The President is losing it.

The President is losing it.

Yesterday, he invited the House and Senate Democrats to meet with him to discuss Infrastructure and they had been discussing $2Tn worth of it but, when they showed up, Trump demanded they drop their investigations or he would not spend any money on Infrastructure – even though it's something America desperately needs action on.

Trump is not above holding America hostage to get what he wants – he shut the Goverment down for 35 days last year just to get funding for his wall and, so far, $1.57Bn has bought America 1.7 Miles of fence. President Donald Trump also commented on the progress of the wall construction on Twitter Wednesday, saying “tremendous work is being done.”

The Democrats did not agree to stop investingating Russian Interference into the US Elections which happens to also include potential charges of collusion and obstruction of justice on behalf of the President and his inner circle. One could say Trump's actions yesterday were obviously yet another attempt to obstruct justice by threatening people involved in an ongoing investigation but, regarless of that – this man is clearly not acting rationally and, unfortunately, he's our President.

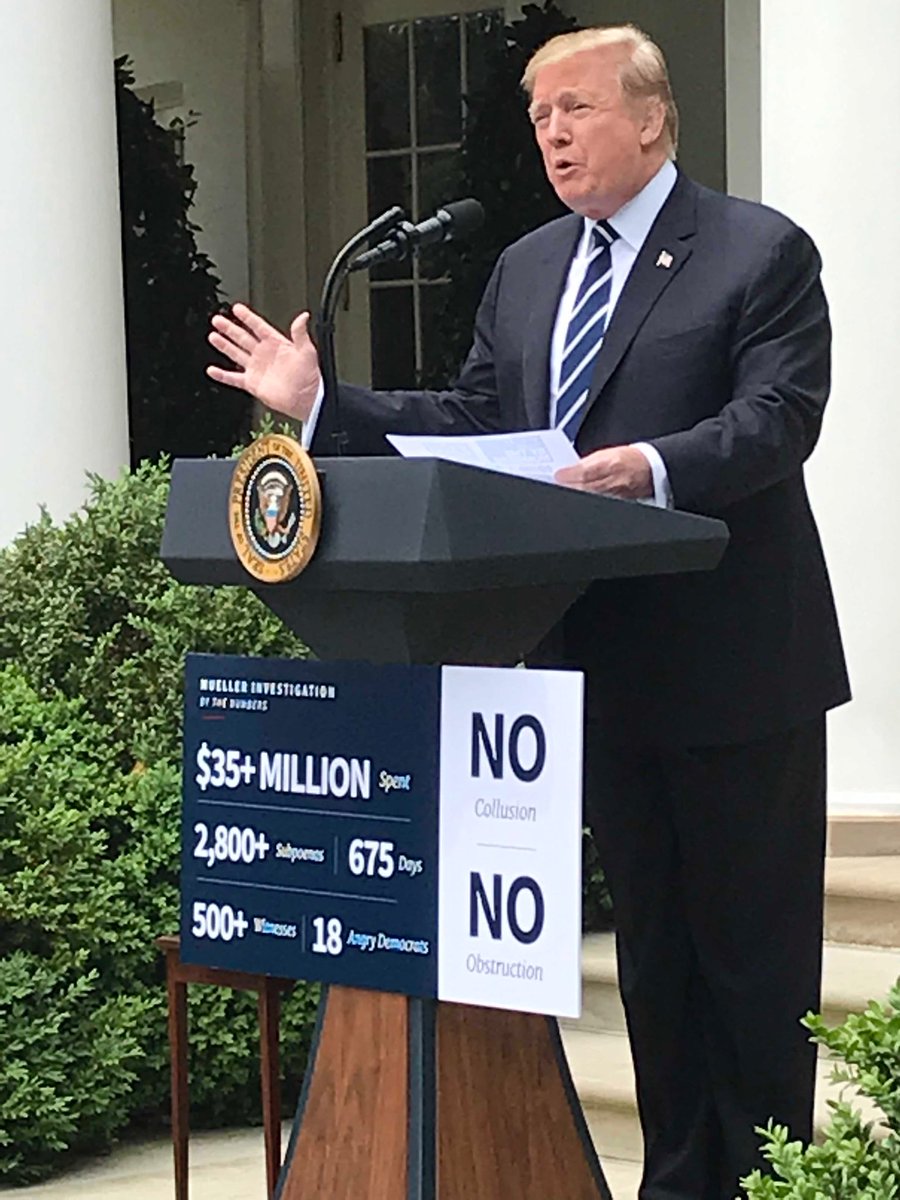

It's interesting that Trump is complaining about the Mueller Investigation costing $35M (his estimate, not a fact) when Trump has spent $102M of the taxpayers' money playing golf in the past two years – and that is a FACT. In fact, Mueller has already collected $47M in fines so there's a $12M+ PROFIT from the investigation, not to mention that there have already been 37 people indicted for criminal activity including 26 Russians who interferred with our Democracy and, so far, 7 people have already pled guilty, including several who were serving directly under the President.

I know people don't like to talk about politics on investing sites but this is serious stuff, folks! When this happened yesterday I told our Members to "GET OUT!!!" of the markets as this was clearly going to lead to some serious selling as, if nothing else, we have a completely dysfunctional government which will be doing nothing to address many, many critical things AND we're on a footing to start a war in Iran, threatening Venezuela, in a Trade War with China AND our economy is clealy slowing – how many more things will it take before people start selling in May and going away?

