Wheee, what a ride!

We came all the way back to Dow 25,000 yesterday as Apple and Boeing (BA) accounted for 2/3 of the gains on the day, both with strong earnings reports that beat expectations. Both are also major S&P components and Apple (AAPL) is over 15% of the Nasdaq's weighting as well so all the indexes flew higher but we shorted the Dow (/YM) Futures at the 25,000 line, expecting at least some pullback off the run from 24,300 on Monday.

25,000 is up 2.88% from 24,300 and the 2.5% line is 24,907.50 though really the main support line for the Dow is 24,000 (8,000, 16,000, 24,000…) so it's more like a 1,000-point rally since mid-Jan and that means we can expect to see a 200-point pullback (weak) to 23,800 and, at $5 per point per contract – that's a $1,000 per contract upside potential vs losing maybe $50 if /YM pops over 25,010 and stops you out so I certainly like the risk/reward on the play – which is how we like to play the Futures.

We are, of course, very pleased with AAPL, which I STRONGLY recommended buying back on Dec 20th in "Market Panic Gives Us An Opportunity To Load Up On Apple (AAPL)" – nothing ambiguous about that one! I followed up on Jan 11th with: "Apple (AAPL) Trade Trade Idea To Make $1,000+ In 2019." My trade idea on Dec 20th was:

We are, of course, very pleased with AAPL, which I STRONGLY recommended buying back on Dec 20th in "Market Panic Gives Us An Opportunity To Load Up On Apple (AAPL)" – nothing ambiguous about that one! I followed up on Jan 11th with: "Apple (AAPL) Trade Trade Idea To Make $1,000+ In 2019." My trade idea on Dec 20th was:

While other retailers are struggling, Apple has been setting new records year after year for retail sales with the average Apple Store generating $5,546 per square foot in revenues. Tiffany is #2 at $2,951 and they sell diamonds! Unlike diamonds, no one has been successful so far in making artificial iPhones that pass for the real thing so it's amazing to me that AAPL's stock is back at $160, $70 (30%) off it's peak.

We are long APPL in our portfolios and we just made an even more bullish call to buy back all our short calls and wait for the bounce. However, as a new play on AAPL, I like the following and we're going to add it to our Options Opportunity Portfolio:

- Sell 5 AAPL 2021 $150 puts for $19 ($9,500)

- Buy 10 AAPL 2021 $150 calls for $34.50 ($34,500)

- Sell 10 AAPL 2021 $200 calls for $15.50 ($15,500)

Although AAPL got cheaper a few weeks later and is only now back to where we jumped in, the volatility on the play has calmed down (we ended up with a more aggressive play as Apple continued to fall) and now the short 2021 $150 puts are $15 ($7,500) and the $150 ($32.50)/200 ($12) bull call spread is net $20.50 ($20,500) for a net of $13,000, so it's already up $3,500 (36%) off our $9,000 entry and right on track to the full $50,000 we expect from the spread by Jan 2021 so, even as a new trade, it still has $37,000 (284%), not bad for a trade you're very late on…

We also made a bottom call for the indexes, saying:

