A World without Trump!

A World without Trump!

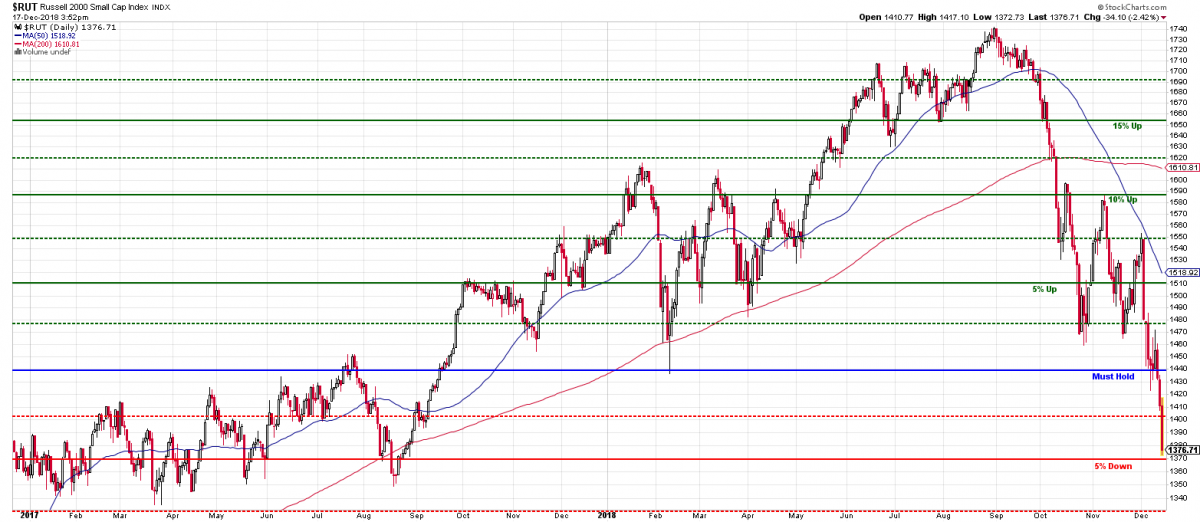

That was the subject of the opening sketch on Saturday Night Live this weekend which, like "It's a Wonderful Life" showed Donald Trump how much better off the World would have been if only he had not been President. The chart on the right shows that small caps (IWM) have already given up ALL of the Trump error gains and the other indexes are not too far behind. As Trump (Baldwin) says in the sketch "It's terrible, everything is falling apart" and that's certainly true of the stock market, which isn't waiting for Trump to be handcuffed and forcibly removed from the White House to roll back the rally that's put the country $2.5Tn further into debt in just two years.

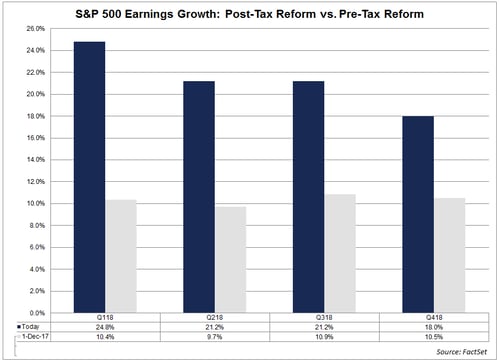

Maybe the markets are worried about the debt, maybe they are worried about President Pelosi (Pence is looking like he'll be out as well) or the looming Government Shutdown or maybe the economy isn't quite as good as Team Trump has been claiming or maybe investors are finally realizing what I've been saying all year: That earnings have been the result of a massive tax-cut sugar-high that cannot be repeated (and shouldn't have happened in the first place) and that there is no way that most companies will live up to the valuations that have been wrongfully extrapolated based on a one-time event.

According to FactSet, almost 50% of the S&P 500s earnings growth has been from Trump Tax Breaks and no, they have not used that money to create more jobs (Trump has created far less jobs than any two Obama years) nor have they used the money to open new factories but they have bought back over $1Tn of their own stock – at record-high prices – isn't that clever?

According to FactSet, almost 50% of the S&P 500s earnings growth has been from Trump Tax Breaks and no, they have not used that money to create more jobs (Trump has created far less jobs than any two Obama years) nor have they used the money to open new factories but they have bought back over $1Tn of their own stock – at record-high prices – isn't that clever?

While $1Tn may seem like a lot of money, it's "only" about 2.5% of the US Market's $40Tn market cap though it does account for more than 1/2 of all inflows into the market in 2018 so, whenever you sell a stock, there's a 50/50 chance you are selling it back to the company!

Lowering the share count by 2.5% means that the number of shares we divide earnings by next year will be lower than this year, making it much easier for companies to hit their earnings targets, so it is a good use of funds for incompetent CEOs who want to make themselves look good to shareholders who can't do math (and, thanks to the US school system, very few of them can). Unfortunately, without another massive tax cut to boost earnings, those CEOs will have to actually figure out how to make more sales or trim costs next year and, since they haven't been able to increase sales the past two years – look for a lot of Corporate cost-cutting into 2019 and that is NOT a good thing for our economy.

