Happy Holidays and Merry Christmas to All!

A Few Charts and a Few More Thoughts

Courtesy of Michael Batnick

“Every past decline looks like an opportunity, every future decline looks like a risk.” – Morgan Housel

Another day where the feeling of risk overwhelms the prospects of opportunity.

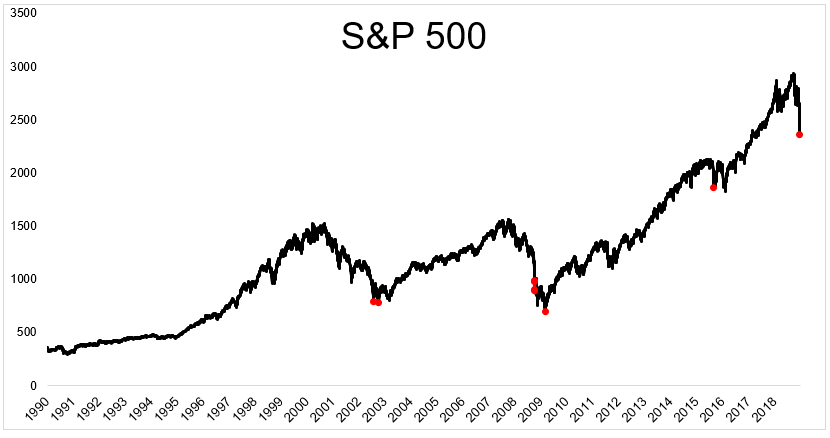

The chart below shows all the times that the S&P 500 declined by at least 1% over 4 consecutive sessions. This has occurred at bottoms (2002, 2009, 2015), and in October 2008, which was…definitely not the bottom. Whether or not we’re near one remains to be seen, but one thing we can all agree on is that this is not the type of behavior that we see in bull markets.

Stocks didn’t just decline by 1% for 4 straight sessions, they fell by 1.5% each day, which has only happened twice since WWII (October 1987, July 2002).

3 out of the 4 major U.S. stock indexes have now closed in a bear market. The 20% distinction might be meaningless to most readers, but for the average investor it can be quite meaningful, because the newspapers and television will be sure to remind them again, and again, and again, and again.

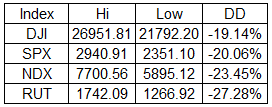

The current market environment feels particularly bad because the selling just won’t let up. Do we blame the algorithms? It’s hard to declare that the market is moving any quicker today than it has in the past, at least looking at the charts below.

With that said, this decline is in fact happening at a rather rapid, but not unprecedented pace. The Dow went into a bear market in 1987 in just 38 days. In 1990, the Dow fell 20% in 61 days. Today, the Dow is 19.14% off its highs in 56 sessions, so it is one more bad day away from joining this short list.