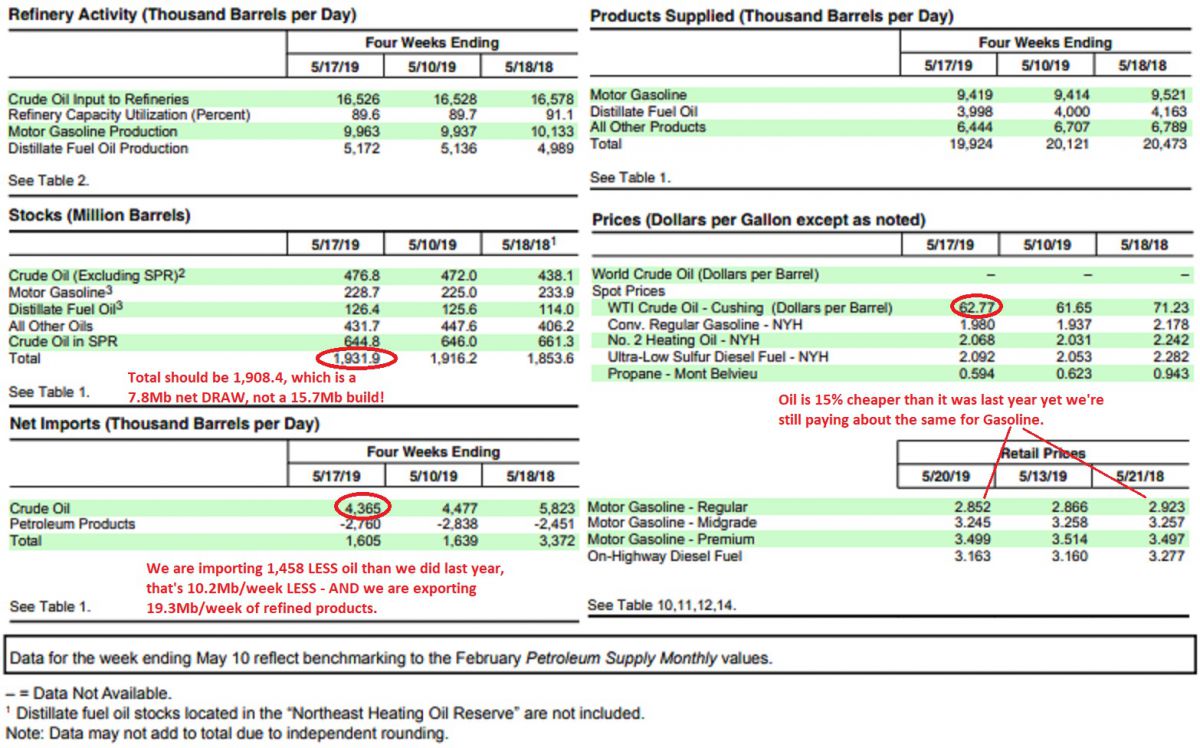

I talked about all this stuff in the Webinar so you can check out the replay when it's ready. Also, despite being down $1,000 per contract with an average entry of $1.9515 now, we're still holding long on Gasoline (/RBN19) and we just added oil (/CL) at $60 as a long but no conviction there and tight stops below the line. A lot of our premise to hold is based on the timing of the EIA Petroleum Status Report, which ended on the 17th and came in too soon to see the effects of the holiday weekend demand AND there's a massive math error in the Total Petroleum Stocks:

There's 23.5M barrels LESS oil than indicated – that's quite a big difference and, while it does nothing to change the weak demand picture that's very obvious (we import less and export more and still we have a surplus), it does mean we don't have the kind of glut traders are fearing. However, this morning the NYMEX traders are dumping their remaining /RBM19 contracts, which expire on Tuesday and that and the strong Dollar (98.06) are putting downward pressure on commodities.

Despite that pressue, Silver (/SI) is hitting our $14.60 goal this morning from our featured play in Tuesday Mornng's PSW Report and an 0.25 gain on Silver Futures is good for $1,250 PER CONTRACT – not bad for a newsletter you can subscribe to for $3/day, right?

We are, of course, taking the money and running here – it's very important not to get greedy – especially in Futures trades as they can go down as quickly as they go up. It's surprising we got this high with the Dollar over 98, so consider it a gift and move on.

Meanwhile, the S&P (/ES) is firmly below 2,860 and the Dow (/YM) is just over the weak bounce line at 25,450 so, if it fails that – GET OUT!!! (or at least short /YM at that line with tight stops above) as it has another 250 points to go before it catches up with the other indexes at the 5% correction line. As I said yesterday morning, we were taking the "rally" with a huge grain of salt and now we're in BIG TROUBLE if the NYSE fails it's 200-day moving average at 12,500 and we'll be really close at the open – so watch that line very closely.

The volume is so low this week that none of it matters but these big trend-lines can be self-fulfilling prophesies so we'll be paying attention to what lines get broken and what sticks. Oil is already down to $59.50 and that's going to be a huge disppointment in the Energy Sector (and our Futures Trades) but we're giving it a day pass with the Dollar soaring to 95.20, even as I write this.

Be careful out there!