I think we're heading lower.

Probably about 10% lower and yesterday's 8% drop in oil is a good indicator of how fast the "value" can come out of the markets – or any other asset you think is "stable" these days. There are still MANY signs of Global Economic Weakness, including Japan's negative GDP, which we noted yesterday. Even worse, Japan's Central Bank owns $5Tn worth of assets – the entire GDP of the country, including 45% of all Government bonds paying near 0% interest that will quickly become worthless if rates rise.

“The Bank of Japan’s policy is clearly not sustainable. The BOJ would suffer losses if it would have to raise interest rates to, say, two percent,” said Hidenori Suezawa, a fiscal analyst at SMBC Nikko Securities. “Also, in case of emergencies, such as a natural disaster or a war, the BOJ won’t be able to finance government bonds any longer.”

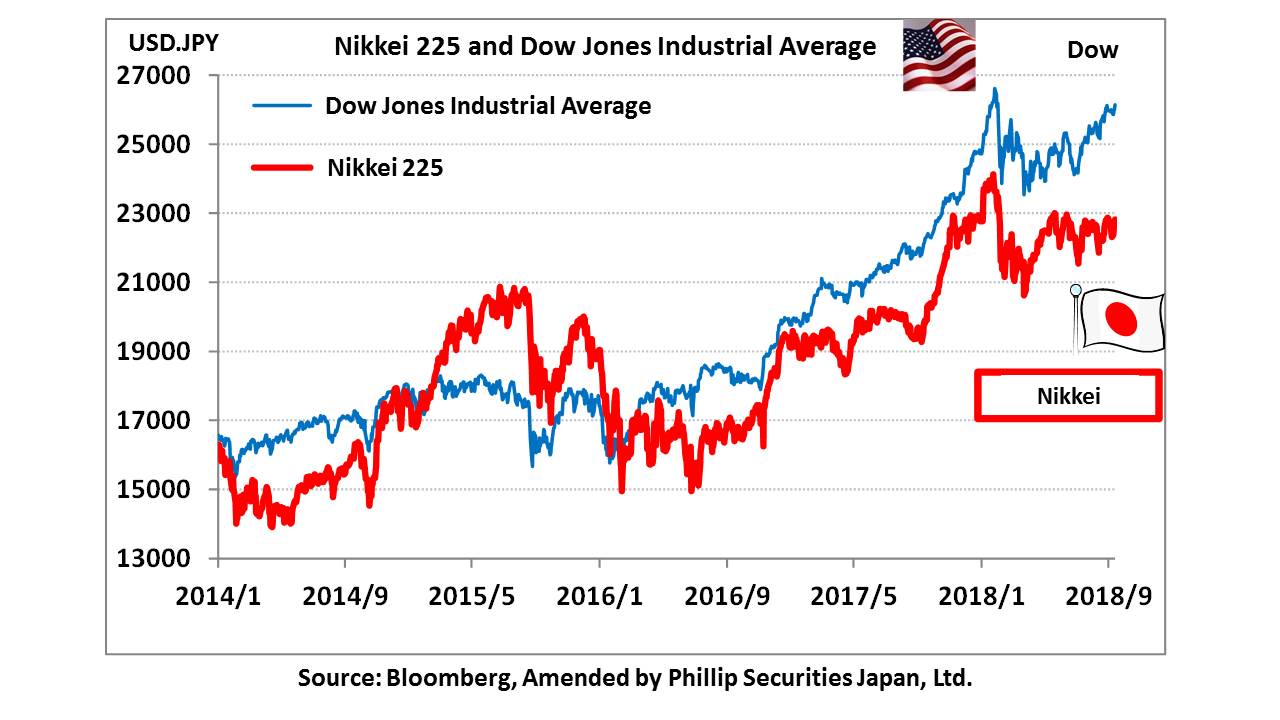

The BOJ has also been a very aggressive buyer of Japanese stocks and is now the largest holder of most of the Nikkei 225 stocks – over 10% on average. This buying spree pushed the Nikkei up from 16,000 when Abe and Koroda unleashed this mad shceme in order to reverse that 20% correction.

Well, what if the 20% correction was correct and Japanese stocks, in an aging population with Government debts that exceed 250% of their GDP, are really only worth Nikke 16,000. That means that, at 24,000, 33% of the money the BOJ spent to prop up the market was wasted and that's very likely the case as the BOJ shouldn't have to be a buyer and their actions created a false sense of demand for Japanese stocks and artificially raised the prices and those prices, in turn, encouraged other Global markets to move higher and now the whole World is a good 10% (still) too expensive but Japan has barely corrected 10% and easily has another 10% to go (19,500) before anything like real buyers begin to show up.

It's not even possible for the BOJ to unwind their positions, they'd destroy the market with way too much supply of stock – much as oil has recently plunged on over-supply. A 10% drop in the BOJ's assets would be a $500Bn loss in a $5Tn economy or 10% negative GDP in a year and yesterday we were fretting over 1% – those were the days!