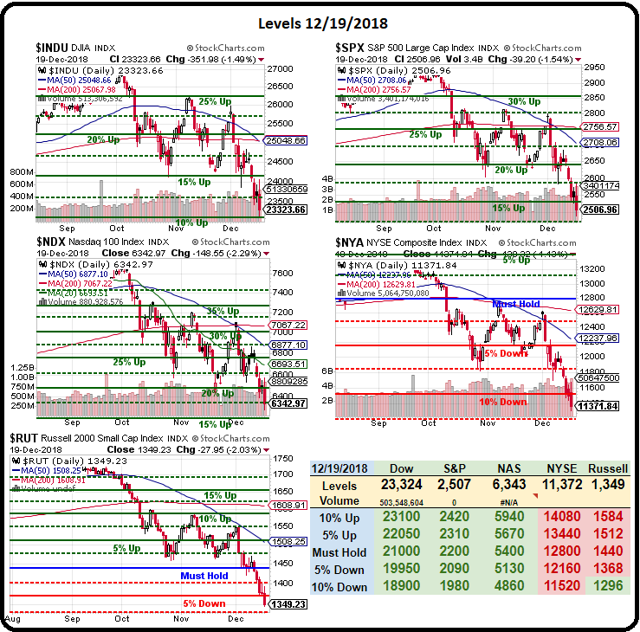

As to the indexes, we're coming into what is effectively a 2-week holiday in the U.S. with the markets officially closed next Tuesday for Christmas and the following Tuesday for New Years and Monday will be half a day but no one is actually going to work in Christmas Eve and then, between Christmas and New Years – good luck getting anyone to show up for that either! So the volume will be dead and we could drift lower but, officially, we do have new bounce lines off the lower lows so we'll be looking for:

- Dow 27,000 to 23,000 is 4,000 points so 800-point bounces to 23,800 (weak) and 24,600 (strong)

- S&P 2,950 to 2,500 is 450 points so 90-point bounces to 2,590 (weak) and 2,680 (strong)

- Nasdaq 7,700 to 6,350 is 1,350 points so 270-point bounces to 6,620 (weak) and 6,890 (strong)

- NYSE 13,200 to 11,300 is 2,100 points so 420-point bounces to 11,720 (weak) and 12,140 (strong)

- Russell 1,750 to 1,350 is 400 points so 80-point bounces to 1,430 (weak) and 1,510 (strong)

As you can see from our color-coding, we're at a very dangerous inflection point as those lows may begin to turn red and then we can begin to calculate the 20% drop lines, rather than the bounce lines, for our next set of targets. Those are Dow 21,600 (not far), S&P 2,360, Nasdaq 6,160, NYSE 10,560 and Russell 1,400 so we're already more than 20% down on the Russell and it's down 350 so a 70-point overshoot (1,330) is not a big deal but lower than that, with another index crossing below 20% – THAT would be a very negative sign!

We have, however, gotten more bullish for the moment as even a test of the 20% lines invites a 4% bounce so, when we're this close to 20% – the odds strongly favor playing for a move higher – even if we go lower first…

We did hit those 20% correction lines but, other than the Russell, we've made our strong bounce targets so now we revert back to our non-panic levels and raise our expectations slightly in the hopes of seeing a true recovery (all bounce lines green, no backsies). Yesterday's surge was almost, but not quite enough and, if that's all earnings has to give us, we'll be very nervous with our now, very bullish portfolios (we pulled our hedges at the -20% mark, anticipating this bounce.

As I said on Money Talk last night, we finally punched over our strong bounce lines due to a stunning turnaround by the Fed, who wiped out talk of 1% rate hikes for 2019 and even walked back $1Tn of balance sheet ajdustments that were anticipated. If this is all we can accomplish off that massive does of stimulus – look out below!

We also discussed the IBM (IBM) and Caterpillar (CAT) trade ideas but, more importantly, we bumped up the TZA hedge to add a bit of protection and that's something we should be doing with all of our portfolios (adding protection) so don't forget to review our recent adjustments and, as a new hedge, we should consider the Dow and the S&P because they are both $15,000 off their lows – in the Futures – and wea already shorted /YM at 25,000 but let's see if we can match that with an option spread.

As I said on TV last night, the short CAT 2021 $100 puts, even at $8 are simply free money. You are promising to buy Caterpillar for $100 and being given $8 in exchange for that promise and CAT is at $130 so 23% off just to get to $100 and you are netting in for $92, which is 29% off. But, since we want to use the $8 we collect, call it a $130 net entry.

