Passive Products and Active Users

Courtesy of Michael Batnick

The 20 largest ETFs have $1.556 trillion in assets. While the indexes they track are passive, their users are anything but. Over the previous twelve months, the total trading volume in these products was a whopping $11.529 trillion.

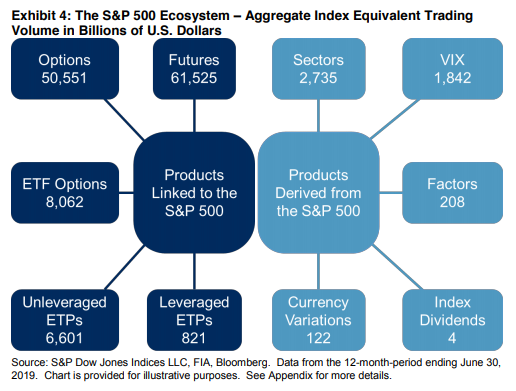

A recent paper from S&P Dow Jones Indices takes a deeper dive into trades linked to some of the most widely followed indexes. For example, there was $127.56 trillion worth of trades either directly in or linked to the S&P 500 in 2018, as you can see in the chart below.

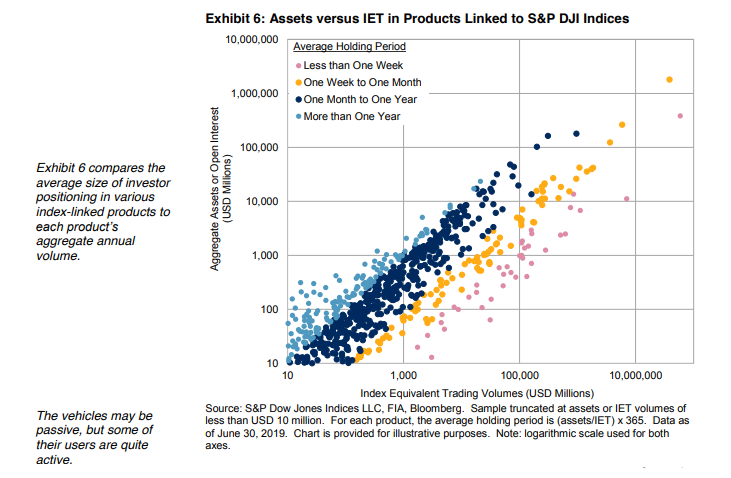

Also in the paper was the average holding period in products linked to S&P DJI indices. They found that the median holding period was 174 calendar days, or around six months. However, using an asset-weighted average, the holding period drops to just 11 days.

Some will look at these numbers and argue that this is helping markets become more efficient. Others will look at it and argue that there is so much money in index funds that they’re distorting the prices of the underlying components. The truth is probably somewhere in-between.

Source:

A Window on Index Liquidity: Volumes Linked to S&P DJI Indices