3,150!

That's up 150 points (5%) from where we cashed out most of our Member Portfolios in September and, though we missed a 10% pullback right after that – we have now missed a 15% recovery.

Of course, at the time, I said we COULD go to 3,300 – if there was a China deal and if Brexit didn't get worse and if Q3 Earnings Reports were not a disaster and, so far, the Earnings were NOT a disaster and we keep hearing that a China deal is close and Brexit continues to stumble along so – YAY!!! – I guess…

Wall Street has taken this year’s quarterly profit contractions in stride, largely because companies, for the most part, have managed to beat already low forecasts. Analysts came into the third quarter expecting profits for the S&P 500 to fall 4%. With 97% of companies in the index reporting, profits are expected to have declined by 2.3%, with three-quarters of the companies topping very low expectations.

“There’s no question earnings are challenged,” said David Kelly, chief global strategist at JPMorgan Asset Management. “The market is to some extent coasting off good stable job performance.” Companies that beat analysts’ forecasts in the third quarter saw an average price increase of 2.2% within the four-day period surrounding their report, according to John Butters, senior earnings analyst at FactSet. That is well above the five-year average price increase of 1% during that same window.

Investors have also been taking it relatively easy on companies that fell short of the mark, according to Butters. Companies that fell short of expectations saw an average price decline of 1.7% during that four-day window. That’s smaller than the five-year average price decrease of 2.6% during that same window for companies falling short of expectations.

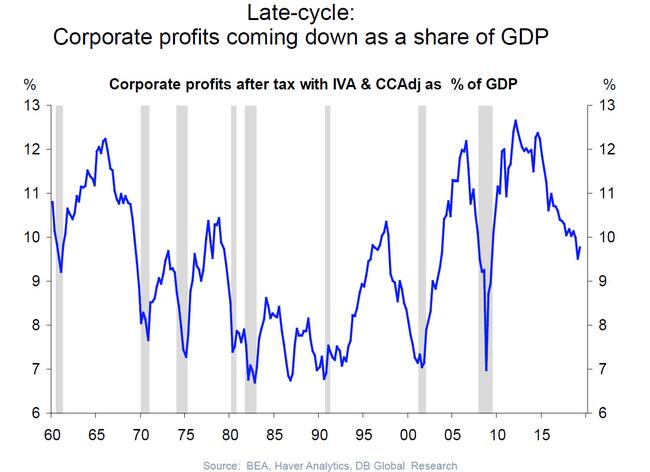

As you can see from the above chart, we began the year down 3.75% in Q1, then gained 3.75% in Q2 and now up 0.25% but those are Q/Q growth numbers coming off a weak Q4 2018 so, overall, we're left down 2.3% on the S&P for the year so far – another down 4th quarter and we're in serious decline – which is odd since the S&P 500 is up 25% for the year – the very definition of "irrational exuberance".

As you can see from the above chart, we began the year down 3.75% in Q1, then gained 3.75% in Q2 and now up 0.25% but those are Q/Q growth numbers coming off a weak Q4 2018 so, overall, we're left down 2.3% on the S&P for the year so far – another down 4th quarter and we're in serious decline – which is odd since the S&P 500 is up 25% for the year – the very definition of "irrational exuberance".

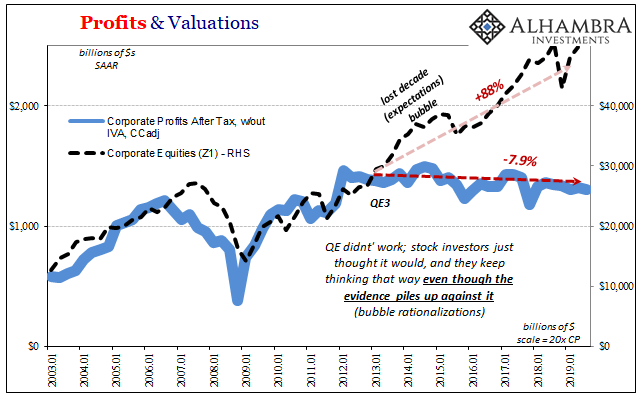

Overall Corporate Profits haven't acutually gone anywhere for the past 5 years and are 7.9% lower than they were in 2013 while Corporate Equities are up 88% over the same time-frame. While we were happy to enjoy the first 83% of that rally – I simply had to switch gears and move to protect our gains as we headed into the end of year 5 of this Price Inflation Bubble.

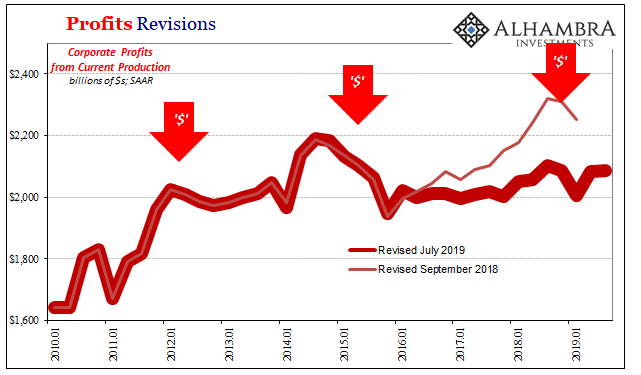

Even worse, what little new profits there are are not being generated from goods or even services that are being produced but are reallly just coming from tax breaks:

This is now way to build long-term value – I'm still happier keeping most of our CASH!!! on the sidelines.

Have a good weekend,

– Phil