Courtesy of Pam Martens

By Pam Martens and Russ Martens

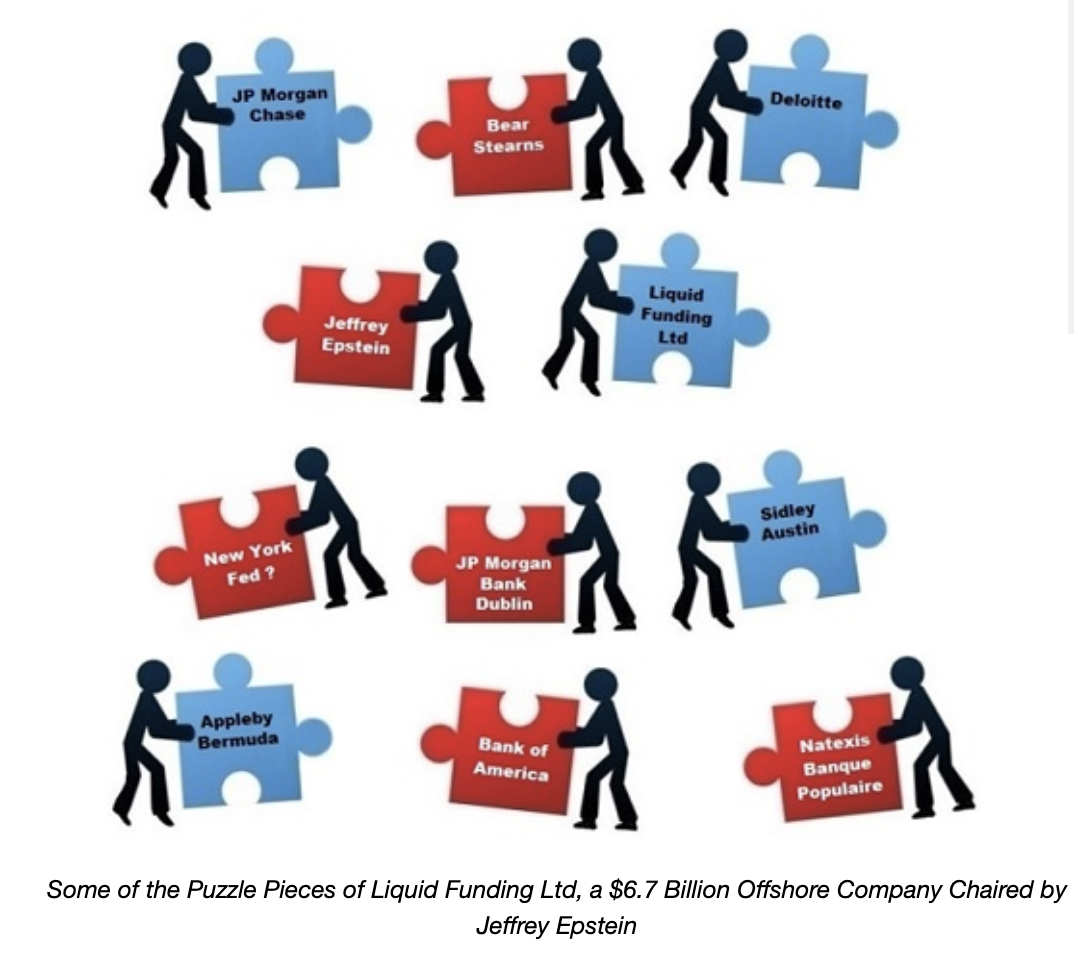

Jeffrey Epstein, the accused sex trafficker of underage school girls, presided over a $6.7 billion offshore company as its Chairman from November 9, 2001 to at least March 19, 2007, a period during which he is accused of committing his sex trafficking crimes against minors. The company is Liquid Funding Ltd. and it had two offshore connections: it was incorporated in Bermuda on October 19, 2000 by the Appleby law firm, known for setting up offshore companies in secrecy jurisdictions like the Isle of Man, Guernsey, Cayman Islands, and Jersey. Liquid Funding’s investment manager was Bear Stearns Bank Plc in Dublin, Ireland – a non-U.S. regulated institution, which was later merged into JPMorgan Bank Dublin.

A Securities and Exchange Commission filing by Bear Stearns, prior to its epic collapse in 2008, indicated that Bear Stearns owned 40 percent of Liquid Funding Ltd.’s equity but the owners of the other 60 percent remain a mystery. The ratings firm, Fitch, reported in 2006 that the company had $6.7 billion in outstanding liabilities. What those liabilities consisted of and who paid them off when Bear Stearns collapsed remains largely unknown, although we did track down $364 million of Liquid Funding’s commercial paper stuffed into U.S. money market funds. Two of JPMorgan’s money market funds held a total of $100 million; two Dreyfus money markets held at least $139 million; and a Frank Russell money market fund held $125 million.

Since our last report, we have uncovered new details from a report issued in 2004 by the Moody’s ratings agency. JPMorgan Chase, Bank of America and Natexis Banque Populaire extended the company a $250 million liquidity facility and Deloitte was its auditor. JPMorgan Chase is also listed as its “Security Trustee.” The large corporate law firm, Sidley Austin, was its legal counsel.

We reached out to JPMorgan, Sidley Austin and Deloitte seeking information on how Epstein came to chair the company and additional details. Thus far, we have not received a response from any of the three. That the French bank, Natexis Banque Populaire, was part of the liquidity facility with two U.S. banks suggests that Liquid Funding may have had business dealings in France. Epstein has an apartment in Paris as well as mansions in Manhattan, Palm Beach, New Mexico and the U.S. Virgin Islands.

…