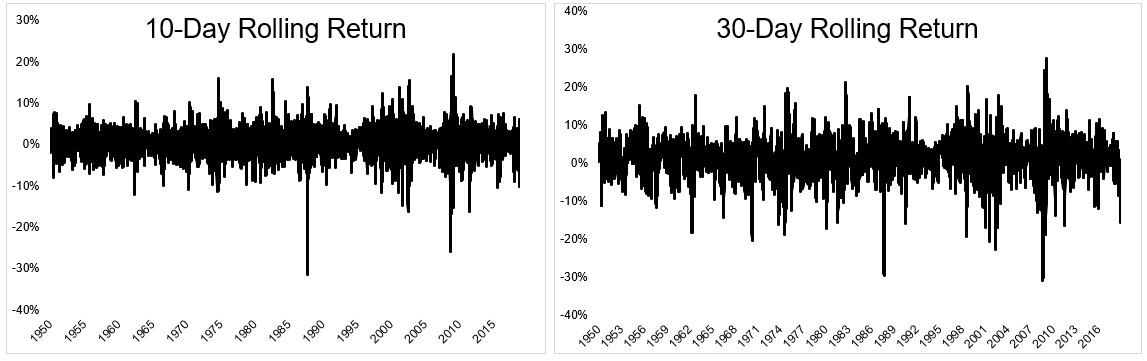

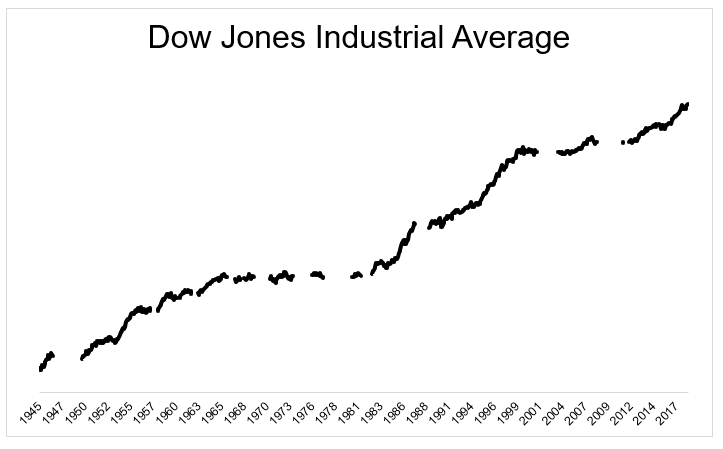

So is the bull market over? Impossible to say. The chart below shows the previous three secular bull markets (Dow, price return, start/end dates subjective). Each one had hiccups and 20% declines along the way.

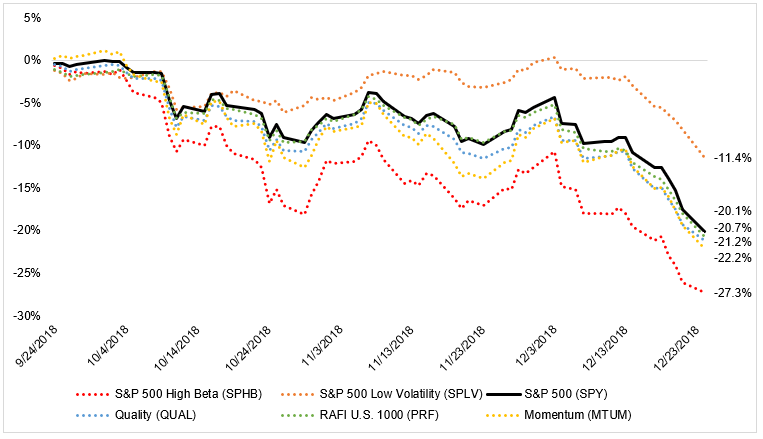

Switching gears for a second. Nothing wrong with any of the products in the chart below, but just a reminder that this is smart beta, not magic beta.

Back to what matters. For those who have little interest in timing the market and have chosen to sit through the pain, I would like to end this with this chart.

I do believe that the current decline will be nothing more than white space in the future.

*****

Previously…

A Few Charts and a Few Thoughts

Courtesy of Michael Batnick

The NASDAQ 100 just had its worst week since 2008. Every stock in the index finished in the red. Twenty-one fell at least 10%.

