Dividends are very nice.

Dividends are very nice.

Over time, dividend-paying stocks tend to outperform the non-paying stocks by a pretty wide margin and they are an excellent way to build a retirement portfolio – even if you are off to a bit of a late start. That's because the dividends themselves are kind of like an investing discipline – forcing you to take profits off the table on a regular basis or at least re-investing the profits into a conservative stock.

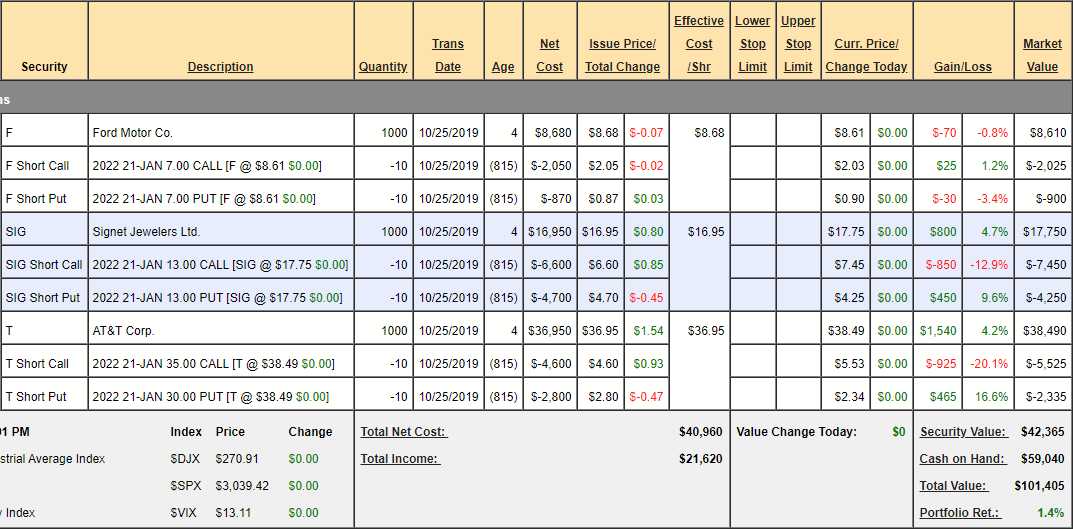

Dividend stocks tend to be the one investors run to in times of trouble, making them outperformers when markets turn ugly as well. On Friday, we initiated a Dividend Stock Portfolio, starting with a virtual $100,000 and our first 3 trade ideas were for Ford (F), Signet Jewelers (SIG) and AT&T (T) and they haven't moved much yet so it's very easy to catch up with us:

Of course, dividend stocks aren't supposed to move that much, we're not in them for the gains (hence the low strikes on the short covered calls), we're in it for those dividend payouts:

- F is a net $5,780 entry that will be called away at $7,000 over $7 for a $1,220 (21%) gain and 0.60 ($600) per year in dividends is another 21% over two years so 42% return potential ($2,420) if Ford manages not to drop 20%.

- SIG is a net $5,650 entry that will be called away at $13,000 for a $7,350 gain (130%) and $1.48 ($1,480) per year in dividends is another 26.2% over two years so 182.4% return potential ($10,310) if SIG does not fall $4.75 (26.7%).

- T is a net $29,450 entry that will be called away at $35,000 over $35 for a $5,550 (18.5%) profit and the dividends are $2.04 ($2,040) per year which is another 13.8% over 2 years so 32.3% return potential ($7,590) on a very conservative target (10% below the current price).

Notice our big cash commtiment is on AT&T because it's a nice, safe stock to play and we'll pick up $7,590 in a stock we're pretty sure we'll keep for life but, overall, just these 3 stocks are going to make us $20,320 in two years if all goes well and that's already 20% of our $100,000 portfolio using just 1/6 of our $200,000 margin buying power.

While these returns (not SIG) may seem very boring compared to our other portfolios, Dividend Portfolios are meant to play it safe for the long haul and, even in this 10-year market run of the S&P, with all that help from the Fed, we've only had two years (including this one) where the S&P 500 returned 20%:

| Year |

Average Closing Price |

Year Open | Year High | Year Low | Year Close |

Annual % Change |

|---|---|---|---|---|---|---|

| 2019 | 2,866.52 | 2,510.03 | 3,039.42 | 2,447.89 | 3,039.42 | 21.24% |

| 2018 | 2,746.21 | 2,695.81 | 2,930.75 | 2,351.10 | 2,506.85 | -6.24% |

| 2017 | 2,449.08 | 2,257.83 | 2,690.16 | 2,257.83 | 2,673.61 | 19.42% |

| 2016 | 2,094.65 | 2,012.66 | 2,271.72 | 1,829.08 | 2,238.83 | 9.54% |

| 2015 | 2,061.07 | 2,058.20 | 2,130.82 | 1,867.61 | 2,043.94 | -0.73% |

| 2014 | 1,931.38 | 1,831.98 | 2,090.57 | 1,741.89 | 2,058.90 | 11.39% |

| 2013 | 1,643.80 | 1,462.42 | 1,848.36 | 1,457.15 | 1,848.36 | 29.60% |

| 2012 | 1,379.61 | 1,277.06 | 1,465.77 | 1,277.06 | 1,426.19 | 13.41% |

| 2011 | 1,267.64 | 1,271.87 | 1,363.61 | 1,099.23 | 1,257.60 | 0.00% |

| 2010 | 1,139.97 | 1,132.99 | 1,259.78 | 1,022.58 | 1,257.64 | 12.78% |

In fact, if we had made 20% a year for the last 9 years consistently, we would have turned 1,139.97 into 5,881.99 – miles past the S&P's current 3,039.42 because, as I teach our Members, CONSITENTLY making money is much more important than making big returns erratically (see: "The Secret to Consistent 20-40% Annual Returns").

That's our system for turning any stock into a "dividend-payer" by selling calls and it's the check-list we're running through on all our trading ideas as we begin to move some of our CASH!!! off the sidelines. In fact, that video is from 2013 and we were using Barrick Gold (GOLD) as an example and it was ABX at the time at $19 and, over the past 7 years, GOLD has moved between $10 and $20 and it's now $16.72 so the stock has gone nowhere but it's paid $7.48 in VERY erratic dividends and, much more importantly, we had the opportunity to sell $6 (easily) of calls each year for 6 years for another $36 so the total returns from $19 were $43.50 (228%) less the $2.30 drop in the stock price (12%) so still very nice returns fo 6 years.

And, of course, the key is to re-invest those returns over time to really boost the gains. I used the example of our AT&T (T) play in yesterday's Morning Report to illustrate the power of re-investing the profits over time.

Our goal for the week is to add 3 more stocks to our Dividend Portfolio, which will make us about 1/3 invested (we usually don't go more than 2/3 total) and we'll give these a while to run before adding more but we should be well on our way to 20% annual returns at that point and, if that's going well for about 6 months, THEN we can go for 40%!