Not again!

Not again!

Now Trump is "considering" Huawei-like sanctions on Hikvision (a $37Bn company) and Zhejiang Dahua Technologies, sending both companies limit-down 10% this morning, even though the US is only 5% of Hikvision's sales. Other companies are supposedly on Trump's "list" but they have not been disclosed.

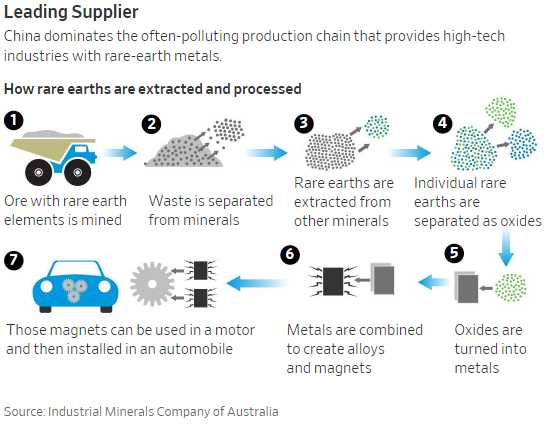

Meanwhile, yesterday, China's President Xi toured a rare-earths manufacturer, likely to point out that China actually has us by the balls as they supply 90% of the rare materials that make electronic manufacturing possible.

On his tour, President Xi was shown on state television on Monday accompanied by his emissary to the trade talks with the U.S., Liu He. Stock prices of companies associated with the industry soared in China in anticipation of a potential increase in prices of the materials. Beijing exerts critical influence on the supply of rare-earth materials. The 17 elements have high-tech uses: neodymium for permanent magnets in mobile phones, terbium in LED lights and dysprosium used to cool nuclear rods, for example. Though the minerals are found in abundance in many parts of the world, processing them into materials is often highly polluting, sometimes releasing radioactivity. China holds that production chain.

This whole thing could be part of a brilliant plan by Trump to manipulate the situation to allow him to lift the environmental restrictions on rare-earth mining in the US. and Texas Mineral Resources Corp. (TMRC) is one company that would greatly benefit from such a decision. I don't usually play penny stocks, but this one could be fun at 0.27, as they would certainly be in the right place at the right time if Trump can play the "national security" card (again) to allow TMRC and others to begin strip-mining America. That's certainly worth a few board seats for the Trump family down the road, right?

We already began the day shorting the Dow in our Live Member Chat Room, my note to our Members at 7:06 am was:

/YM is a nice short below 2,850 if /ES is below 2,860 and /NQ is below 7,450 and /RTY is below 1,545. We're pretty flat at the moment but the Dollar is at 97.84 and, if it breaks over 98 – a lot of things you buy Dollars with will collapse.

At the moment (8:05), we already have a 50-point gain and that's good for profits of $250 per contract and we can cash that in and now watch the S&P (/ES) as it tests the 2,850 line and that can be our next short if it fails (with tight stops above). There's no particular bad news other than the above and the market seems to generally shrug off trade issues – despite how ridiculous that is.

Gasoline (/RB) is still down at $2.07 in the front-month contracts but we're playing July's /RBN19 contracts and they are at $1.985 and we love them long this morning with the EIA Report coming at 10:30. Natural Gas (/NGV19) is also a buy at it tests $2.65 ($2.59 on /NG). Saudi Arabia (Aramco) just signed a deal to buy Liquefied Natural Gas (LNG) from Sempra Energy (SRE) at a rate of 5 MILLION TONS of LNG EACH YEAR for 20 years. A Million tons of LNG is about 48Bcf so 240Bcf from just one deal – almost 10% of US storage!

Silver (/SI) just hit $14.45, which is a nice gain of $500 per contract since we featured it in yesterday morning's PSW Report – you're welcome! Gold (/YG) has also blasted higher, now $1,276 and +$6 on gold is good for gains of $193.20 per contract – aren't Futures fun?

Silver (/SI) just hit $14.45, which is a nice gain of $500 per contract since we featured it in yesterday morning's PSW Report – you're welcome! Gold (/YG) has also blasted higher, now $1,276 and +$6 on gold is good for gains of $193.20 per contract – aren't Futures fun?

Remember: I can only tell you what is likely to happen and how to make money trading it – the rest is up to you…

It's really not complicated, we use the same principle of Fundamental Investing we apply to stock but on a much shorter-term basis and then we apply intelligent cash-management techniques to minimize our losses while we occasionally luck out and have really good gains. Despite underperforming so far (because the API Report showed a big build), we really like our /RBN19 play on Gasoline Futures the best. That hardly ever fails into a holiday weekend though today looks to test that theory.

After the EIA report there will be the Fed Minutes at 2:00 but, before then, We have speeches from Williams, Bostic and Kaplan and Bostic already said yesterday that the December Rate Hike may have been a mistake – and he's supposed to be a hawkish one!

We have a Live Trading Webinar at 1pm, EST for our Members – I think it's going to be a fun day to trade.