December is only 18 days old but, already, this is the worst-performing December in the stock market since December of 1928, when another "Chicken in every pot" Republican President was busy destroying the country. The good news is that, in the spring of 1929, Hoover announced another round of stimulus and the market jumped up 25% – right before collasping 60% that fall. Still, if we time it perfectly – we might make a bit more money on both ends, right?

My take on the market is exactly the same as it was back in August, when I said:

As you can see from the chart on the right (click for bigger view), people have been saying this rally is going to end since it started – and that was about 10 years ago at this point! I'm included in those people as, on several occasions, including this year – I have wanted to cash out and, in fact, I did cash out my kids' college accounts into the Summer (still in cash) and our Hedge Fund is mainly in cash as well as we wait for the market correction (and buying opportunity) that never seems to come.

We got a little into studying the value of the S&P 500 and I said that our old "Must Hold" level of 2,200 on the S&P (/ES) was likely too low for a bottom as long as the tax cuts were in place and it was more likely the 10% line at 2,420 would hold and that's where we wanted to move our CASH!!! back off the sidelines. While we haven't exactly sat on our hands for the last 4 months, we certainly havn't gotten too excited about the minor dips along the way but, FINALLY, we are getting close to 2,420 on the S&P, which lines up (on our Big Chart) with the 10% lines at Dow 23,100, Nasdaq 5,940, NYSE 14,080 and Russell 1,584.

Unfortunately, the Russell (1,400) and the NYSE (11,500) are both miles below their 10% lines, which does not bode well for the other indexes if those two fail to hold these major support lines. If not, it's still the Nasdaq that has the farthest to fall, still at 6,540 – it's 10% over it's 10% line, which is why the Nasdaq Ultra-Short (SQQQ) is still our primary hedge.

We did gamble over the weekend that there would be a bounce and we sold our long Russell Ultra-Short (TZA) calls in our Short-Term Portfolio and our Options Opportunity Portfolio but the Russell has fallen another 20 points since then (1,420) and if we're still below 1,400 today, we'll have to re-buy those long calls for a small loss but it's hard to say things are actually worse for corporate profits AFTER Trump's tax cuts – even if the economy is slowing somewhat.

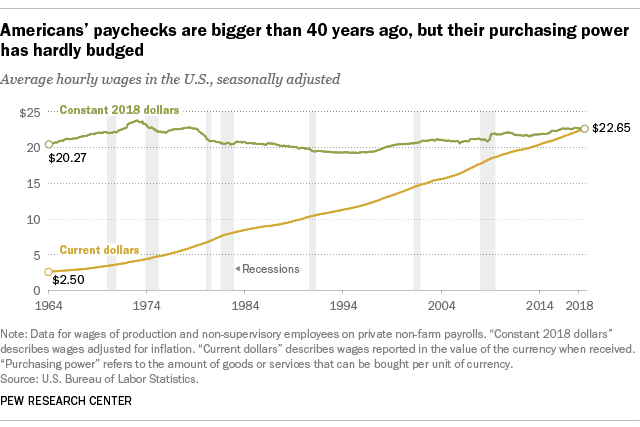

Wages are rising, slowly but surely and you may not think that's a big deal but back in 1973 I felt pretty good about making $20/week on my paper route and FINALLY, after 45 years, we are back to making $22.65 AN HOUR – that's 40 times more comic books than I could afford in 1973! While it's terrible that it's taken 45 years for wages to finally catch up to inflation – the fact is that they have and, long-term, that's still a plus for the economy – it just takes a while for it to have a real effect as people are still paying off 45 years worth of debt.

Wages are rising, slowly but surely and you may not think that's a big deal but back in 1973 I felt pretty good about making $20/week on my paper route and FINALLY, after 45 years, we are back to making $22.65 AN HOUR – that's 40 times more comic books than I could afford in 1973! While it's terrible that it's taken 45 years for wages to finally catch up to inflation – the fact is that they have and, long-term, that's still a plus for the economy – it just takes a while for it to have a real effect as people are still paying off 45 years worth of debt.

My primary motivation for my paper route in 1973 (I was 10) was to save up for a car and I had my eye on a brand new Volkswagen Beetle for $2,000 so I would have to work 100 weeks to get it. A person earning $22.65 and hour makes $900 a week so 100 weeks for them is $90,600 – certainly they can afford a Beetle with that money (though they probably don't live with Mom and Dad, like I did) so things are, finally, getting a bit better for the working American and, hopefully, things don't completely collapse from here but this is not like it was in 1928 or even 2008, when the earnings of energy companies were based on $140 oil that was killing the rest of us and the housing and banking sectors were flying higher on what was, essentially, a huge Ponzi scheme that fell apart and THAT is what wrecked the economy.

These earnings aren't fake, they are artificially inflated due to an unrealistically low tax base that can't be sustatined by a solvent nation and THAT is a problem we will certainly have to deal with but I do stand by my August analysis of the S&P and I don't see any reason we should go much lower than we are now. Hopefully we will form a bottom here and hopefully I will be able to re-deploy my kids' college funds – there certainly are a lot of bargains to be had.