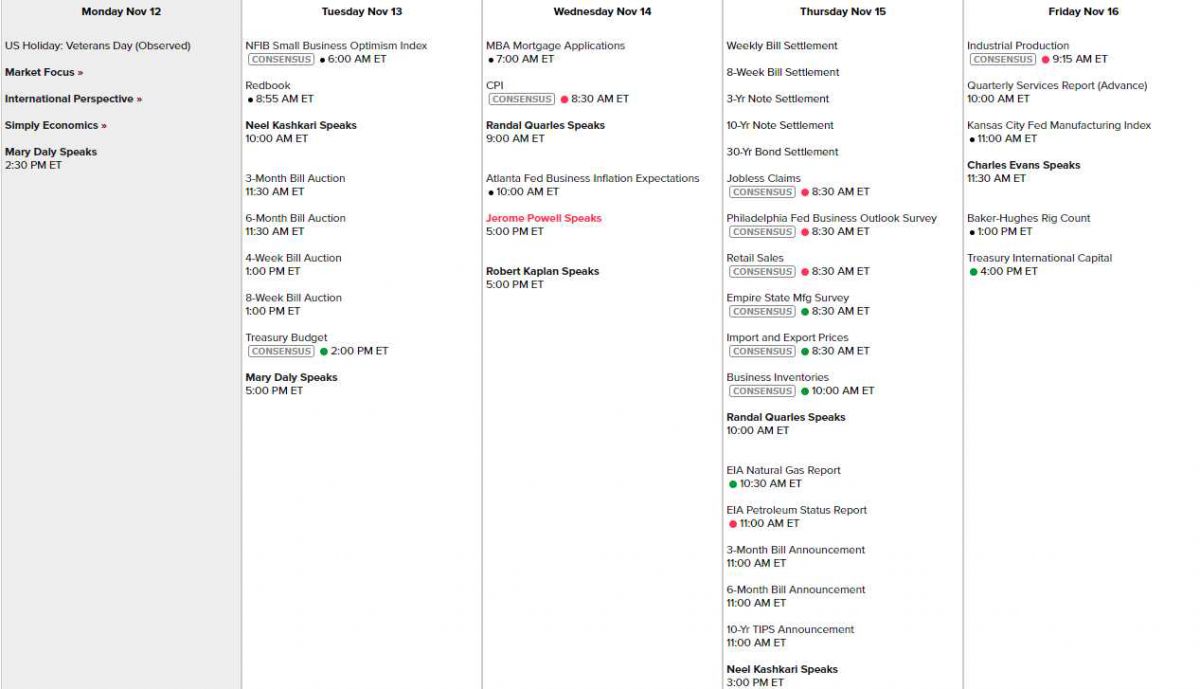

Not much going on this week but 9 Fed speeches will help jerk the markets up and down though 3 of them are repeats by Quarles, Kashkari and Daly. Still, we hear from the Grand Poobah himself as Powell gets the final say on Wednesday, at 5pm and he's speaking with Robert Kaplan in Dallas. We get the Atlanta, Philly and Kansas City Fed Reports this week – thouse should be interesting too.

And, of course, there are still PLENTY of fun earnings reports to take in though the next 3 weeks will give us the last 25% of the S&P 500 stocks as well as all the other slowpokes who put off their book reports until the last minute.

Be careful out there!