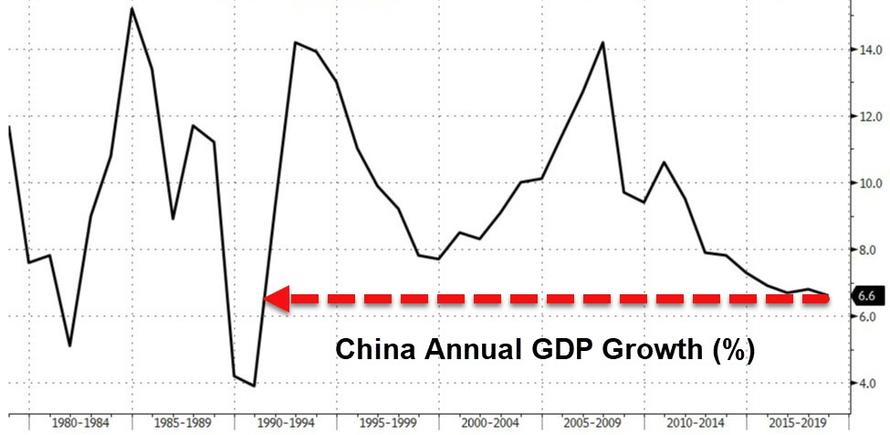

So the World leaders (the ones that matter) are gathered at Davos this week and, so far, they are not too optimisitc about the economy with China's economy posting the weakest growth in 28 years and the IMF taking the entire Global Growth forecast down to 3.5%, from 3.7% last quarter, knocking 0.3% off Europe and 0.6% off Germany in particular – all the way down to 1.3% for Europe's largest economy.

According to Price-Waterhouse, the number of US CEOs feeling optimistic about the economy also fell off a cliff – from 63% last year to a current 37%, barely over 1/3. “It is important to take stock of the many rising risks,” said Gita Gopinath, the IMF's new chief economist. “Given this backdrop, policymakers need to act now to reverse headwinds to growth and prepare for the next downturn.” The IMF also warned the US GDP will fall to 1.8% in 2020 as stimulus from the tax cuts fades and the economy begins to feel the pressure of higher rates – so we have that to look forward to.

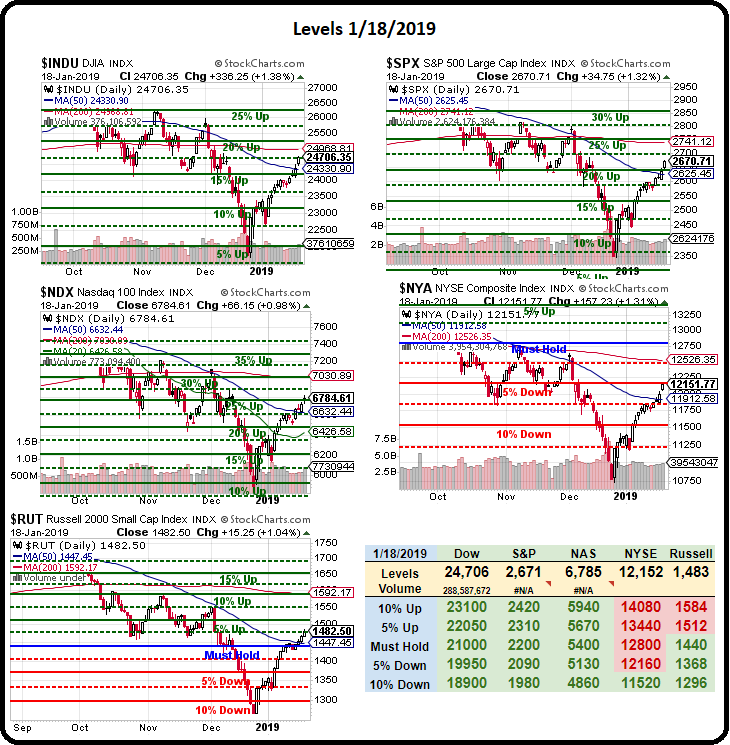

Unsurprisingly, the Futures are down a bit this morning but only half a percent and that's nothing after the recent rallies. What matters this week is whether or not we hold those 50-day moving averages as well as the Must Hold line on the Russell on our Big Chart – which really MUST hold if we are to truly reverse our market downturn. These are just the strong bounces we expected so far – at this point, we're really not expecting much more lift from the markets without re-opening the US Government and establishing a workable trade arrangement with China which, according to recent reports – is at an impasse over Intellectual Property Issues.

Meanwhile, Brexit continues to drag on with Theresa May barely surviving a vote of confidence and now Parliament is asking the EU to extend the March 29th deadline while they negotiate for changes in Irish border rules, which seem to be the main blockage at the moment. Italy's economic growth forecast has been cut to just 0.6% from an October estimate of 1% and likely down to 0.9% in 2020 BUT – at least it's not a recession. The Italian Economy is the worst in Europe, with a 130% Debt to GDP Ratio but let's all keep in mind that that's about HALF of Japan's now 270% (this chart is old) – and we aren't even worried about them – yet…

China also has MASSIVE debts but, unlike the rest of the World, it's not Government Debt but Private Debt that is greater than their GDP and of course that is not sustainable and of course it's all going to collapse one day and take the World Economy with it but not today. Maybe tomorrow though as exports from South Korea, often considered a leading indicator for all of Asia, fell off a cliff in the fist 3 weeks of 2019, down 14.6% from last year. Petroleum exports fell on weaker prices but Semiconductor exports also tanked.

