Here we go again.

Here we go again.

It's day 2 of 90-day trade negotiations but that doesn't stop the market from ignoring TERRIBLE Industrial Production numbers out of Germany which paints a very ugly picture for the Euro Zone and Samsung just beat Apple by a mile, saying their Q4 operating profits will decline 29% but those look great compared to LG, who are warning their profits can slip 80% for the quarter. Q4 is, by the way, the biggest quarter of the year for these companies.

Of course, these are not American companies and American traders are famous for their "not in my backyard" attitude about profit warnings (or human rights violations or disease or poverty or starvation…) so the Dow (/YM) Futures are up 200 points, regardless, and then we'll all be "shocked and surprised" when a US tech company warns that things are slowing. At least the good news for Apple (AAPL) is that they aren't losing any market share – it's just a crap market at the moment!

Trump has a TV event scheduled for 9pm this evening about "Border Security" and then Thursday he will also spreak live from the border and it's widely expected that he will bend (or break) the Constitution and declare a National Emergency in order to move funds and resources to build his wall, over the objections of Republican and Democratic Congresspeople. Invoking "National Security" measures is what all dictators do when they wish to consolidate their power. Before Hitler was Chancellor in 1933, Article 48 of the Weimar Constitution was invoked more than 100 times and when the Generals seized power in Argentina in 1976, they invoked Article 23 of Argentina's Constitution and then used it like a club whenever they needed to trample some human rights.

After a coup in 1973, the new Government in Chile declared a State of Emergency that lasted for 15 years and Myanmar declared one as recently as 2012, imposing emergency powers to segregate the Muslims leading to many "disappearances". Make no mistake, there is no "National Emergency" here, Trump is declaring an emergency to punish another branch of the Government for constitutionally exercising its authority. As noted by the Washington Post:

After a coup in 1973, the new Government in Chile declared a State of Emergency that lasted for 15 years and Myanmar declared one as recently as 2012, imposing emergency powers to segregate the Muslims leading to many "disappearances". Make no mistake, there is no "National Emergency" here, Trump is declaring an emergency to punish another branch of the Government for constitutionally exercising its authority. As noted by the Washington Post:

Totalitarianism rises out of a process, not a single event. Declaring a state of exception in response to a political impasse would be a big step toward degrading an already vulnerable system. A fake emergency could trigger a real catastrophe — one that a split Congress would be unlikely to resolve and that a Supreme Court sympathetic to an imperial presidency might even worsen. We have more than a century of precedents at home and abroad to demonstrate all the ways things could go wrong.

I know people don't like is when I compare Trump to vile dictators but there aren't ANY examples of nice Governments using Emergency Powers – other than clear natural disasters and, even then, they almost never use them because they are far too extreme for rational people and far too dangerous because – once you put them in place – they can be badly abused. Of course, badly abusing emergency powes is Trump's GOAL – not an unfortunate side effect…

The President has already taken one extreme step, forcing some 830,000 federal workers to work without pay or be furloughed because Congress wouldn’t accede to his petulant demand to spend billions of dollars on a bigger, longer wall along the border. In effect, Trump has taken nine federal departments and dozens of federal agencies hostage until he can force his will on the branch of government that, under the Constitution, holds the federal purse strings.