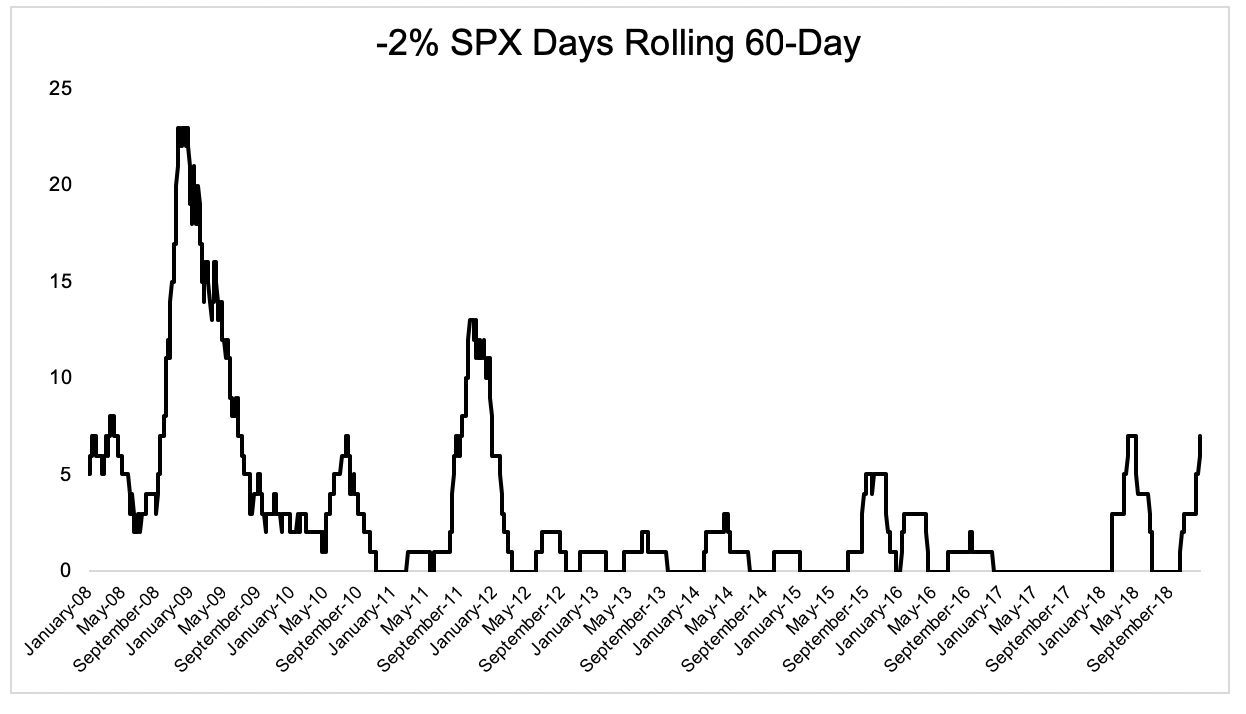

There wasn’t a single -2% day in the S&P 500 from October 2016 through January 2018. There have been 7 over the last 60 sessions.

