AAPL $250!

That's where it looks like we're going this week as Apple (AAPL) closed at $246.58 and it up over $247 pre-market. At $1.14Tn, Apple is just a bit more valuable than Microsoft's (MSFT) $1.074Tn valuation but Apple made $59.5Bn last year while MSFT "only" made $39Bn so AAPL is quite the relative bargain and we will see just how much of a bargain on Wednesday evening.

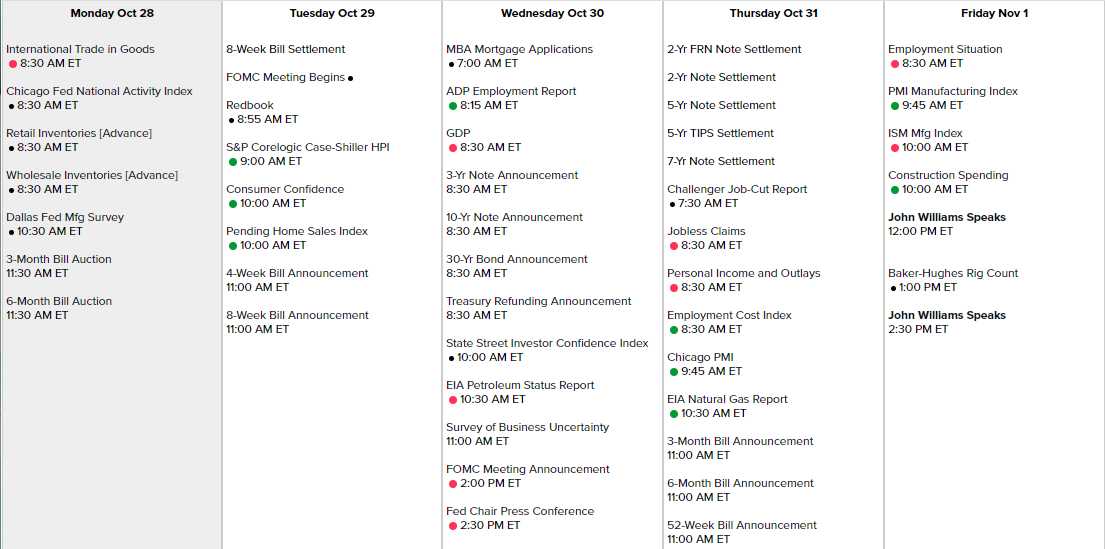

That's not the only thing happening Wednesday, of course. On Wednesday we also get our next Fed Rate Cut – or else! Expectations are near 100% that the Fed will cut rates another quarter-point at Wednesday's meeting (2pm) and then Powell speaks at 2:30 to justify how record-low unemployment and record-high stock prices justify record-low interest rates and a record-high Fed Balance Sheet. He'll probably use the "Chewbacca Defense".

Meanwhile, AAPL stock is up $50 since August and, as a Dow component, it ads about 8.5 points per $1 gained and that, like Chewbacca, does not make sense but it's the way the Dow is structured so that $1 gained by $1.14Tn AAPL stock has the same weighting on the index as $1 gained by $50Bn Walgreens (WBA) or $37Bn Dow Chemical (DOW). Anyway, $50 x 8.5 is 425 Dow points and the Dow is up about 1,000 points so about half the Dow's gains are coming from Apple and that's true for the S&P and the Nasdaq as well.

We are waiting to see if other stocks pick up the slack – because that's what we'll need to break over to new all-time highs – Apple can't do it all unless it pulls a Tesla (TSLA) kind of move and pops 30% on earnings, which would be another $60 on AAPL. Of course, that would be ridiculous but so was TSLA's gain and this weekend the company went into a full-court PR press pushing everything from Solar Panels to Trucks to keep the momentum going as Musk looks to re-capture $380, which would put Tesla at $78Bn in market cap – "only" 80 times their best-case earnings projections for 2020 ($900M).

After losing $702M in Q1 and $408M in Q2 this year, TSLA announced on Wednesday night that they made $150 and, even though the numbers are consistently down from a year ago when they made $254M in Q3 with Automotive Revenues -12.2%, Gross Profit -21.9%, Operating Income -37.3%, EBITDA -7.0%, Net Income (-54.0%) and Cash Flow from Operations -45.7% – at least Operating Expenses were cut by 16.1% with a drastic reduction in Capital Expenses – so the company's market cap jumped $15Bn (100x the quarterly profit) – CHEWBACCA!

