This is sad:

We've been going nowhere for a month and there's nothing wrong with healthy consolidation but, if you listen to the Financial Media, you would think you are missing out on some huge rally. FOMO, or "Fear of Missing Out" is the new driver for market behavior though I can't imagine what it is people fear, when you consider the S&P 500 is up 1,000 points 55% in the last 3 years though we're actually lower now than we were a year ago.

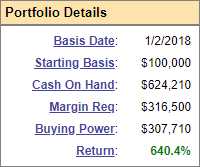

That's why we've been "Cashy and Cautious" since we cashed our our 5 Member Portfolios in December of 2017, when I decided the risk of holding through the holidays wasn't worth it after a year of such spectacular gains. I was a little early with that call but we got a great sell-off last January and we jumped in with our new Virtual Portfolios and now they have made ridiculous gains – especially our skeptical Short-Term Portfolio, which we use to hedge our Long-Term Portfolio.

That's why we've been "Cashy and Cautious" since we cashed our our 5 Member Portfolios in December of 2017, when I decided the risk of holding through the holidays wasn't worth it after a year of such spectacular gains. I was a little early with that call but we got a great sell-off last January and we jumped in with our new Virtual Portfolios and now they have made ridiculous gains – especially our skeptical Short-Term Portfolio, which we use to hedge our Long-Term Portfolio.

I went over the STP and gave my thoughts on it in yesterday's Live Trading Webinar (replay available here) and we feel our current hedges adequately protect us from what we think will be a minor (2.5-5%) correction that shouldn't take us lower than 2,640 on the S&P (/ES), which is the 20% line on our Big Chart, which is still using the 5% Rule™ calculations we applied way back in 2015 so we're right on track but we also need to adjust those brackets 10% higher (Dow, Nas and S&P only) to account for the new, lower, Corporate Taxes and their effect on large-cap earnings.

Despite expecting a sell-off, we're still very bullish in our Long-Term Portfolio as well as our other Member Portfolios. Our public portfolio, the Money Talk Portfolio, which we only trade live on that BNN Show once per quarter, is self-contained, unlike our paired STP/LTP combination, so the hedges are baked in. Our last adjustment came on Jan 30th and we added an IBM trade that's already up $1,185 (182%) against our $650 cash outlay and the whole portfolio, at the time, was up 111.7% at $105,845 (we started with $50,000 on 9/6/17) and now, less than two months later, it's at $125,790, which is now up 151.6%.

Every single trade we add, subtract or change is done on the show and published on our site in public and the portfolio hasn't changed much since October, frankly, though we did send out a special alert and tweet to dump GE on Feb 25th (if you follow us on Twitter, you'll catch all these trades) – as we didn't like the spin-off they were doing. Other than that, all you had to do was leave this portfolio alone since Jan 30th for a $19,945 gain (18.8%), just a bit less than our actively-managed Hedge Fund.

Every single trade we add, subtract or change is done on the show and published on our site in public and the portfolio hasn't changed much since October, frankly, though we did send out a special alert and tweet to dump GE on Feb 25th (if you follow us on Twitter, you'll catch all these trades) – as we didn't like the spin-off they were doing. Other than that, all you had to do was leave this portfolio alone since Jan 30th for a $19,945 gain (18.8%), just a bit less than our actively-managed Hedge Fund.

And that's the point of Philstockworld – we teach ordinary investors how to trade like Hedge Fund Managers and we teach Hedge Fund Managers how to do their jobs properly! To me, Hedge Funds are for busy people who are out making money (or having fun) and don't want to sit around worrying about the stock market. That's something that's worth paying someone else to do and we're happy to do that if people want us to. BUT, for people who don't qualify for a Hedge Fund or simply like trading (I do!), then the key is to learn to treat trading more like a profession and less like gambling – which is where our famous "Be the House – NOT the Gambler" tag-line comes from.

That's what I like about the Money Talk Portfolio – it emphasizes our dual strategies of Balance as well as learning to LEAVE YOUR POSITIONS ALONE! Over-trading is a huge problem and too many people feel the need to constantly adjust and change things but we recognize that markets go up and down and a well-hedged portfolio has little to fear from normal market gyrations – it's the Fundamentals we keep our eye on – and that's why GE got the axe when they spun off one division too many for our liking.

Here is the MTP as it currently stands – last time we calculated that, if all went to plan, the positions we had would make $152,476 (150%) less a $13,760 loss on our hedges over the next two years so gaining $20,000 in two months is really just "on track" for our plan:

- ALK – Often, when we want to buy a stock, we first sell a put in order to be able to buy the stock for a net discount. The guy we sell the put to owns ALK and pays us $8.20 in exchange for our promise to buy the stock from him any time he wants, between now and Jan 17th, 2020, for $60 (the put strike). This would net us into the stock for $60-8.20 = $51.80 so we either get the stock for a nice discount or the stock goes higher and the contract expires without being used. Either way, we keep the $8.20 and, since we promised to buy 500 shares, that's $4,100! Despite ALK's recent sell-off, we expect it will go back up so we expect to collect the full $4,125 that is currently a debit ($25 loss) on the account. Not only is this good for a new trade but, if ALK is still low in April (our next show), I will add to it!