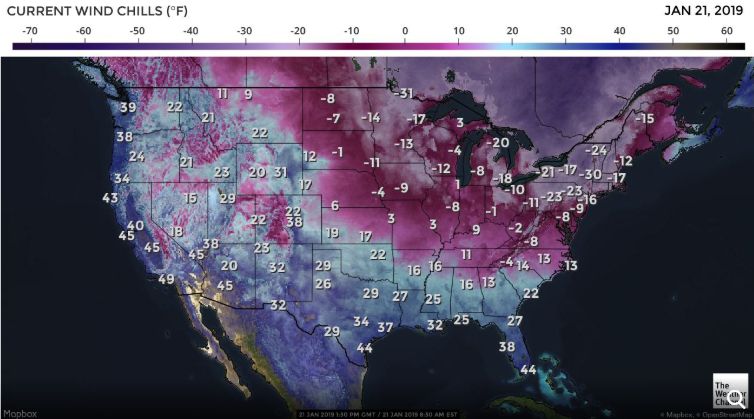

It's not just the economy that's cooling as we had an Arctic Blast this weekend that was so cold that some ski resorts had to close down due to dangerous conditions. New York City advised residents to stay indoors as the danger of frostbite was "extreme" – even with only limited exposure as wind-chills fell into the negative teens in Manhattan and as low as -30 in Albany (and my daughter's school in Amhers, MA!).

It's not just the economy that's cooling as we had an Arctic Blast this weekend that was so cold that some ski resorts had to close down due to dangerous conditions. New York City advised residents to stay indoors as the danger of frostbite was "extreme" – even with only limited exposure as wind-chills fell into the negative teens in Manhattan and as low as -30 in Albany (and my daughter's school in Amhers, MA!).

You would think that would be bullish for Natural Gas prices (/NG) but they are down 9% this morning at $3.17 on the expiring /NGG19 (February) contracts that finish next Monday while our /NGN19 contracts stopped out as they retraced from a very nice $2.95 (we went long at $2.89) and now we'll be very interested in picking up the March contracts (/NGH19) as we test the $3 line – with tight stops below but down from $3.40 last Wednesday is a good enough correction for us and we'll look for at least a weak bounce back to $3.08 which, at $100 per penny, per contract, would be good for $800 per contract gains.

So the risk is stopping out a $2.995 with a $50 loss vs. the good likelihood of a $400-$800 gain – those are the kind of trades we like to get into! Notice on the chart that the next proper support below $3 is $2.80 and we'd LOVE to get in with some conviction down there but first we'll see what kind of bounce we get at $3 and then there are the inventory reports on Thursday, where we're very likely to see a surge in demand while a second cold blast is forecast so the conditions are ripe for a nice rally – despite this sudden flush.

So the risk is stopping out a $2.995 with a $50 loss vs. the good likelihood of a $400-$800 gain – those are the kind of trades we like to get into! Notice on the chart that the next proper support below $3 is $2.80 and we'd LOVE to get in with some conviction down there but first we'll see what kind of bounce we get at $3 and then there are the inventory reports on Thursday, where we're very likely to see a surge in demand while a second cold blast is forecast so the conditions are ripe for a nice rally – despite this sudden flush.

If you are Futures-challenged, you can look at the Natural Gas ETF (UNG) and pick up the Apri $26 calls at $2.80 this morning (assuming the dip holds) and, as /NG recovers, I'd look to sell the $30s for $2 and that would net you into the $4 spread for net 0.80 with $3.20 (400%) upside potential if UNG can get over $30 and hold it into the spring thaw.

We think the continuing export of LNG out of the country is going to keep pounding away at inventories and, by spring, we will be significantly lower than the 5-year average and the drawdown cycle tends to peak out in mid-March, so it's a good time-frame to test our theory as export capacity is scheduled to double, to 8Bcf/day during 2019 and, when you consider that total storage is about 3,000Bcf, you can imagine that exporting an additional 1.46Bcf (divided by 2 due to the ramp-up average) will have a substantial impact at some point, right?

That's a pretty simple investing premise – if we're going to export +4Bcf/day out by the end of the year then we will begin to draw down our inventories unless production capacity increases significantly to keep up and production is very unlikely to keep pace with such a significant increase in exports as it's also constrained by infrastructure (pipelines, roads, rails) that is needed to move the gas to the ports and these LNG projects are VERY expensive ($10-20Bn per terminal complex) so they WILL be exporting /NG as soon as they are ready – no matter what it costs them to buy it on the open market (because the global market is much more expensive than the US, which is the whole point).

So, we can expect /NG to rise into 2020 but, at some point, there will be terrible blowback as we're not the only country building LNG termials so, down the road, everyone will be trying to sell LNG to everyone else and prices will collapse – kind of like oil – so we have that to look forward to – but not until at least 2020.

With the Government shut down, we're getting very few data reports this week and NO Fed speak is scheduled so we're really on our own for the week and that means the spotlight will be on earnings and we hear from our 2019 Stock of the Year (IBM) this evening along with fellow Dow component Johnson and Johnson (JNJ) but it's still early innings in the earnings cycle so far. IBM is right back to the $120 line, not far from where we made our pick on October 30th ($115), so still time to get into the trade from here.

Today is going to be rough but, if we can hold the 50 dmas today, we're set up for a better move tomorrow.