What a month this has been!

It's all over now because Monday is a holiday and EVERYONE (who matters) is out the door early on Friday or Thursday or Wednesday for that matter and they don't come back until next Tuesday or Wednesday or, if they do – they sure aren't working much. While Americans complain that they don't get many holidays – they certainly seem to stretch the ones they do have out quite a bit.

I said we shouldn't expect much volume and yesterday's SPY volume was 60% of Friday's and I think we'll see even lower transaction numbers as the week goes on. In other words, the whole thing is a joke – you may as well take the week off. Our picks from yesterday morning were no joke as the Nasdaq (/NQ) Futures popped back to 7,450 this morning for a lovely $1,000 per contract gain from the long play we discussed in Monday Monring's PSW Report. Likewise the S&P Futures (/ES) gained 10 points at 2,860 (again) and that was good for $500 per contract – not a bad way to start our trading week.

This morning we're playing JULY Gasoline (/RBN19) Futures at $1.99 and I'll be very surprised if we're not at $2.05 by Thursday and, at $420 per penny, per contract, that could be good for $2,520 per contract – good enough to barbeque some steaks instead of hot dogs this weekend. A stop below the $198 line limits the risk to $420.

This weekend is the start of "Summer Driving Season" and the EIA forecasts a slight increase in consumption vs. last year, despite a 1% increase in overall fuel efficiency for the motor vehicle fleet:

For summer 2019, EIA forecasts U.S. motor gasoline consumption will average 9.54 million barrels per day (b/d), up 29,000 b/d (0.3%) compared with last summer’s level and nearly the same as the record summer average set in 2017. Highway travel is forecast to be 1.3% higher than last summer. The forecast increase in highway travel is largely because of growth in employment and population. The effect of the increase in highway travel is forecast to be partially offset by a 1.0% increase in fleet-wide vehicle fuel efficiency.

Last summer, in late May, Gasoline Futures peaked out at $2.25 and stayed between $2 and $2.15 for the rest of the summer so we like to jump in at $2 with tight stops below as we should have multiple chances to make money this summer – isn't that a nice, simple trading premise? It's the same premise we had on May 7th (in the PSW Morning Report), when we went in at $1.92 and cashed out Thursday at $2.03 for a gain of $4,720 per contract!

In fact, we have a July spread on UGA in our Short-Term Portfolio, also from 5/7's PSW Morning Report, and that's a spread we started with a net credit that's already up over $2,000 in just a couple of weeks, so congratulations to all who played along at home! The trade is already at our goal but just net $2,425 out of a potential $6,000 if UGA holds $32 so another $3,575 (147%) left to gain over the next 60 days if our premise holds up so – good for a new trade!

| UGA Long Call | 2019 19-JUL 29.00 CALL [UGA @ $32.04 $0.00] | 20 | 5/7/2019 | (59) | $5,500 | $2.75 | $0.70 | $2.75 | $3.45 | $0.00 | $1,400 | 25.5% | $6,900 | ||

| UGA Short Call | 2019 19-JUL 32.00 CALL [UGA @ $32.04 $0.00] | -20 | 5/16/2019 | (59) | $-4,000 | $2.00 | $-0.50 | $1.50 | $0.00 | $1,000 | 25.0% | $-3,000 | |||

| UGA Short Put | 2019 19-JUL 32.00 PUT [UGA @ $32.04 $0.00] | -10 | 5/7/2019 | (59) | $-2,250 | $2.25 | $-0.78 | $1.48 | $0.00 | $775 | 34.4% | $-1,475 |

You can subscribe the the PSW Report HERE and have these trade ideas delivered to you every morning.

Part of the reason the markets are up this morning is because the Dollar, once again, has been rejected at 98 and that's because (please hold your laughter), Theresa May has a new Brexit deal! Just look how excited the Pound is about that news – up half a point in two hours. We don't know what the deal is yet but she's giving a speech later today and everyone is very excited – for some reason.

Meanwhile, Boeing (BA) says one of the crashes was caused by a bird and NOT their faulty design or faulty software, faulty training or (new information) faulty flight simulators. A bird strike makes me feel so much better because there are hardly any birds in the sky so hitting one is considered an "Act of God" – and not at all something BA would have to compensate people for. Ethiopian Arilines thinks this is nonsense, but they are foriegn and our Government could care less what they think.

BA is up 2.5% this morning at $362 but we already put our foot down and sold the 2021 $280 puts for $21 last week (15th in our Live Member Chat Room) as it netted us in for $259 and that seemed like a stupidly low price for BA. Of course, we don't expect to get BA for $259 as the sell-off is a bit overdone but we promised to buy 1,000 shares for $280 and collected $21,000 against $28,000 in ordinary margin and that's what we'll "win" if BA manages to not drop $80 (22%) between now and Jan 15th, 2021. That's all there is to put selling!

