Are we weathering the storm?

Are we weathering the storm?

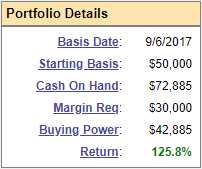

So far, not so bad as we're down $14,755 from our April Review, when the overall market was 5% higher. Options tend to be very volatile, of course and the Volatility Index (VIX) is higher now, which inflates the asking price of the options we sold. This doesn't matter as long as we're not buying them back at the moment, but it can make our balances look ugly.

Not that being up 125.8% is "ugly", of course, but we were up 155.3% and it sucks to backslide. Another problem we have at the moment is our hedges certainly don't kick in on a 5% market drop – so they are not helping but, since I can only adjust this portfolio when I'm live on BNN's Money Talk (here's the April show), I needed hedges that would keep us safe all the way into July, which will be the next time I'm on the show (once a quarter it becomes the Phil Show).

Since our longs were on track to make $83,104 in a flat to slightly down market – we don't mind losing a bit of money on our hedges to take us through a rough quarter – like this one. As I said on the show, we expected at least a minor correction but there's a fear of missing out (FOMO) as this portfolio was only at $88,922 on Feb 15th, so of course we were going to give back some of those ridiculous gains – but that doesn't invalidate our long-term positions, so we choose to ride out the rough spots.

As FUNDAMENTAL VALUE INVESTORS we believe that stocks – even the ones we like – can be too expensive, as well as too cheap. When they are too cheap, we buy them – when they are too expensive, we sell them. It sounds logical but how many traders actually do it when the time comes? Unfortunately, we can't make adjustments until July but we can certainly check in our our positions – so let's do that.

