I Guess I’m Bearish Now

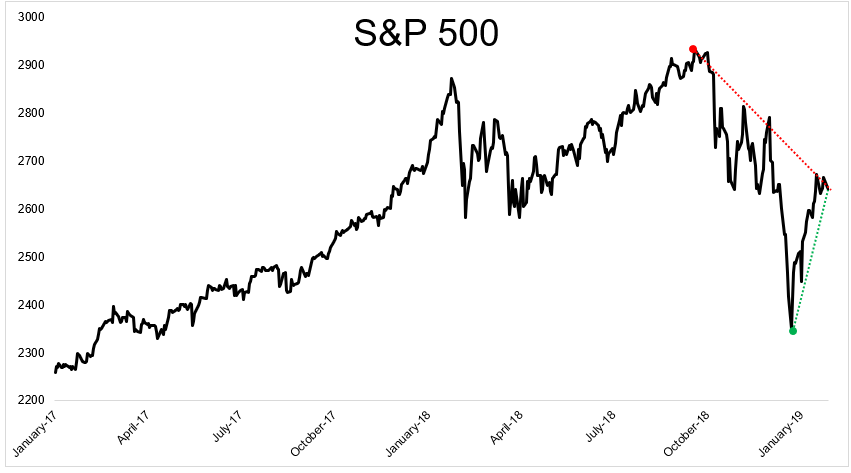

Courtesy of Michael Batnick

One of the simplest ways to explain how a market functions is that rising prices attract buyers and falling prices attract sellers. Theory doesn’t always cooperate with reality, however, because prices don’t always fall neatly into one of these two columns.

Often times prices are rising and falling and falling and rising.

It’s never easy to predict the future, but it’s even harder when stocks are middling, which is where we are today.

The S&P 500 is 10.2% below its all-time high, but 12.5% above it’s recent lows.

When stocks are equidistant between their highs and lows, it stands to reason that neither the bulls nor the bears have the upper hand. So how do we view the middle markets?

In a perfect world, we would view things objectively, paying no mind to sunk costs or previously held beliefs. But in the real world where hindsight bias attacks your senses, whether you’re bullish or bearish can sometimes be determined by what you own.

Let me share a quick story.

Years ago when I was trading, probably 2010 or 2011, I had some fun trading weekly options around earnings releases. I was gambling, which is not something I only recently came to terms with. I knew it at the time which is why I never put a lot of money at risk. During one of these wagers I meant to buy calls, but by accident I bought puts. In that moment a funny thing happened. It wouldn’t have been much trouble to unwind this trade, but instead I rationalized why puts were the right decision. “I guess I’m bearish now,” I thought. My actions influenced my mindset. I was owned by my possessions.

Take a look at your portfolio. I bet there is at least one position that you wouldn’t buy today but that you won’t sell tomorrow.

Our portfolios are not a blank slate, we build positions over time, which can influence how we feel about these positions individually and how we feel about the market as a whole.

How you view the market is not necessarily reflected in your portfolio. Perversely, what you own often determines how you feel.