QE-Distorted Markets

Courtesy of Michael Batnick

J.P. Morgan put out a new piece called Active management and QE-distorted markets. The main point is that it’s been incredibly easy for active managers to beat the index in an era of manipulated markets. I pulled three charts that I thought were interesting.

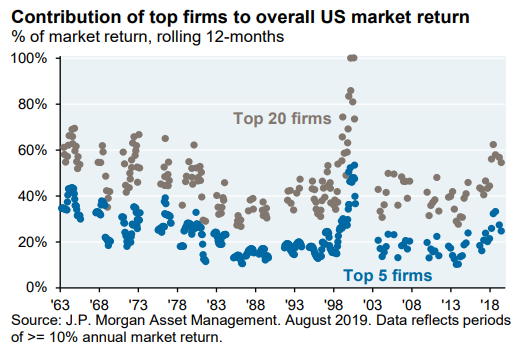

The first one shows the contribution of the top 5 and 20 stocks to the overall return of the market. The biggest winners have been a big driver of returns, but that’s almost always the case. The past five years have been slightly elevated, at least relative to the years from 2003-2013, but it looks very much in line with the last six decades. I don’t see much of a story in this chart.

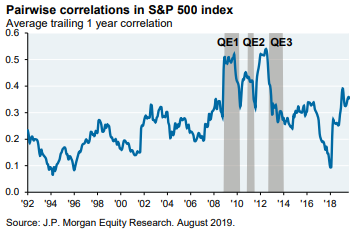

The story of the last few years is that all stocks move together. Okay, certainly there was a spike in 2009, but in 2018 stocks moved together at the lowest rate in 20 years. I don’t remember active managers parading around last year talking about how easy it was to beat the market.

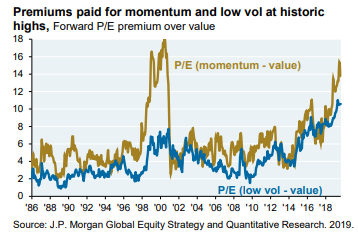

The last few years can be defined by new factors over old factors. Momentum and low vol have crushed value, and as a result have gotten expensive relative to it. Maybe this time is different, who knows.

There are a ton of charts in here, hit the whole thing for more.

Source: