A bit of a roller-coaster, right?

A bit of a roller-coaster, right?

Since we posted this chart last week, we've been right in the range predicted by our 5% Rule™ and, unfortunately, that means we're likely to test 2,850 again and likely to fail it on the way down to 2,700 at the moment, we can blame escalating trade tensions between the US and China or, as noted yesterday, the Hong Kong protests which Cramer now says are serious (since reading my report) and, of course, yesterday, the Argentine Stock Market fell 48% in a single day – something that's got to make investors in the Developed World Markets reconsider the lofty valuations they are paying for stocks in countries run by tyrants-in-training.

I have been warning people to stay away from Argentina since 2013, when the index first spiked up to ridiculous levels and we had a correction but then spiked to even more ridiculous levels but now Argentina has given up all those gains and more and it's still a stay-away country with a President who lost an election and refuses to leave office (shades of futures past for the US?) and a bond market that's showing a 72% chance of default within 5 years – 50% higher than the chances were on Friday.

And this is why we told you to stay far away from 100-year bonds:

Meanwhile, Argentina is only one of many things on the Global Radar we should be paying attention to and, quite simply, when there are a lot of macro issues to be worried about – we should be a lot less willing to pay higher forward multiples for stocks – in case one of those issues becomes a bigger problem than it is now.

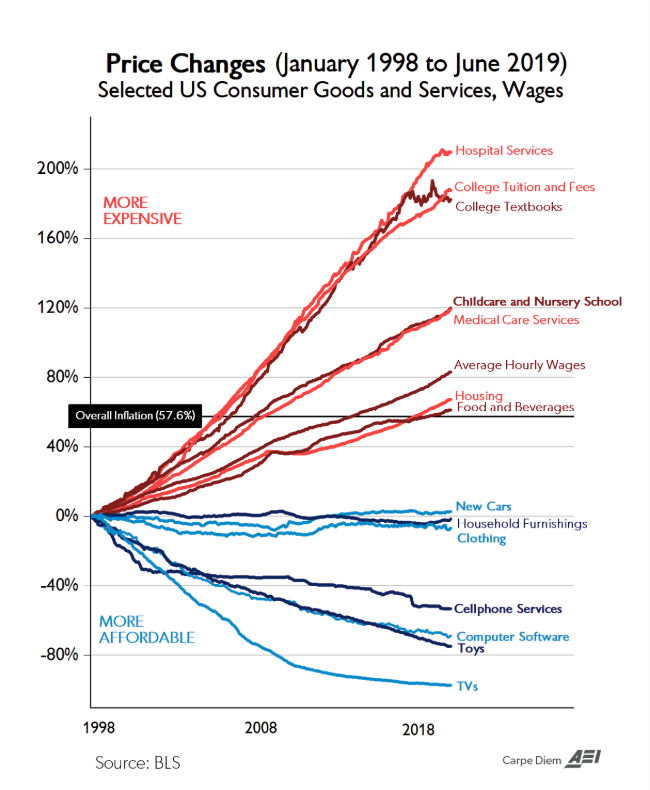

Higher prices eroded workers’ wage gains, a separate report showed Tuesday. Adjusted for inflation, average hourly earnings for all private-sector, nonfarm workers slipped 0.1% in July from June. For production and nonsupervisory employees—a category that includes most blue-collar workers—wages fell 0.2% in real terms.

Notice on the inflation chart that the only things getting cheaper are TVs and Phones (and the Toys kids no longer want because they all have Phones) – no wonder we've become a country of internet/entertainment addicts – it's all people can afford to do! Coporate Profit Forecasts have turned a bit negative this quarter and the writing is on the wall for an Earnings Recession as Consumers are forced to cut back as prices are outpacing wages. With record-high employment – they can no longer get jobs to make up the difference and, as we discussed last week – household debt has already hit all-time records that are now as bad (as a percentage) as they were just before the last crash, 11 years ago.

It's really just low rates keeping all the plates spinning at the moment, which is why Trump is so desperate to keep them that way but low rates cause their own problems, not the least of which is making the Fed unable to reaction if we find ourselves back in a real recession and now Goldman Sachs is cutting their Q4 US Growth Forecast by 20 basis points, to just 1.8%, saying the Trade Wars are leading to escalating Recession fears.

“The policy uncertainty effect may lead ?rms to lower capex spending as they wait for uncertainty to resolve. Relatedly, the business sentiment effect of increased pessimism about the outlook from trade war news may lead ?rms to invest, hire, or produce less. Supply chain disruption of rising input costs may lead U.S. firm to lower their domestic activity.” said Goldman's Hatzius.

Goldman Sachs said it expects the new round of tariffs to go through in September and it no longer expects a trade deal before the 2020 election. Even self-inflicted wounds can become fatal if you let them get worse and worse – as we've been doing…

Be careful out there.