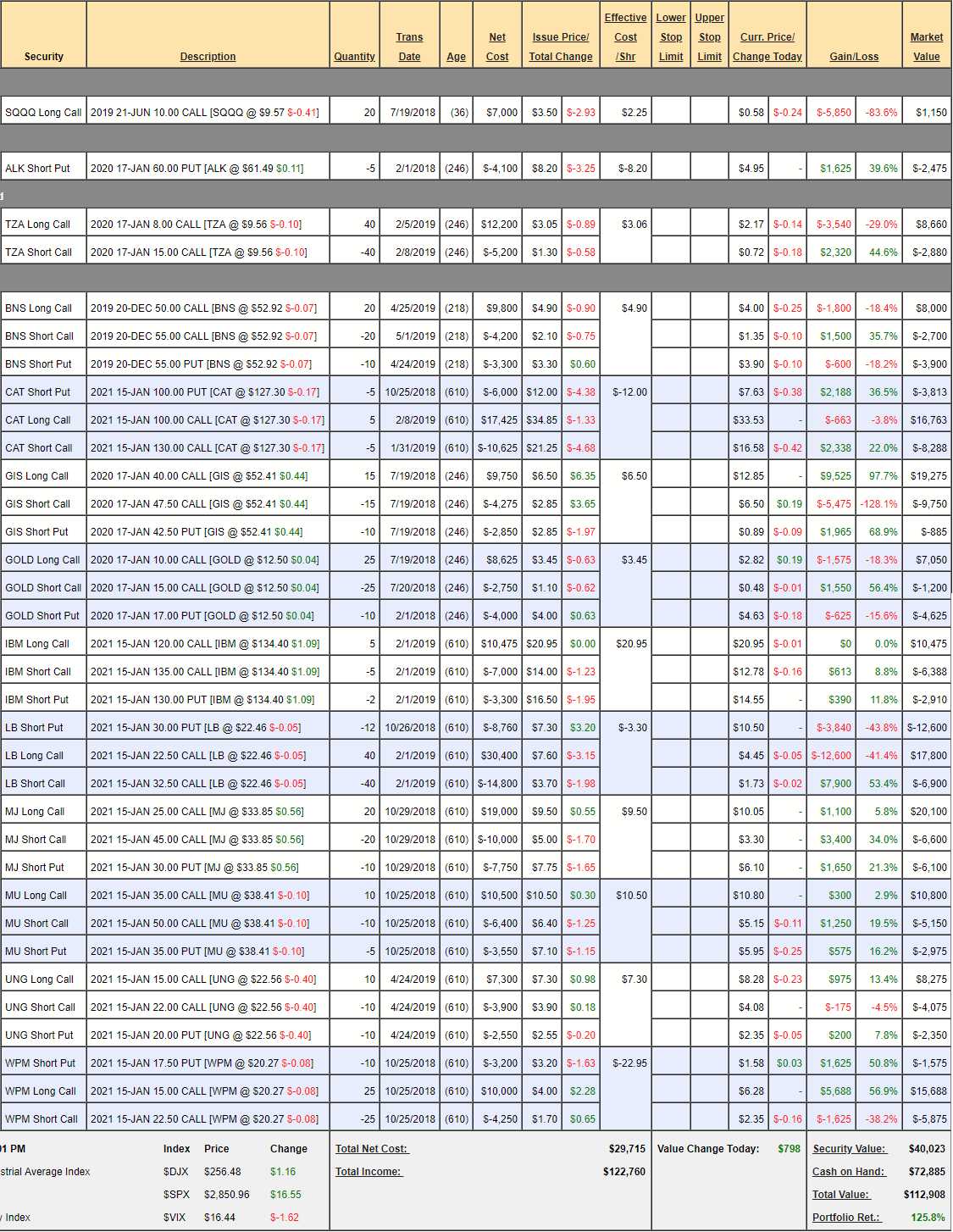

- Nasdaq Ultra-Short ETF (SQQQ) – A hedge we expect to lose on and so far, so good as we're down about $5,850 with just $1,150 in value left. It's a 3x ETF so, if the Nasdaq drops another 15%, SQQQ goes up 45% to $13.87 and that would make the hedges $7,740 so $6,590 worth of protection here. We expect to lose the remaining $1,150.

- Alaska Airlines (ALK) – Just a short put that nets us in for $51.80. We're not worried about it. Expect to gain the full $4,100 so $2,475 left to gain.

- Russell 2000 Ultra-Short ETF (TZA) – This will become our primary hedge as it's still in the money and has more time. TZA is a 3x Ultra-Short so a 15% drop in the Russell should give us a 45% pop in TZA but, starting from $9.56, that only gets you to $13.86 and that would pay $5.86 per contract so net $23,440 less the current value of $5,780 means $17,660 worth of protection on this one is accepable as it covers an additional 15% drop in our portfolio. In a bull market, we expect to lose the remaining $5,780.

- Bank of Nova Scotia (BNS) – This is one of our new trades from the last show and it's down a bit so far at net $1,400 on the $10,000 spread so $8,600 (614%) upside potential at $55 does not seem like to much of a stretch to count on by December if the markets don't collaps.

- Caterpillar (CAT) – Had good earnings but tariffs hammered the stock lower but we are still over our goal so the $3,000 paper loss since the last review is just that and we're confident it will come back. It's a potential $15,000 spread we paid net $800 for and currently the net value is only $4,662 so this trade has another $10,338 left to gain if CAT can hold $130 into Jan 2021. It's still good as a new trade – even if you missed the first $3,862 (482%) worth of gains!

- General Mills (GIS) – Notice we love to buy beaten-down blue chips! This is an $11,250 spread that's well in the money at net $8,643 and I'm confident enough that we'll collect the remaining $2,607 (30% of the current net) but it's right on the cusp of not being worth it as, clearly, we can do more with $8,643 over 18 months than just 30% so, if we're over $8,643 in July, we'll probably cash this one in and I'd do it now in an uncertain market if my hands weren't tied.

