2,880.

That's the weak bounce line on the S&P 500 and, as we predicted in yesterday morning's report, that's right where we ended up, though it was only due to a "stick save" into the close, which popped the S&P up to 2,881, but this morning, when we're back to 2,861 because that 20-point afternoon surge was nonsense – meant to entice retail traders into buying the dips (while the big boys sell into the bounces).

That's what our 5% Rule™ is for – to prevent us from chasing false rallies or panicking over normal corrections. The 5% Rule™ works best when bots are doing most of the trading and that's a trend that's worked well all decade and should continue to do so as we begin to look forward to the next decade as well.

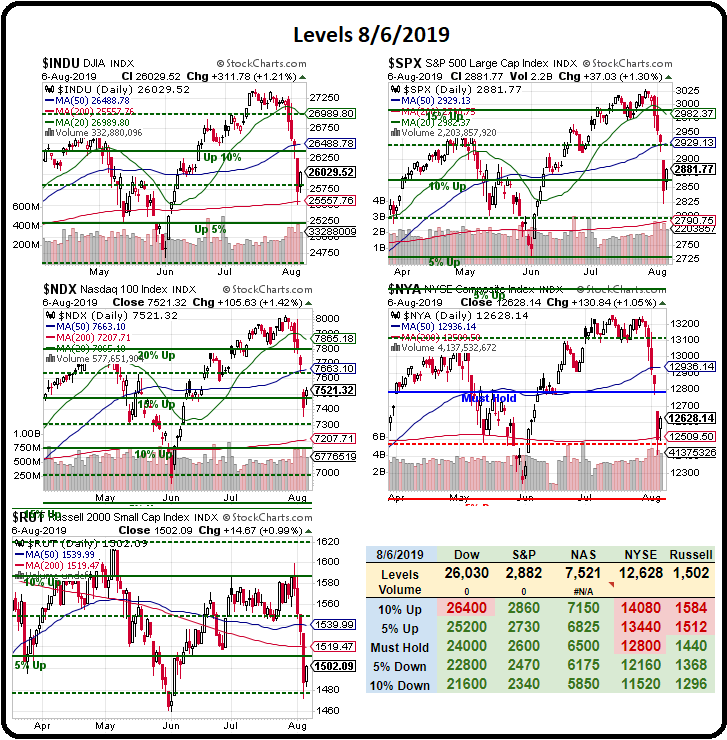

Yesterday morning, in our Live Member Chat Room, we calculated the bounce lines for the other indexes as well so, to summarize here (green or red determined by Futures at 8:30 am):

- Dow 25,000 is the mid-point and bounce lines are 25,550 (weak) and 26,100 (strong)

- S&P 2,850 is the mid-point and bounce lines are 2,880 (weak) and 2,910 (strong)

- Nasdaq 7,200 is the mid-point and bounce lines are 7,360 (weak) and 7,520 (strong)

- Russell 1,440 is the mid-point and bounce lines are 1,472 (weak) and 1,504 (strong)

Before we had our Big Chart (thanks StJ), we just had the little spreadsheet in the corner of the Big Chart and that's really all you need to gauge the health and we simply count the red and green boxes and, if things are getting redder, the market is getting weaker and if things are getting greener, the market is getting stronger and anything that happens in-between those lines is meaningless.

Of course, the above bounce lines are just measuring the short-term action but we also apply them to weekly and monthly charts so we are able to plot our trading ranges over years of time. Another big factor in why the 5% Rule™ is so accurate is because, at the heart, it's based first and foremost of the FUNDAMENTAL values of the stocks or indexes we're tracking – not just on some silly chart action. The 5% Rule™ is not TA – it's just MATH!

These levels are also useful to see which index to short in the Futures, if the S&P fails the 2,850 line, then we pick the index that has the furthest left to fall as our primary short and, at the moment, that would be the Nasdaq (/NQ) below the 7,450 line with tight stops above OR if the S&P crosses back over the 2,850 line. 1,500 on the Russell (/RTY) is another great shorting spot because the 1,500 line is such a good backstop to set your stop over.

And, of course, our call from Monday morning's Report still stands when I called the massive crash, saying:

Meanwhile, the markets are starting off down another 1.5-2% this morning as we're completing the first half of the much-anticipated post-Fed correction. We expect to see those 200-day moving averages get tested and that's another 1,000 points down on the Dow to 25,500 so still shortable when it fails the 26,000 line for $2,500 per contract at goal.

As you can see, we hit 25,500 on the nose Monday afternoon and, this morning, we got another chance to make another $2,500 per contract doing the same thing we did Monday. See – trading futures is not that complicated – you just have to pay attention to the support and resistance lines and don't be an idiot and try to guess where things are going when we're in-between those lines. That's not complicated, is it?

Remember, I can only tell you what is likely to happen and how to make money trading it – that is the extent of my powers!

Aside from needing low rates to prevent the economy from collapsing during an election year, Trump is very worried about the prospect of returning to the private sector so he wants rates as low as possible so he can borrow as much money as possible before he defaults on the next round of suckers who do business with him (at the moment – it's the American people!).

Here's a couple of charts that summarize the situation quite nicely:

The Dollar Index was at 102.5 when Trump took office in Jan, 2017 and now it's at 97.31, which is down 5% and Gold was at $1,150 in Jan, 2017 and is now $1,500, which is up 30% – as it's not just US investors panicking into Gold. Trump says he's lowering your taxes but a 5% devaluation of the Dollar isn't just a tax on what you earn (since the Dollars you earn have 5% less buying power) but a tax on EVERYTHING YOU OWN as well.

That's why these idiotic tax cuts are nonsense and only benefit the investor class (the Top 1% own 80% of the investments) as they (we) are the ones buying stocks and buying Gold (and GOLD is one I've been banging the table on for quite a while) and benefitting from the weak Dollar by making 30% on our Gold investments against 5% losses of our Dollars. That is the opposite of what is happening to the Bottom 99%, who have no gold bars in their safes – not even a Krugerand! – and they are not protected from Trump's weak-Dollar stealth tax that removes 5% of their wealth and lowers their effective wages.

That's why YOU (Top 1%) can think the economy is in great shape while it's really falling apart – it is great for us but "cord cutting" and "coverage gaps" and "Dollar Store trends" that you think is a good investing premise are life and death decisions made by the Bottom 80% who have to choose between entertainment, health care or food on a daily basis.