Why are we in cash?

Why are we in cash?

Certainly it starts to feel like we're missing out as the indexes rally back near their highs but this is where we got off in mid-September and here we are, a month later, not quite back to where we were when we cashed out. Some of the uncertainty is out of the way now – it looks like we will have a trade deal with China, no one seems to care that Trump is being impeached (no on trading), Brexit is likely to have no deal but will happen anyway and Bank Earnings, at least so far, aren't so bad-looking.

Of course I'd like to see more than one day of earnings before jumping back in but what really bothers me is that ALL these positive things happened and we're still struggling to get back to 3,000 on the S&P 500. Even Apple (AAPL) has been leading us again. blasting back to $236 yesterday – up 20% since early August. With all this "great" stuff going on – why is the broad index only back at 3,000? Something is not right and, until we can see what that is – CASH!!! is still safer than equities.

Of course we are picking up some bargains: Just last Friday, we added Freeport McMorRan (FCX) to our Short-Term Portfolio in the Morning Report and that spread, with a target of $10, is already on track as FCX blasted 0.50 higher so far.

Earnings season should give us plenty of opportunities to pick up cheap stocks as traders panic out of positions but it's too early in the cycle to start guessing which way they will go – even the banks presented a mixed bag this morning:

- Citigroup (C) had 3% lower Interest Revenues but beat low expectations by 0.02 on strong Consumer Debt Spending.

- Wells Fargo (WFC) significantly missed on Earnings but Revenues were up slightly.

- JP Morgan (JPM) had rising delinquency rates but overall Consumer Debt Spending boosted profits.

- Goldman Sachs (GS) missed Earnings and Revenues and took 67% more Loan Loss Provisions than last year – which indicates trouble ahead.

- Blackrock (BLK) had a really nice $84Bn of Net Inflows in Q3 as they tend to be seen as a relatively "safe" place to store money.

So nothing really bad is happening but will it be good enough to lift the Banking ETF (XLF) to new highs. We've been in a "bad news is good news" market for a couple of years but what if good news no longer moves the market, presumably because it's over-priced and very hard to move higher than S&P 3,000 – what is the market going to do for the closing quarter of the decade?

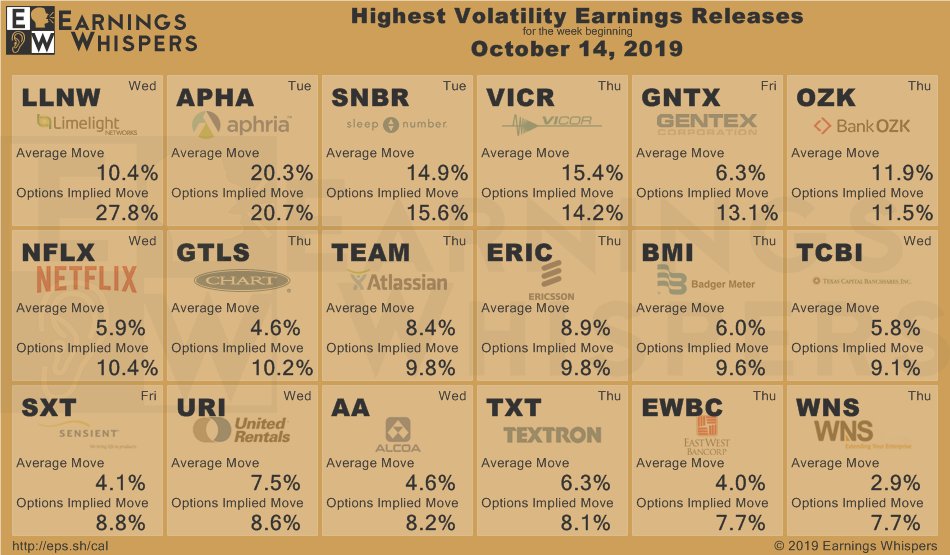

No really, what? Usually I know so I tell you what's going to happen but, this quarter, I have no idea – another good reason for us to stay in cash for now – why play when you aren't confident in the outcome? This is not gambling, this is investing and investors don't play unless the odds are in their favor. We have a fun week of earnings and these are some of the more exciting reports we're expecting:

I like URI and I like AA but, as we're in cash, we hope the sotcks we like sell off for a silly reason (that doesn't change our long-term premise) so we can jump in and buy on sale. Then there's stocks like Netflix, which pay so much for a move that we decided to bet it WON'T move as much as expected (less than 10%), giving us an excellent chance to make money on both sides by selling out-of-the-money puts and calls to people who want to bet on a big move.