Now Show Japan

Courtesy of Michael Batnick

I did a post a couple of weeks ago about the potential benefits of dollar cost averaging.

To recap:

- It’s automated

- It’s a great way to force you to save money

- It gives you the ability to systematically buy low, with the cherry being that you’re buying more the lower stocks go.

I explained that it was no panacea and that the only reason why this had higher returns than the market over this period was because of sequence of returns, which cuts both ways.

But this disclaimer wasn’t good enough, because every time you write about the benefits of long-term investing, specifically of the buy and hold variety, you have people who say “now show Japan.”

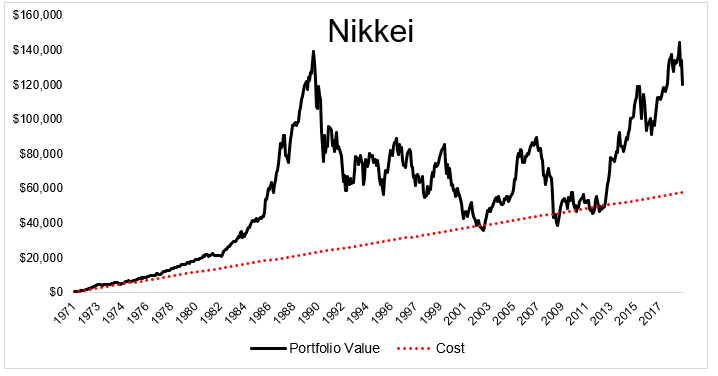

It’s true that the efficacy of buy and hold investing is challenged through the lens of a Japanese investor. As the chart below shows, you could have made regular contributions from 1971 through 2012 and still have not made any returns on your investment.

Had 100 Yen been invested every month into the Nikkei from 1971 through October 2012, after contributing 50,000 Yen, the account would be worth just 49,568 Yen. Saving 50,000 Yen is better than spending it, but you took a lot of risk and were provided with zero reward.

So, is Japan proof of the fact that buy and hold is for the birds? I don’t believe that. I wrote a post a few months ago about how people who say this might have learned the wrong lessons from the epic Japanese stock market bubble.

Josh and I speak about this in the video below.