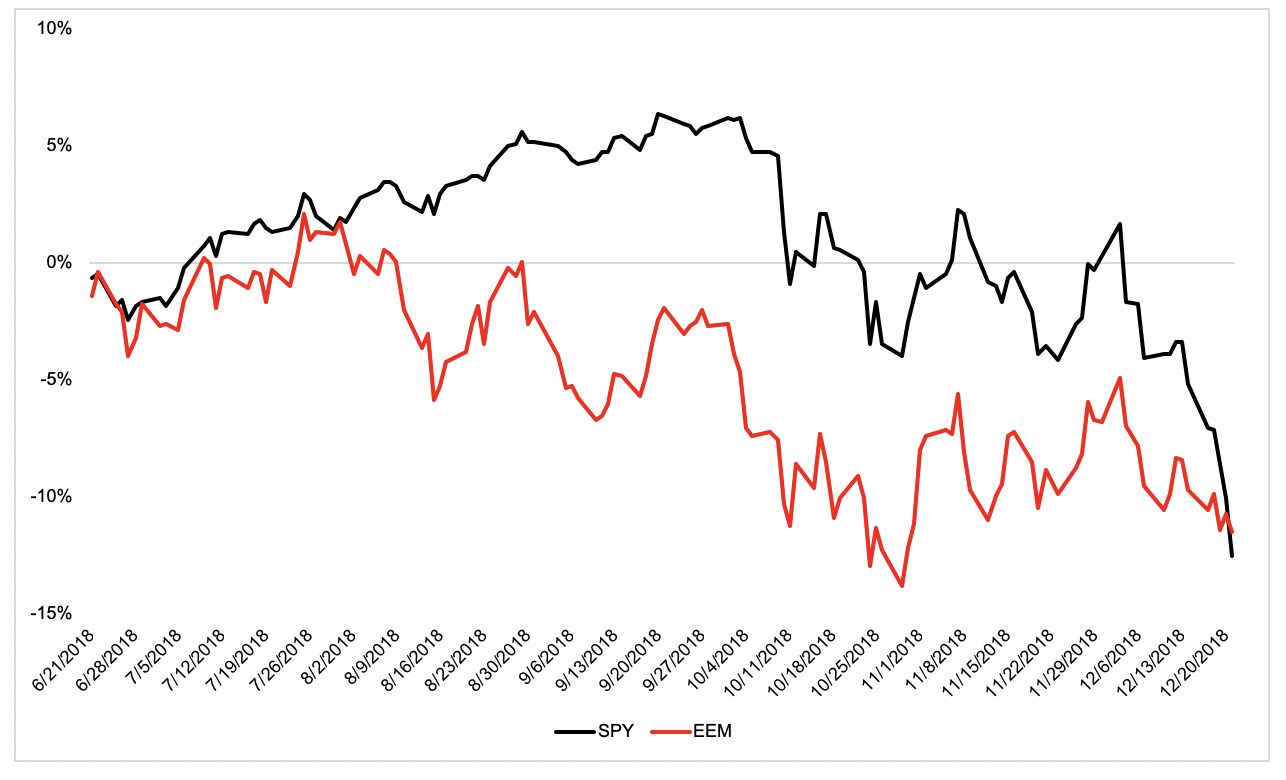

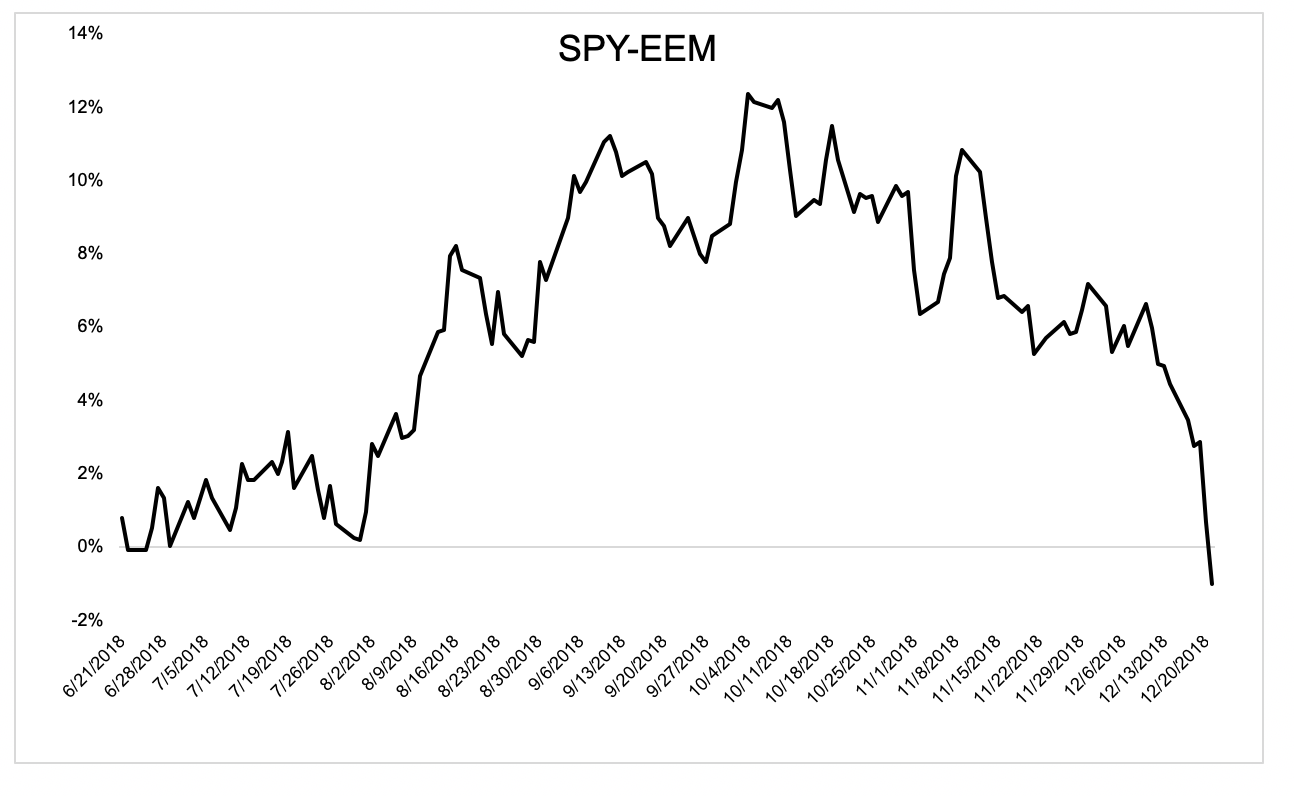

Something interesting has been going on the past six months that a lot of investors aren’t aware of. The U.S. had been far outpacing the rest of the world, particularly emerging market stocks. But recently, that’s begun to change.

This chart shows the difference in performance over the last six months, the black line minus the red. This was one heck of a relative round trip.