It's not even possible for the BOJ to unwind their positions, they'd destroy the market with way too much supply of stock – much as oil has recently plunged on over-supply. A 10% drop in the BOJ's assets would be a $500Bn loss in a $5Tn economy or 10% negative GDP in a year and yesterday we were fretting over 1% – those were the days!

Our own Fed has also been a buyer of assets but not so much our stock market – there seem to be plenty enough fools rushing in to buy that at any price. And again, I'm not really a bear – I just think too many stocks are far too expensive to justify entire indexes still trading within 10% of their all-time highs. Even that is misleading as there's an assumption that all-time highes are justified just because they were hit but you may recall paying $140 a barrel for oil in the summer of Bush and yet, today it's $55.

Was oil ever worth $140 a barrell or were people wrong at the time? Was GE (GE) ever worth $58, now it's $8, was Amazon (AMZN) worth $2,100, now $1,644? In our Member Chat Room, we were just discussing the need to re-short Chipotle (CMG) as they come back to test $500. Our Long-Term Portfolio's position on CMG is 20 of the 2020 $460/580 bull call spreads that we paid net $105,700 for but we're not actually that bullish on CMG – that position came from the profits of a much lower spread we cashed in and we flipped to the 2020 spread to cover short calls we sold last time CMG was up this high.

Just because we like a stock, doesn't mean we're blind to it's true value. $500 on CMG is a $14Bn market cap but CMG only made $176M last year and, in 3 quarters this year, they have made $140M, so on track for the same so $14Bn is about 80 times their earnings – which is a bit much for a fast-food franchise (MCD trades at 27x earnings and that's way over their usual sub-20x).

Chipotle was spun out of McDonald's, who bought the chain in 1998, when they had 16 restaurants and built them to 500 restaurants before spinning them out in Jan, 2006. Chipotle was founded in 1993 so it took them 5 years to build up to 16 restaurants and then, backed by one of the largest companies on the planet, another 8 years to get to 500 stores and now, 12 years later, they have 2,461 stores.

Why is that important? Because even with all the money in the world and a red-hot concept that was sweeping the nation 10 years ago – it took Chiptole essentially 20 years to get to $14Bn so, EVEN IF they come up with another great idea and EVEN IF it grows as fast as CMG and EVEN IF it all goes perfectly, they are still about 20 years from adding another $14Bn in market cap and that makes paying 80 times their current earnings INSANE when MCD and others only costs you 27 times earnings.

Why is that important? Because even with all the money in the world and a red-hot concept that was sweeping the nation 10 years ago – it took Chiptole essentially 20 years to get to $14Bn so, EVEN IF they come up with another great idea and EVEN IF it grows as fast as CMG and EVEN IF it all goes perfectly, they are still about 20 years from adding another $14Bn in market cap and that makes paying 80 times their current earnings INSANE when MCD and others only costs you 27 times earnings.

You can fool some of the people all of the time and you can fool all of the people some of the time but you CAN'T fool all of the people all of the time and that is why things like this are simply unsustainable – it's just a question of when the investors realize it.

That's why we cashed in our original calls when CMG hit $500 (and put on the current spread to cover the short calls which we've since bought back) and now that CMG is back on the crazy train – we can sell 10 of the Jan $485 calls for $26, collecting $26,000 against our $105,700 spread or about 25% over the next 65 days. If we can do 6 of those sales over the next 12 months, that would generate $156,000 and whatever value was left on our $105,700 spread would be bonus money. Not bad for a year's work!

We LOVED CMG when it was beaten down over contamination scares, we were sure that would pass and CMG would head back over $400 but $500 – PLEASE – that's just silly! So we turned our longs into shorts but, because investors are silly, we hedge with a long-term cover. Very simple concept. It's the same with many stocks we have. Back on Sept 26th, we put out a Top Trade Alert featuring 9 similar trade ideas to take us through the correction with the goal of making $109,000 by the January expirations including that CMG position (but we bought back the short calls when CMG tested $400 and now we'll sell new calls) and the smaller trades are also on track – I'll do a full review of those next week but this week November options expire on Friday so we will be reviewing our other positions first.

Anyway, my point is that things are still very expensive and this morning we're popping on bullish rumors about China Trade Talks but we're still going to keep our hedges as I'd rather lose money on them than not be hedged and lose money on our longs if things turn lower. Japan wasn't even one of our main concerns last month – now it is and, if the Trade War isn't resolved soon – China will move up the list of BIG problems.

On a positive note, Brexit seems to be moving along to a resolution and that's one worry off the table – so we have that going for us. Don't forget – Powell is spreaking after the close today and it's probably not a good day to have a rally if you want the head of the Fed to change his mind about raising rates… just saying…

We're not doing a Webinar today because I have to go to the Cannabis Convention in Las Vegas (officially, the Marijuana Business Conference) so I'll be leaving early today but I'll take plenty of notes and look for investing opportunities to share. If I have a chance, I'll do some live comments for the Chat Room too.

We're considering setting up a $20M+ fund next year specifically to invest in the Cannabis Sector – let us know if you have an interest in participating (contact Greg) and, of course, it will only be for accredited investors (sorry). If you have qualification forms, we'll be able to contact you post-conference with some early details.