Good news everyone!

Good news everyone!

China's Manufacturing PMI rose from 49.2 in February to 50.05 in March, which is back to expansion and that's boosted Asian markets which in turn boosted the EU open which is now boosting the US Futures, so it looks like we're going to have a good open. Of course, Chinese PMI always rises in March as Feb is their Lunar New Year, when things are closed for a week but, shhhhhhhh… let people celebrate if they want to….

Even if we pretend to trust Chinese data, if their economy is rebounding while under Trump's sanctions, they may consider that they don't have to make as many trade concessions – and that can drag out or completely derail the process that has been the basis for these record-setting Q1 gains in the indexes. David Lipton, the International Monetary Fund’s first deputy managing director, said last week that trade tensions between the two biggest economies “pose the largest risk to global stability.”

To boost the Chinese economy in March, policy makers urged banks to lend more, especially to small and private companies, boosted spending on infrastructure and promised 2 Trillion yuan ($298Bn) in cuts to taxes and fees on businesses and households. First-quarter reports of company borrowing matched the highest level since mid-2013

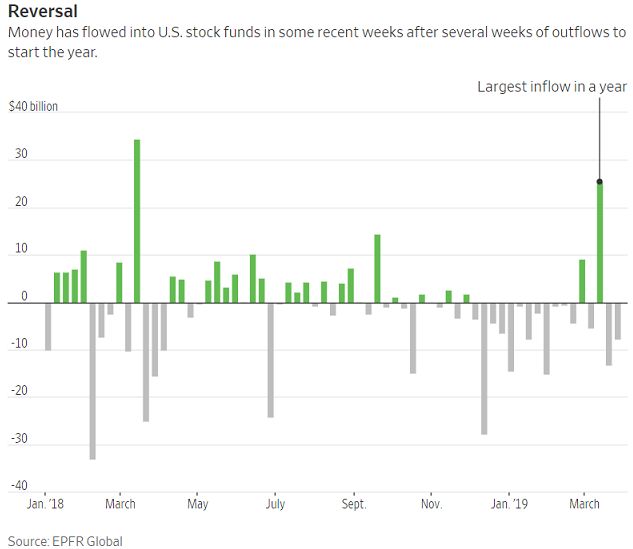

According to the WSJ, FOMO (Fear of Missing Out) is back as a driving force in the market as investors are worried about missing the rally and falling behind and I have to agree with that assessment as it's the only reason we haven't cashed out – and it bothers me every day as it's a pretty dumb reason to be bullish but, on the other hand, we'd hate to miss more gains...

According to the WSJ, FOMO (Fear of Missing Out) is back as a driving force in the market as investors are worried about missing the rally and falling behind and I have to agree with that assessment as it's the only reason we haven't cashed out – and it bothers me every day as it's a pretty dumb reason to be bullish but, on the other hand, we'd hate to miss more gains...

And, of course, if you don't want to buy stock in a company, they are happy to buy it themselves. Some analysts say greater investor demand for stocks could join robust corporate buybacks in supporting major indexes. S&P 500 share repurchases in the fourth quarter rose to a record $223 billion, a 63% increase from a year earlier, according to S&P Dow Jones Indices.

Meanwhile, these record-high market levels are MADNESS considering we're heading into a significiant slump in Corporate profits – the first one after two straight years of gains:

Meanwhile, we can't complain too much as our portfolios keep tacking on stunning gains in this ridiculous rally. I'm glad we didn't miss out, for example, on the Money Talk Portfolio, which we thought was doing great on Feb 13th, when it was up "only" 137% at $118,630 since it's 9/6/17 inception at $50,000. We like using the MTP as a benchmark since it's a portfolio we only adjust live on BNN's Money Talk Show once per quarter so it's a good example of how our trades do if you simply leave them alone.

In this case, just 6 weeks later, we've jumped another 33%, now up 170.3% at $135,153 and that includes the hedges, which are included in the mix on this portfolio. It is RIDICULOUS to make over 5% PER WEEK in your portfolios, that would be 260% per year so, when we make this much money this fast – we HAVE to be suspicious that there will be Hell to pay on the other end of this streak.

Meanwhile, the fear of missing out on another 30% gain over the next 6 weeks is keeping us invested, though we keep bumping up our hedges and we keep one hand firmly on the exit door at all times – just in case.

Retail Sales were already a bust this morning, coming in at -0.2% vs +0.2% expected by leading Economorons. Ex-Auto was even wose, down 0.4% vs up 0.3% expected which reminds us that no one understands this economy, which means the exuberance shown by investors at the moment is very likely to be irrational.

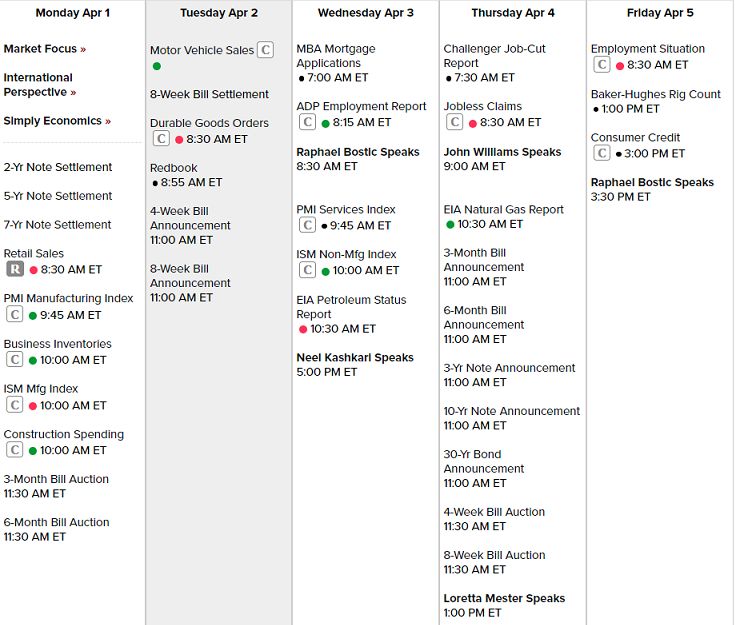

We have PMI, ISM and Business Inventories this morning, Durable Goods tomorrow and then a bunch of Fed speak into Non-Farm Payrolls on Friday. Last month's report was a disaster and the market still raced to new highs so really, does it matter?

Let's start trading – or else we might miss out!