Nasdaq is up 1.5% this morning!

That's 100 points and that erases all of Tuesday, Wednesday and Friday's losses but we're still, unfortunately well below our 6,870 failure line (10% correction) and the weak bounce line for that is way up at 7,080 – so let's not injure ourselves patting each other on the back on a no-volume pop in the Futures.

I would much rather see the market consolidate and form some sort of proper base before climbing back up – when you build a recovery on low-volume rallies, you have nothing but a house of cards, ready for the next economic wind to collapse it all over again.

The good news this morning is progress on Brexit, hopes that the US and China can make trade progress at the G20 and oil has finally stopped falling at $50 – so the energy sector is having a bit of a relief rally. Also, border patrol agents seem to have saved us from that deadly migrant caravan by gassing women and children who dared to approach the US Border to file legal claims for asylum, rather than trying to sneak in. I guess that's why they call them terrorists – those children sure look terrified (cue music "Proud to be an American").

The good news this morning is progress on Brexit, hopes that the US and China can make trade progress at the G20 and oil has finally stopped falling at $50 – so the energy sector is having a bit of a relief rally. Also, border patrol agents seem to have saved us from that deadly migrant caravan by gassing women and children who dared to approach the US Border to file legal claims for asylum, rather than trying to sneak in. I guess that's why they call them terrorists – those children sure look terrified (cue music "Proud to be an American").

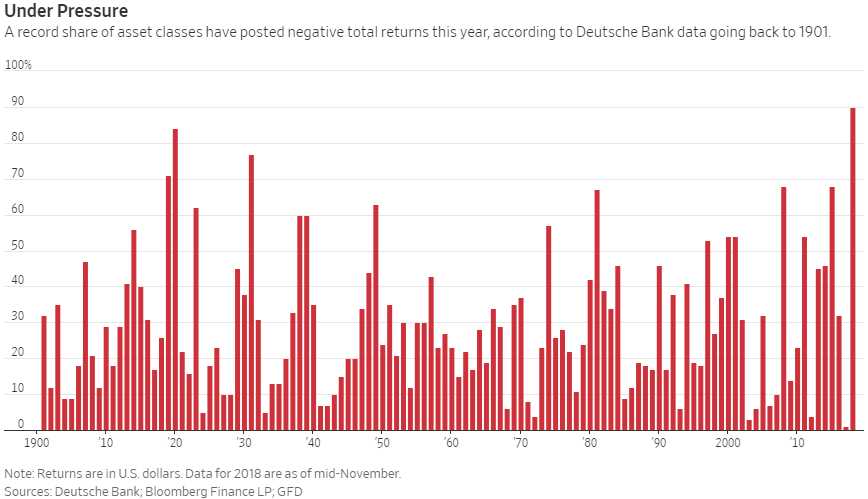

Now we have to see if the markets can cross the border back into positive territory for the year but 2018 has been an exceptional disaster with 90% of all 70 standard asset classes now down for the year, the worst overall performance since data has been kept, starting in 1901 so it seems Trump has indeed set a record that may never be broken because, not even leading up to the Great Depression have stocks, bonds, metals, munis, energy, metals – even crypto currencies – ALL down for the year!

I had predicted way back on Jan 25th that 2018 was going to be a stock picker's market (our favorite kind) and, oddly enough, Apple (AAPL) was at $173.07 that day and it's right back there now. The S&P 500 (/ES) was at 2,850 (now 2,657) and the Nasdaq was just testing 7,000 (now 6,625). As noted by Poullaouec, it's been a pretty miserable year but you might not have thoght so because our Liar in Chief has been telling us, over and over again, how great the economy and the market is doing to the point where our brains have been thoughroughly washed and it's kind of hard to tell what reality is anymore.

I had predicted way back on Jan 25th that 2018 was going to be a stock picker's market (our favorite kind) and, oddly enough, Apple (AAPL) was at $173.07 that day and it's right back there now. The S&P 500 (/ES) was at 2,850 (now 2,657) and the Nasdaq was just testing 7,000 (now 6,625). As noted by Poullaouec, it's been a pretty miserable year but you might not have thoght so because our Liar in Chief has been telling us, over and over again, how great the economy and the market is doing to the point where our brains have been thoughroughly washed and it's kind of hard to tell what reality is anymore.