Hopefully the rest of the week will make some sense, we have the Non-Farm Payroll report already and the Fed has the doveish John Williams speaking at noon and 2:30 that day – so I think they think they are going to need some spin. Other than Williams and Powell's speech on the 30th (2:30), there is no Fed Speak this week due to the meeting so we're on our own with the data – and earnings!

Earnings are still hot and heavy and we have our new Earnings Portfolio to play with as well as our even newer Dividend Portfolio, which we just initiated on Friday. We started the Earnings Portfolio last week and we're off to a rocky start with only a 3% gain so far. As noted by Own_Account over at Seeking Alpha, it seems strange to have 2-year set-ups in a quick-trade portfolio but we find it's a great way to sell a lot of premium to suckers who think they know which way a stock is headed and Being the House – NOT the Gambler is what we are all about:

We're very excited about Boeing (BA) as that spread pays $25,000 if BA is back over $350 in two years and, even though we're already up $1,000 from our 10/22 entry, it's still just net $12,013 so more than a double ahead of us from this position – not bad for a 2-year play, right Own_Account? You don't have to risk short-term options to make short-term money. We took the BA spread at net $11,000 so it's already up 9% for the week.

Most importantly, it's much easier to CONSISTENTLY make money with more conservative long-term spreads, especially as we have 2 years to make adjustments along the way. We tend to start out playing conservatively and get a bit more aggressive as the profits roll in – gambling with money that is ahead of our 30% annual returns goal. For now, we're still looking for "obvious" trade ideas on companies that are way undervalued into earnings:

We already added AT&T (T) to our new Dividends Portfolio on Friday (see Friday's Top Trade Alert) and they did well and should open up about 5%. That trade idea was:

- Buy 1,000 shares of T at $37 ($37,000)

- Sell 10 T 2022 $35 calls at $4.60 ($4,600)

- Sell 10 T 2022 $30 puts for $2.95 ($2,950)

That's net $29,450 and getting called away at $35 ($35,000) makes a nice $5,550 (18.8%) or, if assigned 1,000 more shares at $30, then average entry is $29.275 – which is where we like to buy T anyway. That will pay $2,040/year for each 1,000-share block in dividends, another 13.8% over two years so a very nice, conservative trade for anyone to add to a portfolio but, again, I'd rather wait for a pullback and, if I REALLY wanted to jump in now, I'd just sell 5 2022 $33 puts for $4 ($2,000) and that's the same $2,000 you'd collect in dividends but a much lower net entry to the downside and, next January, I'd sell 5 more more for the next year's collections (if it hasn't come down low enough to buy and DD and cover).

Remember, these are very conservative plays and we're going for the dividends, not so much gains on the stocks. The idea was to create a stable, dividend-producing portfolio where the dividends will go to charity so it's not so much about generating wealth as it is to create a stable source of reliable funds – very similar to what you would want to do with retirement money or even sidelined CASH!!!

Keep in mind that, as a retirement strategy, if the stock simply holds $35 into January 2022 and you can replicate that 32% return every 2 years going forward and re-invest in more T stock and options, you could ramp up like this:

- 2022 1,320 shares of T

- 2024 1,724 shares of T

- 2026 2,300 shares of T

- 2028 3,035 shares of T

- 2030 4,007 shares of T

- 2032 5,289 shares of T

So let's say, in 2032 (just 12 years from now) your original $29,450 is now (assuming just $35/share) $185,115 and it's throwing off about $10,500 in dividends and the nice thing about blue-chip dividend stocks is both the stock and the dividends they pay off tend to keep up with inflation.

It's a very nice thing to do with some of your money and the sooner you get started the better. If you give those 5,289 shares another 10 years to grow (2042), they turn into 21,195 shares ($741,825) and throw off $42,390 in annual dividends (at $2/share) – that's 143% of your initial investment – every year! If you have a kid or grandkid (you can give up to $15,000 tax-free per kid), set up an IRA for them NOW and put $2,000 a year in invested in dividend stocks like T and your kids will have a nice income for life….

Tomorrow we'll talk about other candidates for our brand-new Dividend Portfolio.