That's a line from Speed used to describe Dennis Hopper's insane actions and demands (he was a mad bomber) and I used it to describe Trump's trade actions back on May 7th and yesterday Robert Meuller clarified the fact that President Trump is indeed a criminal and simply can't be convicted only because he is currently the President. Hundreds of former federal prosecutors signed a letter stating that Trump’s conduct would be chargeable as a crime if he was not the president. Mueller’s view is that it’s up to Congress, not him, to make that decision.

This has now led to Trump, who needs another distraction, lashing out at Mexico and threatening to sanction them with tariffs (ie. – more taxes on the American people) if they don't stop people from legally crossing through Mexico on their way to the United States where they attempt to LEGALLY seek asylum. The US, of course, looks completely ridiculous, trying to force a foreign Government to solve what is really a domestic problem and it puts the entire USMCA (NAFTA) in jeopardy but also makes us look completely irrational to anyone else we're negotiating with:

WASHINGTON—President Trump said Thursday the U.S. would impose escalating tariffs on all Mexican imports beginning June 10, in an effort to push the country to deter the flow of asylum-seeking Central American families to the southern border.

Reacting to what he described as “Mexico’s passive cooperation in allowing this mass incursion,” the president said the tariff on America’s third-largest trading partner would begin at 5% and grow steadily, hitting 25% on Oct. 1 unless Mexico takes satisfactory action to halt the migrants.

“If the illegal migration crisis is alleviated through effective actions taken by Mexico, to be determined in our sole discretion and judgment, the Tariffs will be removed,” Mr. Trump said in a statement released by the White House.

The president also lashed out at Democrats, who he said “refuse to help in any way, shape, or form.”

We import $346Bn worth of goods from Mexico and a 25% tariff tax, paid by the AMERICAN PEOPLE, would give Trump another $86.5Bn to hand out to his buddies – that's what this is really about.

We import $346Bn worth of goods from Mexico and a 25% tariff tax, paid by the AMERICAN PEOPLE, would give Trump another $86.5Bn to hand out to his buddies – that's what this is really about.

“This is a misuse of presidential tariff authority and counter to congressional intent,” said Sen. Chuck Grassley (R., Iowa), chairman of the Senate Finance Committee. “I support nearly every one of President Trump’s immigration policies, but this is not one of them.”

Mexican President Andrés Manuel López Obrador responded with a letter addressed to Mr. Trump in which he called for deeper dialogue on the migration issue.

“Social problems are not resolved with taxes or coercive measures,” he said. He reiterated his proposal to confront migration through development efforts in Central America, adding that Mexico is doing what it can to curb the flow of migrants across Mexico without violating human rights.

“People don’t leave their homelands for pleasure but out of necessity,” Mr. López Obrador said. “I don’t lack courage, I’m not a coward or timid, but act out of principles. I believe in politics which, among other things, was invented to avoid confrontation and war.”

This has been a last straw event for China, whose Commerce Ministry announced this morning that it will create an “unreliable entity list” comprised of foreign companies, organizations and individuals. The list will target entities that “disobey market rules, deviate from contractual obligations,” block supplies to Chinese companies for noncommercial purposes and otherwise damage Chinese companies’ legitimate rights, spokesman Gao Feng said according to a transcript of a briefing posted on the ministry’s website.

This has been a last straw event for China, whose Commerce Ministry announced this morning that it will create an “unreliable entity list” comprised of foreign companies, organizations and individuals. The list will target entities that “disobey market rules, deviate from contractual obligations,” block supplies to Chinese companies for noncommercial purposes and otherwise damage Chinese companies’ legitimate rights, spokesman Gao Feng said according to a transcript of a briefing posted on the ministry’s website.

Since this list is sure to include Donald Trump – it's likely to impact his personal business as well as the US's business with China in general. As this escalates, countries may be forced to choose whether they want to do business with China OR the United States – I wonder how many will choose the US if it's run the way Trump is running it?