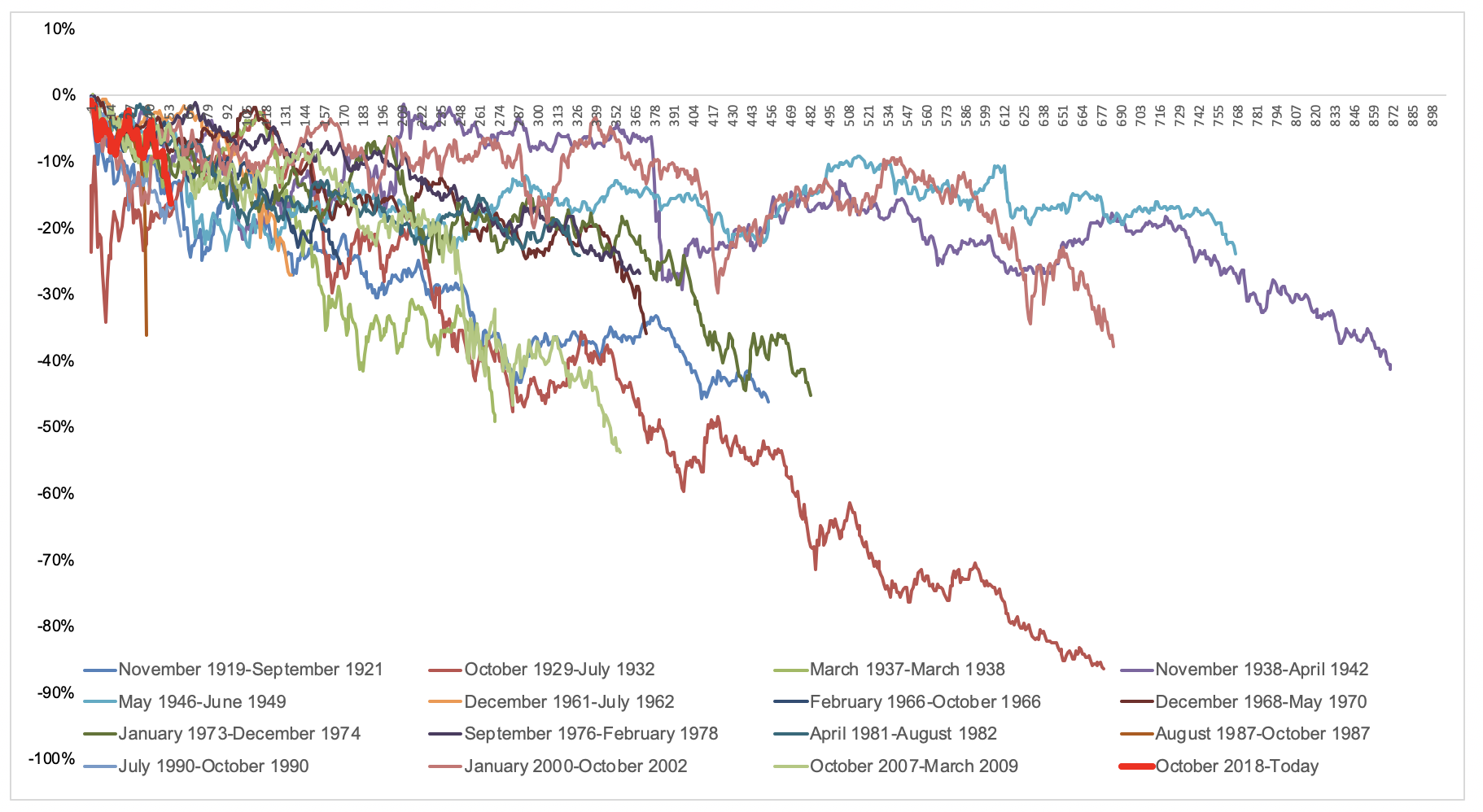

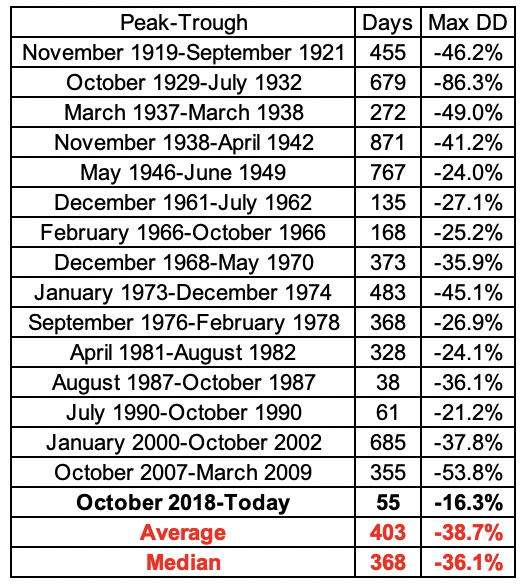

If U.S. stocks are entering a bear market, they likely have a ways to go before they reach a bottom. You can see where we currently are (red) versus the 15 bear markets we’ve had over the last century (DJIA). The selling might be jarring because the speed at which it’s happened, and the absence of any short-term relief, but this chart should put today’s declines in perspective. I’m not saying this doesn’t hurt, but there’s a big difference between pain and trauma. We ain’t seen nothing yet.

The table below shows the numbers from the chart above. The average bear market has lasted just over 400 days and saw a 38% decline. Some were shorter and shallower, others were longer and deeper, but I actually think this is a rare case where the average provides decent context for the pain a bear market entails.

There are things that matter over the long-term that are completely meaningless in the short-term. Valuations are a good example. Buyers didn’t care on the way up and sellers won’t care on the way down. It’s easy to get caught up in narratives and stories but nobody knows why stocks are going down and nobody knows when this is going to turn around.

Nobody said investing was easy. Drawdowns are the cost of future gains, and every successful investor has their fair share of receipts.