- Barrick Gold (GOLD) – Gold (the commodity) can't seem to get things going but $1,294 an ounce is still some very healthy profits for GOLD (the company), who pull it out of the ground for $825 an ounce (higher than it was due to acuisition of less-effiient mines). This quarter will be worse than last year simply because Gold averaged $1,325 last year in Q1 and more like $1,275 this year so it's likely to be a rocky ride but you can still get into the $12,500 spread for net $1,225 and that makes the upside potential a very nice $11,275 (884%) if GOLD is over $17 (with the aggressive short puts puts) in January. I do NOT think we'll make it on time, however, so I anticipate rolling this spread which means I will not be counting on any profits from it at the moment.

- IBM (IBM) – Is our 2019 Trade of the Year so yes, I am confident we will collect our full $7,500 and the current net is $1,177, so well worth sticking with in anticipation of making another $6,323 (537%) and that's obviously still good for a new trade as who doesn't like making 500% on cash in 18 months off a spread that's starting out 95% in the money, right?

- Limited Brands (LB) – Was our 2018 Trade of the Year along with HBI but this is a re-entry as we cashed the original when they spiked over $35. Now back to $22.50 we're good for a new trade at a net $1,700 CREDIT on the $40,000 spread so there's $41,700 (2,452%) upside potential and all we have to do is get back over $32.50 by Jan 2021. I'm pretty confident in that but let's say we strongly expect to make "just" $16,000 on this one at $27.50 and anything else is a bonus. LB reports earnings next Wednesday (22nd) – break-even is expected for Q1.

- Alternative Harvest ETF (MJ) – Lovely name but these are POT companies and we love this sector for 2019 and it already loves us at net $7,400, up $6,150 (492%) from our intial $1,250 cash outlay. At $45, it's a $40,000 spread so there's still $32,600 (440%) left to gain and I'm very confident that an ETF made up of the largest Marijuana Companies in the World can gain another 33% in 18 months so we expect to made the additional $32,600.

- Micron (MU) – They have been getting hammered with the chip sector but it's a 2021 play so we're not worried. We're now back at net $2,675 and that makes this position half our losses since the last review BUT now is your chance to get in if you haven't already as it's still a potential $15,000 and I have no reason to think we won't collect the additional $12,325 and that's another 460% from here – so worth sticking with and great fro a new trade.

- US Natural Gas Fund (UNG) – Our other new trade from April and already up an even $1,000 off our $850 entry so up 117% in less than a month is not too bad, right? It's a $7,000 spread now netting $1,850 so $5,150 left to gain is still a nice 278%, even if you missed the initial entry.

- Wheaton Precious Metals (WPM) – This was our 2017 Trade of the Year and this one is a triple dip for PSW players and, yet again, it's making us money. Net is now $8,238, which is up $5,688 (223%) from our $2,550 cash outlay and we're back to our mid-point at $20.27 and it's an $18,750 spread so another $10,512 (127%) left to gain and I'm super-confident in this one so I'd say good for a new trade – even if you missed the first 223% gains.

So we now have $106,930 that we expect to gain over the next 18 months less $6,930 we expect to lose on our hedges is net $100,000 exactly, which would be up another %88.5 from our current $112,908 but we can do much better and we're very confident in our current positions and we do have hedges and we're hardly using any margin (just $30,000) so we're in very good shape – even if we do have to make adjustments next quarter.

See how easy it is to make these decisions when you know EXACTLY what to expect from your portfolio!

For every trade, we have a clear plan and clear targets so that, at any given moment, we know if we are on or off track. We KNOW how much we expect to make (now $100,000) and we KNOW how much our hedges will make on a 20% market drop ($30,030 at $13.87 on SQQQ and TZA) to offset some of our long losses and that plus our portfolio's $72,885 (64.5%) CASH position means even a severe downturn is unlikely to hurt us very much.

CONTROL. Control and BALANCE are the keys to successfully managing a portfolio and, if you have those things – you can run a portfolio you only touch once per quarter that still makes market-beating returns. It's not about active investing – it's about KNOWLEDGEABLE INVESTING!

Join PSW right now and we will turn you into a Knowledgeable Investor!