As noted in the chart above, Auto Sector, Auto Parts, Electronics… will all get hit hard today as Mexico is as big a trading partner as China but much more balanced as they buy $250Bn from us as well so we're talking about a major economy-wrecker for both sides, again.

Oil is also being hammered as not only is an expanding trade war bad for Global Demand (which is already in the crapper) but Trump delayed oil-based Iran sanctions AND allowed ethanol to be added to our summer gasoline in another favor to farmers and one which knocks up to 5% off our projected demand for gasoline (500,000 barrels/day).

Oil is also being hammered as not only is an expanding trade war bad for Global Demand (which is already in the crapper) but Trump delayed oil-based Iran sanctions AND allowed ethanol to be added to our summer gasoline in another favor to farmers and one which knocks up to 5% off our projected demand for gasoline (500,000 barrels/day).

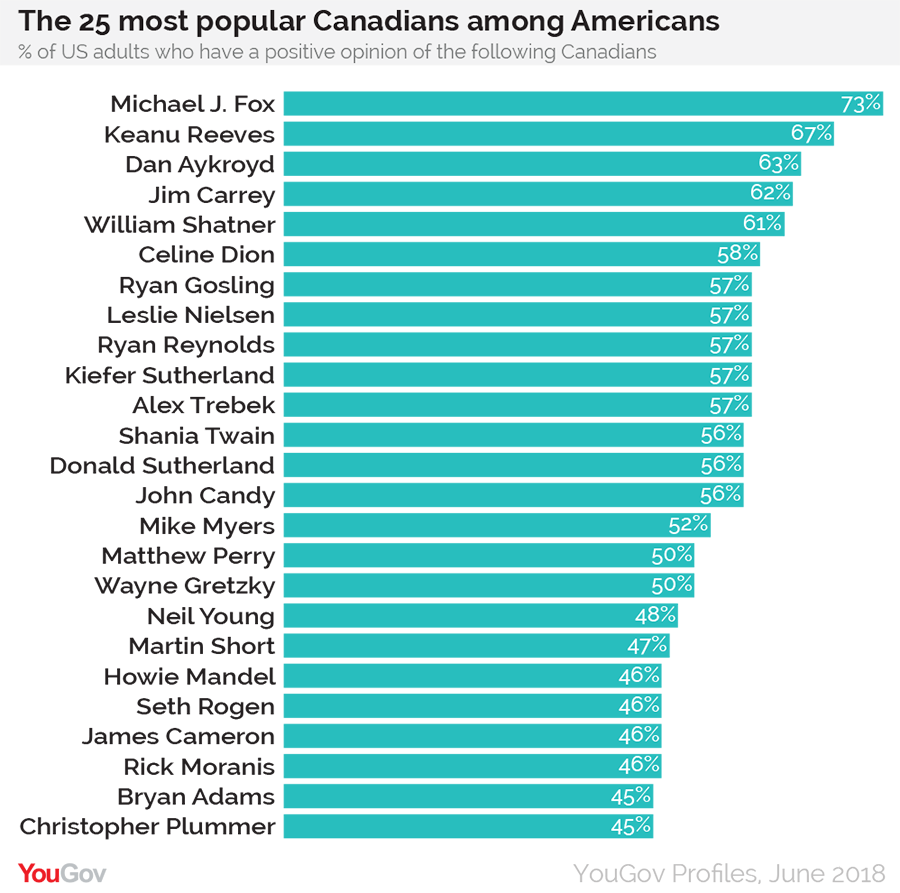

I wonder what kind of fight Trump will pick with Canada? Canada is the largest trading partner we have left and I see a lot of Canadians playing hockey for American teams and in the entertainment industy, stealing more American jobs!

Fortunately, there's a solution for all of this on the table and it's called the United States of Canada in which 19 US States succeed from the Union and join up with Canada, leaving the Red States in the US to make themselves great again while we enjoy free health care and free college and cooler temperatures as Canada benefits from Global Warming while the Southern US turns into Africa. See you on the other side!

Have a great weekend,

– Phil