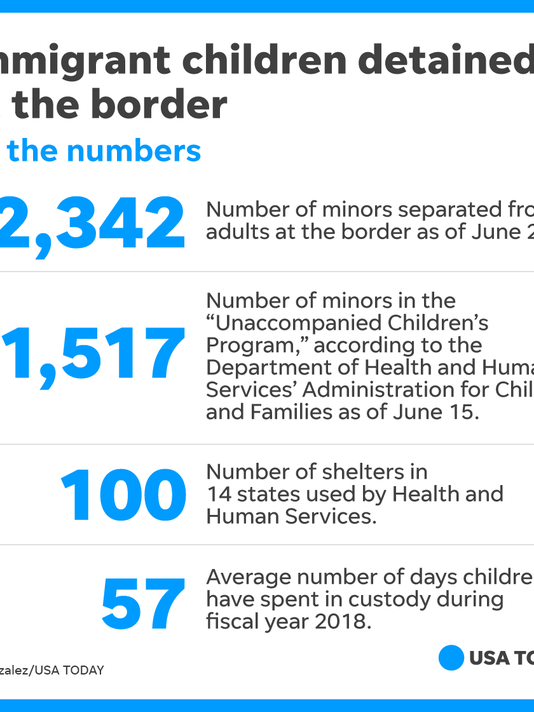

The President laid out a false premise Monday when he tweeted his plan to address the nation about “the Humanitarian and National Security crisis on our Southern Border.” There is no national security crisis — thousands of would-be immigrants seeking asylum do not constitute an invading army, and Trump has never backed up his assertions that the group is rife with terrorists. And while there is a humanitarian crisis, it’s one Trump could solve himself by expanding the nation’s capacity to handle asylum requests, rather than forcing migrants to spend weeks in squalid camps near ports of entry. It’s not as if the border is being overrun — detentions last year were roughly 75% lower than they were in 2000, though the number of children detained is up 11,000%.

The President laid out a false premise Monday when he tweeted his plan to address the nation about “the Humanitarian and National Security crisis on our Southern Border.” There is no national security crisis — thousands of would-be immigrants seeking asylum do not constitute an invading army, and Trump has never backed up his assertions that the group is rife with terrorists. And while there is a humanitarian crisis, it’s one Trump could solve himself by expanding the nation’s capacity to handle asylum requests, rather than forcing migrants to spend weeks in squalid camps near ports of entry. It’s not as if the border is being overrun — detentions last year were roughly 75% lower than they were in 2000, though the number of children detained is up 11,000%.

Notice that this "State of Emergency" is distracting the public from the Government Shutdown, which continues on Day 18 as well as the ramping up of the Mueller Investigation, which was just granted a 6-month extension of the Grand Jury – because there are that many more indictments to go through! It's also distracting us from the China Trade Negotiations, which the entire Global Economy hinges on – but let's worry about a wall between US and Mexico instead…

As I noted yesterday, there's not much economic news due to the Government shut-down so who knows how our economy is actually doing – perhaps that's another reason Trump doesn't want the Government open – now he can make things up and there's no facts to check him against – BRILLIANT!

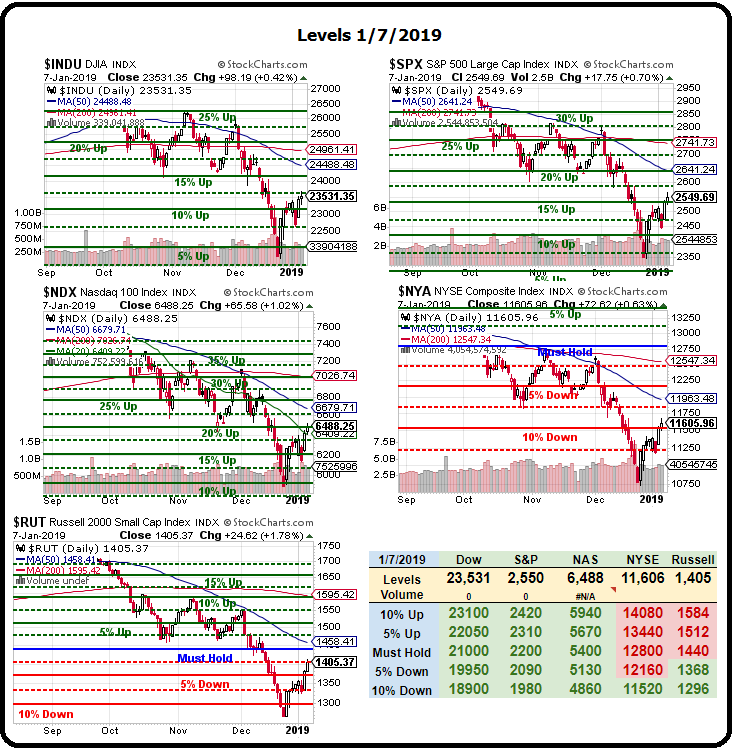

We are still moving along inside our bounce ranges but making good progress and we do intend to test our Strong Bounce Lines and we gave you the Futures longs last week, which are still in play, of course. The Nasdaq has taken back it's 50-day moving average at 6,488 and is well over that this morning (6,460 was the weak bounce line) so now we'll look for the russell to confirm with a move to it's weak bounce line at 1,470, which would be $2,500 per contract up from here (1,418), so still fun to play but be careful as a breakdown in the China Trade Talks can have us back to our lows in a flash-crash.

Fortunately we have a master-negotiator as President!