All that glitters may not be gold but Silver (/SI) will do for us at $14.35 this morning – that's a no-brainer of a long and silver contracts pay $50 per penny, per contract so don't be a hero if $14.35 doesn't hold and take the quick loss but /SI should be at least $14.60 and hopefully the Dollar comes down to help it out. /SI is another one we always play when it's down at these levels.

And, of course, if we're playing /SI we can also play Gold (/YG) at $1,270 though it's not as stupidly cheap as silver, they do both tend to bounce at the same time and, like silver, if it fails here, it's not worth sticking with… Copper (/HG) is also back to our buy line at $2.72 so a very good morning for commodities trading it seems.

The sustatined downturn in copper (caused by the trade war and slow building in the US) has been killing Freeport-McMoRan (FCX) and they are back down to $10.25 and you can sell the 2021 $10 puts for $2 to net in for $8 – so I love that as a solo trade but, since I think $10.25 is a fine price to pay for FCX as it's a $15Bn market cap for a company that made $2.9Bn last year but we'll call it $2Bn as they paid no taxes (thanks Donald!) and that's only 7.5x earnings but this year will suck and MAYBE they make $750M but it's a cyclical company – you are supposed to buy them when they are low!

Anyway, so if we did own FCX at $10.25, we could sell the 2021 $10 calls for $2.40 and the $10 puts for $2 and that would lower our net basis to $5.85 with a nice $4.15 (71%) gain if called away at $10 so I REALLY don't mind being assigned at $10 which means we can treat the $2 we collect on the $10 puts like free money and set up the following spread:

- Sell 20 FCX 2021 $10 puts for $2 ($2,000)

- Buy 20 FCX 2021 $8 calls for $3.40 ($6,800)

- Sell 20 FCX 2021 $12 calls for $1.70 ($3,400)

That's net $1,400 on the $8,000 spread so the upside potential is $6,600 (471%) if FCX is at $12 or better in Jan, 2021 and the worst-case is you get assigned 2,000 shares of FCX at net $10.70 ($21,400) but then we sell 20 of the 2023 puts and calls for $4+ ($8,000) and our net becomes just $13,400 or $6.70/share so, if you don't mind owning FCX for $6.70/share (33% off) or getting paid $6,600 for not owning it – this is the trade for you!

See how much fun options are!

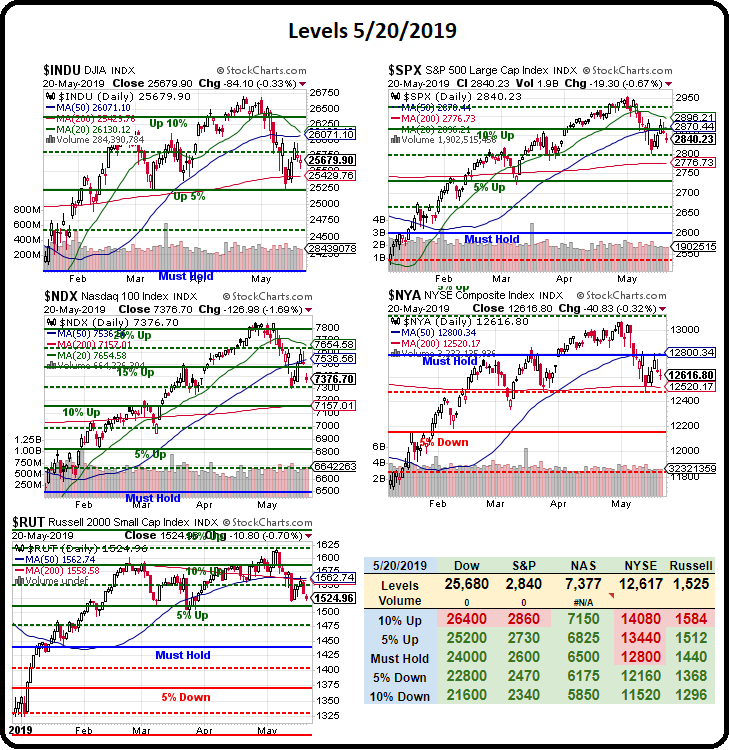

Meanwhile, we're still watching our bounce lines and, as I noted last week, they keep us from doing dumb things like chasing weak bounces and, with this low trading volume, it's mostly a watch and wait week anyway. BA has pushed the Dow (/YM) over the Strong Bounce Line but the S&P (/ES) is still right at it's -5% line and the Nasdaq (/NQ) and the Russell (/RTY) are below theirs and BA is responsible for half the Dow's gains this morning so, like the Nigerian Air Traffic Investigators – we'll take it with a grain of salt:

- Dow 25,200 is the 5% line and the bounce lines are 25,450 (weak) and 25,700 (strong)

- S&P 2,860 is the 5% line and the bounce lines are 2,875 (weak) and 2,890 (strong)

- Nasdaq 7,475 is the 5% line and the bounce lines are 7,540 (weak) and 7,605 (strong)

- Russell 1,550 is the 5% line and the bounce lines are 1,565 (weak) and 1,580 (strong)