That's why it's bad for investors when the Government lies to us. We need good information to make good decision and, when your Government and the Banksters turn the Financial Media into nothing more than a propaganda machine to support their objectives – it makes it very hard for investors to figure out what to do with their money.

Hedge-fund manager Pierre Andurand, who earlier in the year bet oil could soon hit $100 a barrel, saw his $1Bn Andurand Commodities Fund suffer its largest monthly loss ever in October. Funds that had built up large stakes in fast-growing technology companies were also stung by sharp reversals. Twenty-six funds dumped their entire stakes inFacebook Inc. in the third quarter, according to a Goldman Sachs Group analysis of 13-F filings, including billionaire Daniel Loeb’s Third Point LLC, which offloaded 4 million shares, citing “a very disappointing quarter” for Facebook.

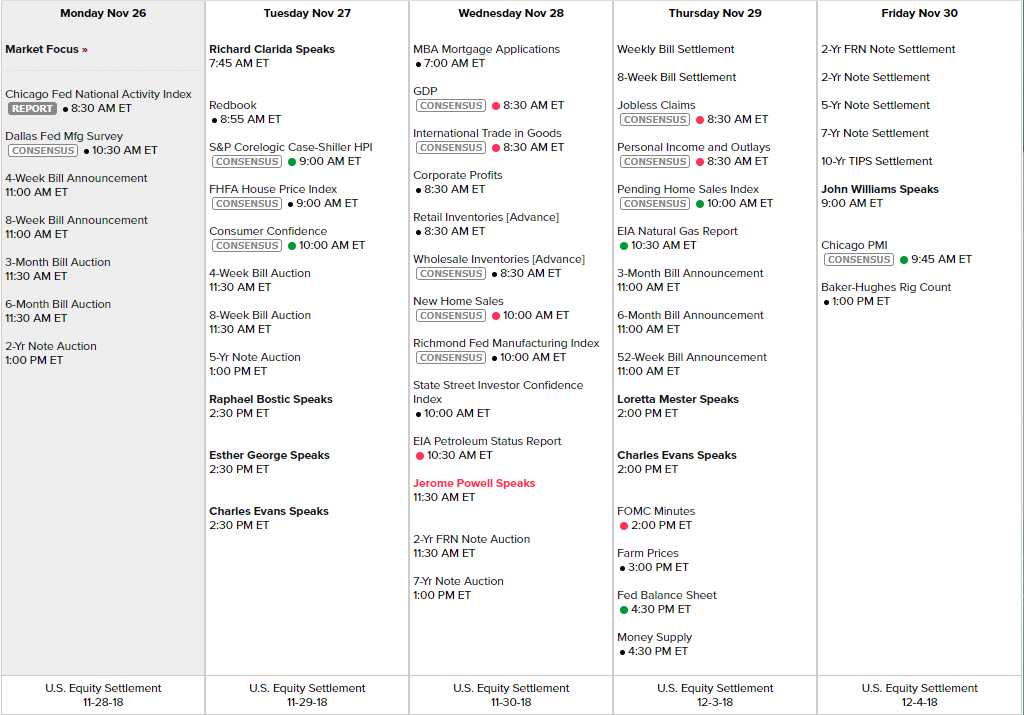

Speaking of bonds, we have a lot of them to auction off this week and a lot of data to catch up on as well and we have 6 Fed Speakers including Powell on Wednesday just ahead of their December meeting, where they are widely expected to hike rates. Powell is speaking just ahead of a large 7-year note auction, which is interesting as they can't afford to see that go off badly. The next day, Thursday, we get the minutes from the last Fed Meeting with Mester, Evans and Williams all scheduled around it to give it some spin so it does look like we have a market-boosting week ahead of us. The question is, whether or not we make it back to those strong bounce lines.