The Portfolio Gap

Courtesy of Michael Batnick

Dalbar is known for publishing a study on returns from equity funds compared to the returns that investors capture in those same funds. Every year reveals the same message: The average investor, with remarkable consistency, underperforms their own investments, ostensibly by buying and selling at inopportune times.

The methodology behind the study has been under assault for at least the last 15 years. Here is Jason Zweig on the matter:

Dalbar’s formula, according to these experts, has the effect of taking returns over the full period and dividing them by the total assets at the end—including money that wasn’t in the funds from start to finish. The result, they say, could significantly inflate the amount by which investors appear to lag behind their funds.

In 2004, Jonathan Clements wrote:

With the formula that Dalbar uses, stock-fund investors don’t earn the full monthly return on any money that they invest during that month. As a result, investors appear to lag far behind the S&P 500 when the market rises and investors are simultaneously shoveling money into stock funds. This, of course, is what happened for much of the 19-year period studied.

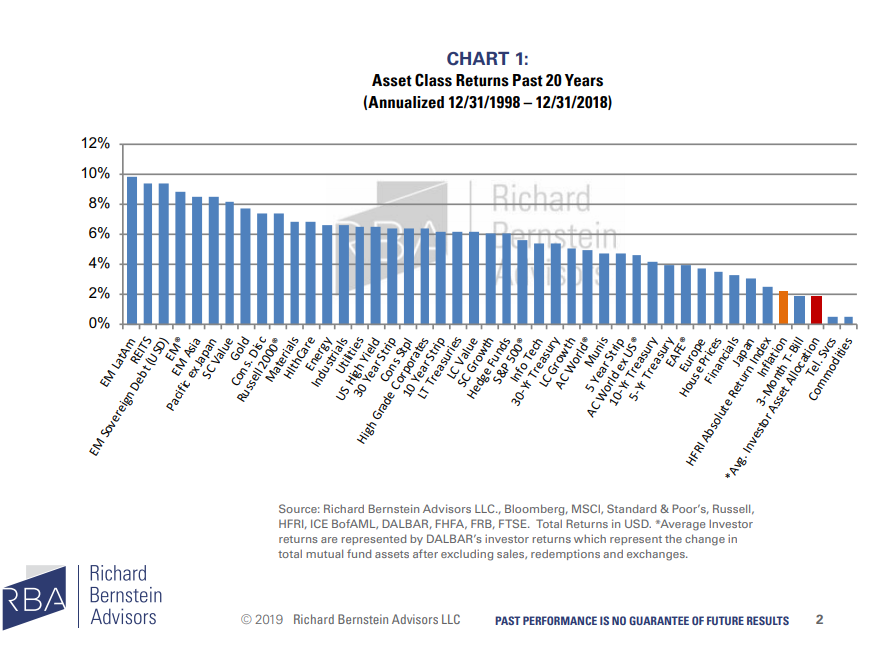

I agree that the reported behavior gap between what the market offers and what investors in those funds receive might be overstated, but there’s another gap out there that doesn’t get enough attention, probably because it’s impossible to quantify. I believe there is a significant gap between what people can earn on their assets and what they actually earn.

The main culprit for the portfolio gap is cash, which we spoke about with Morgan Housel recently.

Christine Benz, director of personal finance at Morningstar wrote about her experience with holding too much cash in an article, learning from my financial mistakes, which I think we can all relate to in one way or another:

Sure, holding cash provides peace of mind, but it’s possible to overdo it. Like being slow with IRA contributions, holding too much cash has an opportunity cost in upward-trending markets. While our IRAs and 401(k)s are fully invested and quite stock-heavy, my husband and I typically have been slow putting cash to work in our taxable account, often holding well more than we need for emergency expenses. There are a few reasons. While we’ve long used automatic investments to move money automatically from our checking to our investment accounts, we’ve been too conservative with those monthly contribution amounts. Another factor is that we’ve sometimes received lumpy influxes of cash (bonuses, and so on) that we’ve been slow in putting to work. In part because of the rapidly rising market that we’ve enjoyed over the past decade, it never seemed like a great time to do so.

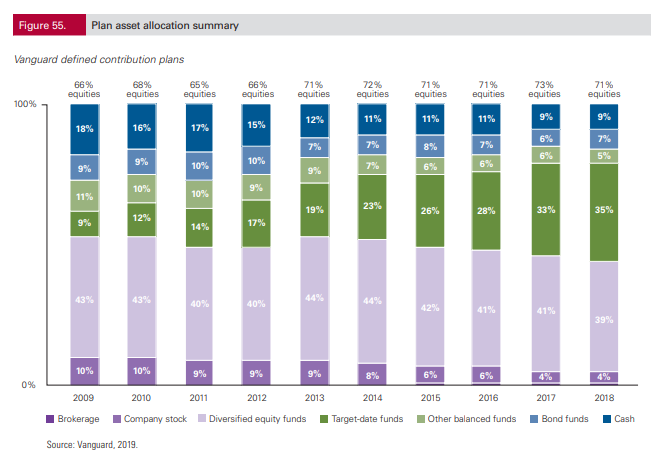

According to this study from Vanguard, Christine is hardly alone. The average cash position in defined contribution plans has been 12.9% over the last ten years.

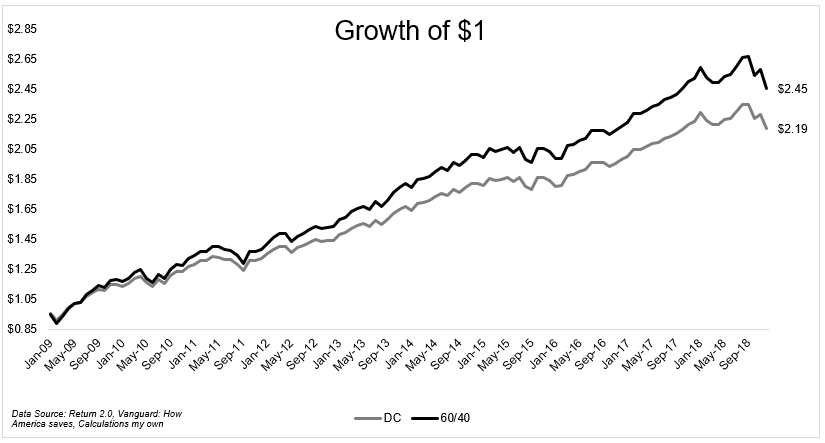

What effect would these cash allocations have had on performance? In the chart below I oversimplified Vanguard’s findings and compared a 60/40 portfolio to a 60/40 portfolio with the cash position by year. So for example, in 2009, 18% of the portfolio was in cash, and the remaining 82% was allocated to U.S. stocks and bonds.

The fully invested 60/40 portfolio would have done 9.4% a year, the one less than fully invested would have done 8.13% a year.

I can’t prove this, but I believe that people are much more likely to hold larger levels of cash in their taxable accounts than in their retirement accounts because the money feels more “real.” They know they can’t touch their retirement accounts until, well, retirement, so psychologically it’s easier to invest it all and just be done with it. If 12.9% was the average cash position in defined contribution plans over the last 10 years, it’s easy to imagine this number being 20% or higher in taxable accounts.

Alright, enough of the numbers let’s talk about the feelings.

The reason that Morgan has a higher cash allocation than might be recommended is because it helps him sleep at night. That feeling cannot be quantified and trumps anything the numbers might show. Knowing your actual risk tolerance is the first thing an investor needs to figure out, and unfortunately you only know where your line is after you crossed it.

The portfolio gap is real, and that’s okay, because investing is not about maximizing returns, but about maximizing returns that you can reasonably be expected to achieve.