As long as you REALLY want to own CAT at $100, then there's no harm in selling the puts. In our CAT trade yesterday, we had already sold those same puts for $12 last year but collecting $4,000 for selling $5 now is still very good. You can substitute any stock you REALLY would like to own but remember, if the market does crash, you'll need to have enough money to deal with a potential assignment – selling puts is no joke! That being said, our trade idea using the Dow 2x Ultra-Short (DXD) is:

- Sell 5 CAT 2021 $100 puts for $8 ($4,000)

- Buy 40 DXD April $30 calls for $2.00 ($8,000)

- Sell 40 DXD April $35 calls for 0.80 ($3,200)

The net cost of this spread is $800 in cash and about $5,000 in ordinary margin would be required for the short puts and the DXD spread would pay $20,000 at $35 or higher, which is only half of where we topped out in December. Ignoring the fact that the point is to protect the rest of your portfolio, if the market did tank and you ended up buying 500 shares of CAT for $100 ($50,000) plus the $800 you paid for this spread, you get back $20,000 and your net cost is $30,800 or $61.60 per share of CAT – seems pretty good to me!

AAPL is still cheap enough for us to want to sell puts and you can collect $11 for each 2021 $140 put you wish to sell for a net $129 entry. I'll bet you wish you bought AAPL for $129 on the dip we just had only it never went that low, $142 was the Jan 3rd low – it only seemed like it went lower the way people were freaking out about it!

So, I love making that put sale the basis of another hedge, and for this one we'll use the S&P 2x Ultra-Short (SDS):

- Sell 5 AAPL 2021 $140 puts for $11 ($5,500)

- Buy 50 SDS June $38 calls for $3 ($15,000)

- Sell 50 SDS June $43 calls for $1.50 ($7,500)

Here we're netting into the $25,000 spread for $2,000 so the upside protection is $23,000 and our worst case is owning 500 shares of AAPL for $140 + $4 ($2,000/500) that we paid for the spread so $144 – but that's assuming AAPL goes down and the Nasdaq stays up – so very, very unlikely! Apple is volatilie so the ordinary margin requirement on the short puts is $7,000 but they are past earnings and the volatility should ease off shortly.

We are, of course, worried about the Trade Talks with China and Factory Activity in China's PMI contracted at 49.5 (below 50 is contraction), it's weakest level in 28 years and that's now two months in a row of negative movement. If the two sides cannot reach an agreement by March 1st, Trump has said he will increase the tariff rate from 10% to 25% on Chinese goods worth an estimated $200bn and, sadly, I believe Trump WANTS to enact this tax on the American people to help fund the tax breaks he gives to his friends and family of Oligarchs.

In other news the markets should be worried about:

- Samsung earnings reveal sharp drop in profit for the end of 2018

- Hundreds More Chinese Companies Just Warned on Profits

- Cost-conscious Chinese tourists staying closer to home for Lunar New Year

- Japan Factory Output Stalling After Helping Economy Rebound

- Italy Falls Into Recession as Output Shrinks

- MarketPulse Europe: Weak Data Take Gloss off Post-Fed Rally

- Import Quotas On Steel Would Reverse America’s Energy Dominance

- Microsoft Shares Slip Despite Q2 Earnings Beat as Azure Growth Rate Stalls

- The Forces That Could Plunge Venezuela Into Chaos

- Giant cavity found eating away at Antarctic glacier from underneath

- Thai Officials Close Schools As Toxic Air Pollution Chokes Bangkok

- Aruba Tourists Hit With A New Sin Tax Of Up To 333%. Will Other Countries Follow?

- Jobless claims hit 16-month high on government shutdown

I have said before, these are not the kind of headlines we should be seeing if the markets are heading back to all-time highs. These are the headlines of a 20% correction that isn't going away, even with the most recent round of Fed stimulus so we'll take our hedges – and it looks like our /YM shorts should hit our primary target this morning (+$1,000/contract) and then we'll look 200 points lower for the next leg of the retracement if 24,800 fails to hold.

See – we have fun no matter what!