- SQQQ – This is a hedge that protects us against a market downturn. The net is currently $2,550 and it pays $10,000 if SQQQ goes up $3.60 (31.5%) and, since SQQQ is a 3x Ultra-Short on the Nasdaq, that means about a 10% drop on the Nasdaq will lead to a $7,450 (292%) gain on the spread. Overall though, we HOPE to lose the $2,550 as the market goes higher.

- TZA – Another hedge and this one is net $6,580 on a $28,000 spread so the upside at $15 is $21,420 (325%) but TZA has to gain 50% to hit $15 so about a 17% drop in the Russell to make all that. On the whole, we hope to lose the $6,580 as it's just insurance to protect our long gains.

Keep in mind that, in our last review, we expected to lose $13,760 on our hedges and now they are down to $9,130 – also right on track as they lose value while our longs move up – all accounted for in our net $19,945 gain. And, by the way, if you don't know EXACTLY how much money you plan to lose or make on EVERY single one of your positions – YOU ARE DOING IT WRONG!!!

By KNOWING, for a FACT, how much money a position should be making and when, we are easily able to tell if our positions are on track and, if we know whether or not our positions are on track – we can easily identify and fix problems and then it's very simple to keep our entire portfolio on track and – TA DA! – MAKE MONEY CONSISTENTLY!

- CAT – We have a very conservative spread that is, at the moment, in the money but we have 2 years to go. So far, the net of the spread is $6,299 and it's a $15,000 spread, so we have $8,701 left to gain and that's still another 138% from where we are now so no reason to take the money so early and, besides, we began with just net $800 in cash deployed so we're already up 687%! CAT is a notoriously rough ride but I'm confident we'll get there.

- GIS – Almost at our goal already. The net of this spread is $4,403 and it's a $11,250 spread so $6,847 (155%) left to gain and I'm very confident in this one as well.

- GOLD – Was ABX, who bought GOLD and kept their symbol. Now they want to buy NEM, which is kind of scary as they might over-leverage but the management thinks it's a good time to buy up the competition. We have a net loss so far on this one at net $912 nd the upside potential is $12,500 but I'm not confident enough, at the moment, to log that as an expected win so we'll see how they look in April and maybe we'll adjust or maybe we'll get out – depends on the NEM deal details.

- IBM – Our 2019 Trade of the Year and we haven't missed one yet! We're already at net $1,360 off a net $175 entry so up $1,185 (677%) on cash since 2/1 is pretty good for the first month. The potential at $135 is $7,500 so another $6,140 (451%) still to gain off our now $1,360 is not just a keeper – but still good enough to be our Trade of the Year – even if you did miss our original entry!

- LB – This was the runner-up for last year's Trade of the Year only due to timing. We already cashed in our first set and this is round 2 with LB and now we're at net $7,900 on the $40,000 spread that's $8,000 in the money but I have a lot of confidence that they will pull off their turnaround and $32.50 is a modest target so let's say we do expect to gain another $32,100 (406%) from here, which makes it still good for a new trade.

- MJ – The Marijuana Biz is very hot right now and this is the ETF that's buying them. My logic on them is that if any two their 10 biggest holdings become 10-baggers, then the whole ETF doubles – even if the rest go to zero and, since we also invest in MJ companies through PSW Investments – we know first-hand what a gold-mine this industry is. Net $12,050 is already up $10,800 (864%) from our $1,250 initial cash outlay but it's a far cry from the $40,000 potential that I feel strongly is going to give us another $29,200 (270%) in gains.

- MU – They were doing great but the global slowdown is spooking the chip sector. Still the Internet of Things (IoT) is coming and our two-year time-frame and modest target ($50) make me think we can still expect to make the full $15,000 on this trade and currently we're at net $2,125 so another $12,875 (605%) of uspide potential makes this great for a new trade – even if you missed our original net $550 cash entry.

- WPM – Our 2017 Stock of the Year and we are now in this one for the 3rd time and, once again, LOVING IT! We had a very conservative line and I think it will head up to the $30s but that's fine with us as our spread has $18,750 pay-off potential and is currently at net $9,600 so still another $9,150 (95.3%) left to gain, which is great – though it may not seem that way compared to our other trades.

So that's $109,138 of expected gains on our 9 long positions and we expect to lose $9,130 on our hedges if all goes well. Taking GOLD off our expected profit list cost us $11,588 compared to last time so, as I noted above, we can quickly zero in on the problem and we will either adjust or kill GOLD to get it back on track and we will look for a resource play to replace it (keeping diversified and balanced is the key to success).

We won't be making adjustments this month but next month I should be scheduled for the show and then we'll see how things look for Q2. Don't forget, we're expecting more of a pullback than this between now and then!